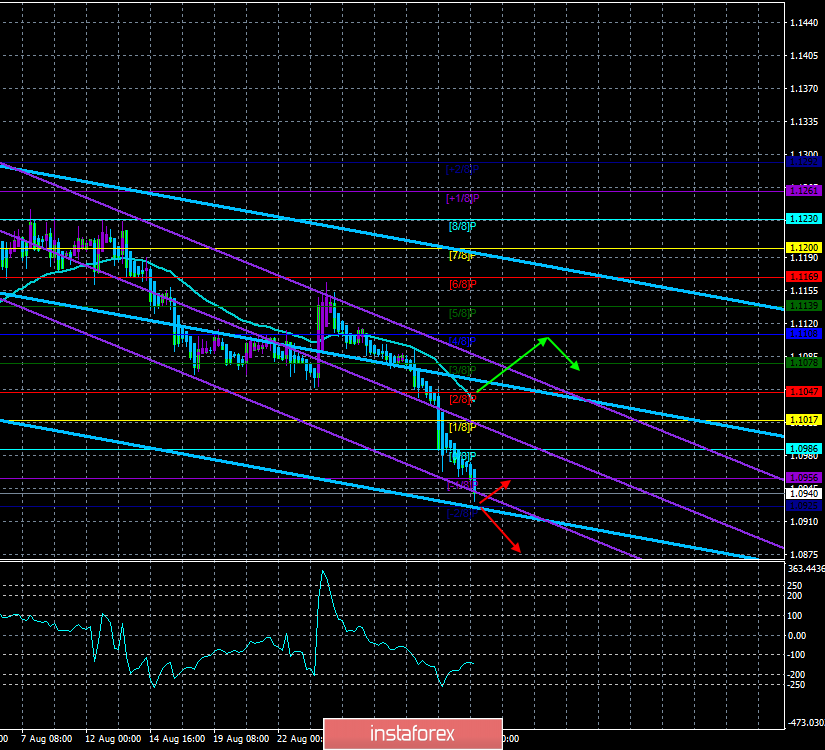

4-hour timeframe

Technical data:

The upper channel of linear regression: direction – down.

The lower channel of linear regression: direction – down.

The moving average (20; smoothed) – down.

CCI: -149.6018

Last night, we said that Christine Lagarde's performance will be very significant for the EUR/USD pair. It will take place at 10:00 (UTC +03:00) in front of the EU Committee on Economic and Monetary Affairs. A week ago, this event would not even have been included in the calendar of macroeconomic events, as no one expected that Lagarde would begin to announce changes in the monetary policy of the ECB, not yet taking office as Chairman of the ECB. However, last Friday showed what will happen, and now traders are waiting for a new speech on the weakness of the EU economy, the threats of a global recession and the growing threats of a trade war with the United States. As a result, we expect new statements on the need to reduce the key rate, as well as the adoption of additional measures to stimulate the EU economy. Such a speech can send the euro further down, although the first trading day of the week for it ended with significant losses.

However, it is not only Lagarde's performance that will attract traders' attention today. In America, indices of business activity in the manufacturing sector in two versions, Markit and ISM will be published today. Traditionally, it is believed that the ISM index is stronger. According to experts, both indices will continue to decline, and the Markit index may cross the line of 50.0 today, which will mean a change of growth in the industry to decline. As for the ISM index, the forecast is 51.0, but the overall trend is also downward. This suggests that the American economy is also experiencing problems, may also begin to slow down, and the trade war with China does not pass without a trace. I would like to say that this is a chance for the euro. The chance to finally stop falling against the US dollar, however, a decrease in the business activity index is clearly not enough to radically change the mood of currency traders.

The technical picture of the euro/dollar currency pair does not change: all indicators confidently signal a downward movement, allowing us to consider only the euro sales and US dollar purchases.

Nearest support levels:

S1 – 1.0925

Nearest resistance levels:

R1 – 1.0956

R2 – 1.0986

R3 – 1.1017

Trading recommendations:

The euro/dollar pair continues its downward trend without signs of a correction. Thus, it is recommended to sell the pair with the last target of 1.0925, and if it is overcome, keep the short positions (all levels of Murray will be recalculated). A turn of the Heiken Ashi indicator up will indicate a round of upward correction. Buying euros is still recommended.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustrations:

The upper linear regression channel – the blue line of the unidirectional movement.

The lower linear regression channel – the purple line of the unidirectional movement.

CCI – the blue line in the indicator window.

The moving average (20; smoothed) – blue line on the price chart.

Murray levels – multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.