The euro continued to decline after a series of weak reports on manufacturing activity in the eurozone countries, which once again confirms the fact that economic growth has slowed and there is a need for intervention by the European Central Bank.

As throughout this year, the decline in production activity in the eurozone is due to a sharp decline in exports due to the aggravation of trade conflicts between the United States and China and the EU, as well as due to a slowdown in global economic growth, which is still the "echo" of US protectionist policies.

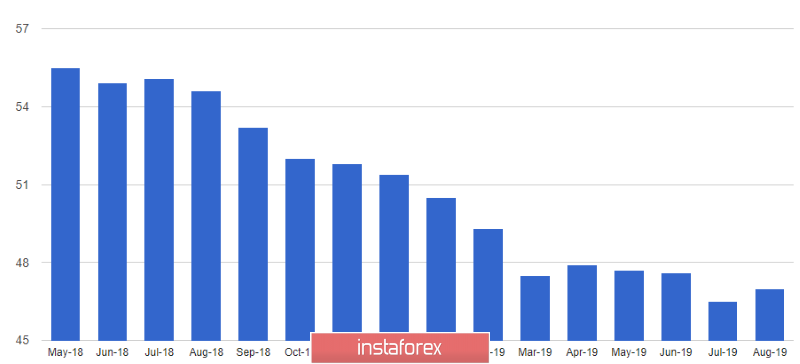

According to Markit, the PMI for Purchasing Managers Index for Italy's manufacturing sector remained below 50 points and amounted to 48.7 points in August this year, which indicates a reduction in the sphere against 48.5 points in July this year. Economists had expected the index to be 48.5 points.

France is perhaps the only country where the manufacturing sector has returned to the right track. According to the report, the PMI Purchasing Managers Index for France's manufacturing sector rose to 51.1 points in August this year, while it was 49.7 points in July. Economists had expected the index at 51.0 points.

Germany continues to alarm with very weak fundamental statistics, which have been coming in all last week and continue to come in now. Thus, the PMI Purchasing Managers Index for Germany's manufacturing sector again declined in August to 43.5 points against 43.2 points in July. Economists had forecast the index at 43.6 points.

Therefore, it is not surprising that the general index of procurement managers for the manufacturing sector of the eurozone remained unchanged at its level below 50 points and amounted to 47.0 points in August, which fully coincided with the forecasts of economists.

As for the technical picture of the EURUSD pair, bears continue to push the market down on bad reports, and it turns out that they are pretty good. The next goal is support at 1.0950, a breakthrough of which will draw risky assets even lower to the area of 1.0920 and 1.0900 levels.

GBPUSD

The British pound continued to decline after the release of the same weak report on activity in the UK manufacturing sector, which fell in August amid falling new orders and company confidence.

The situation with Brexit also does not add optimism and creates a number of uncertainties. A hearing will be held today on the case of the illegitimate suspension of the work of the British Parliament in the Scottish Court. However, most likely, it will be a failure, which will only put pressure on the British pound in the afternoon.

The opposition's actions on September 3, the official date for the Parliament's return from the summer holidays, remain more interesting. Most likely, the emphasis will be placed not on a vote of no confidence in current Prime Minister Boris Johnson, but on the development of a law that does not allow Britain to leave the EU without any agreement on Brexit. In other words, the Laborites will try to exclude an unordered exit without an agreement, to which everything now goes.

Meanwhile, Boris Johnson is not standing aside. At the weekend, he announced that those Conservative MPs who oppose Brexit without an agreement and want to delay it can ultimately be left without their seats in Parliament. The leader of the Conservative Party also noted that any Conservative deputy who decides to join the opposition on this issue will be expelled from the party in Parliament.

As for the data that I spoke about above, the IHS Markit report indicated that the PMI purchasing managers index for the UK manufacturing sector fell to 47.4 points in August from 48.0 points in July. Markit drew attention to the fact that some respondents, companies in the eurozone, began to avoid suppliers from the UK, which is directly related to the emergence of new trade barriers due to the situation with Brexit.

The British pound, meanwhile, is storming new weekly lows in the support area of 1.2060. Their breakthrough will lead to a new wave of decline to the lows of the year in the region of 1.2020 and 1.1985.