The pound was in the undivided power of British politicians, whose hands seem to grow out of the wrong place, because they only send him all to new historical lows with their actions. Also, given the fact that the House of Commons has only four days before the suspension of the parliament, we have a fun week. The British parliament clearly opens the "crazy hands" artel for urgent drafting and adoption of legislative initiatives designed to tie Boris Johnson hand and foot. But in any case, all of these only adds to the uncertainty because no one understands at all what will happen now. So investors hastened to start getting rid of pounds in advance. Even though everyone will closely monitor what is happening in the United Kingdom today, who clearly intends to set a new historical low, it is unlikely that this will somehow help the unfortunate pound. The only question is how many times he will execute it this week. Moreover, Boris Johnson has already made another contribution to achieving the goals, announcing the possibility of early elections. In turn, the Labor Party has already published a bill banning Brexit without an agreement with the European Union. Only a small formality remained like the adoption of it by parliament. Here, Boris Johnson threatens with the dissolution of parliament in order to prevent such a development of events. Hence, the series called this week will break all records.

What happens with the single European currency will not cause so many emotions and will not lead to a local shortage of popcorn. Although the mass media of agitation and misinformation tried to make Christine Lagarde as the main event from today's speech, the future head of the European Central Bank herself greatly disappointed them. In fact, she said nothing but words may be redundant as today's data on producer prices may show a slowdown in growth from 0.7% to 0.2%. Well, this indicates a serious slowdown in inflation, and the European Central Bank needs to use all its intellectual abilities to consider easing monetary policy.

Dynamics of producer prices in Europe:

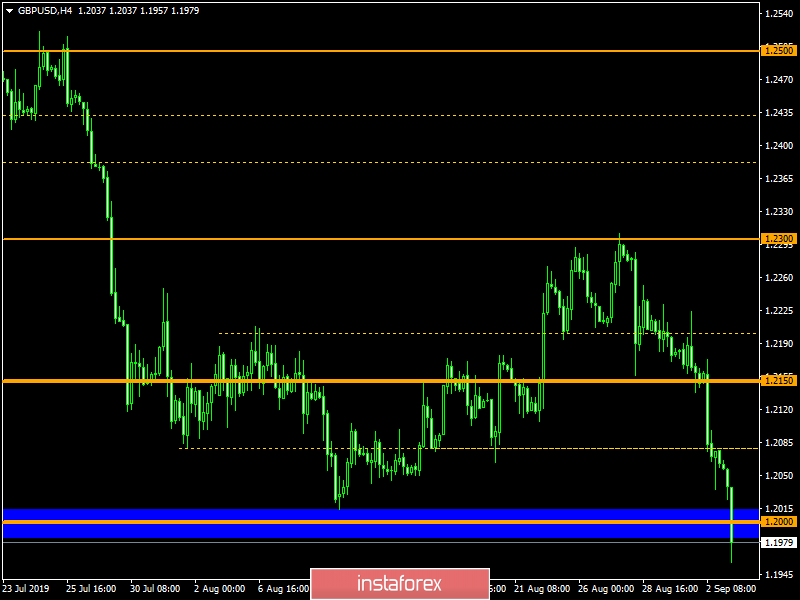

The Pound/Dollar currency pair overcome the psychological level of 1.2000 in one breath and rushed to a further decline. It is likely to assume that a sequential descent will hold us for more than one day. Now, we are considering points 1.1950-1.1900 in the form of the primary move.

The Euro/Dollar currency pair did not lag behind its counterpart and likewise showed an intense downward move, overcoming the psychological level of 1.1000. It is likely to suggest that a slowdown is possible around 1.1900, where it is worth analyzing fixation points for further trading deals.