The British currency falls for the fifth consecutive trading session. Another wave of fears about the consequences of Brexit returned the pound to the area of 36-year lows. This morning, the GBP/USD pair fell below $1.20. A vote should be held on holding early elections and the possibility of blocking exit from the European Union without a deal should occur later on. It is worth noting that the chances of this kind of scenario are slim, since the majority of the votes are with the ruling party. The foreign exchange and debt markets react negatively to such news. It seems that the sterling will have a hard time in the event of the failure of the above initiatives.

Background

British Prime Minister Boris Johnson plans to hold an early general election if his opponents can pass a bill blocking Brexit without a deal. No final decision has yet been made on this issue. Those who will impede exit from the EU at the end of October will lose their seats. Among the conservatives who advocate for the bill above are former Justice Minister David Gock.

Meanwhile, the Conservative Party still have a confident chance of winning, according to the latest YouGov poll. About 33% of the British expressed their willingness to cast their votes for the Conservatives, whose leader is Johnson. Another 22% of respondents said they would side with the Labor Party, and 21% of respondents did not exclude the support of the Liberal Democrats Party.

The MUFG believes that at first an extraordinary election will be perceived by the market as negative for the pound, given that the idea of a "hard" Brexit should win.

The next stop for the GBP/USD pair after falling below $1.20 will be $1.10. This will happen if the government receives a simple majority and chooses to exit their EU without a deal, the bank said.

It will be useful to look at the situation from a different angle. Market participants avoid situations without specifics, and the fact that all other possibilities are marked out narrows the range of uncertainty. This means that the first reaction may well be followed by the restoration of the British currency. A similar situation was in 2017. Then, finding the bottom near $1.20, the pound turned around.

Quite interesting is the positioning of the stock market. Over the past five sessions, the FTSE100 index gained 3.1%, while the GBP/USD pair lost 2.1% of the value. This indirectly indicates that buyers consider the current pound to be too low to support the competitiveness of UK companies. This is happening despite the fear of the consequences of a random exit from the EU.

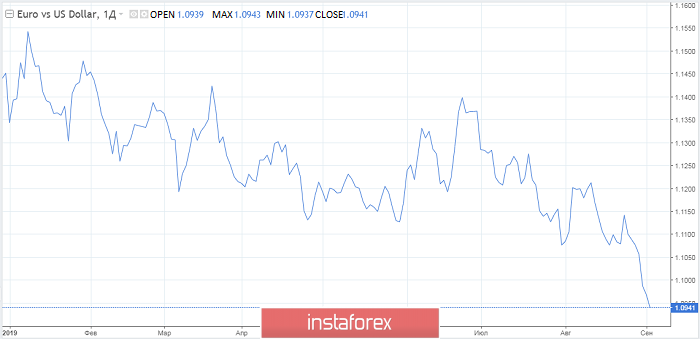

The euro and the European stock market also show opposite movements. EUR/USD has gone beyond $1.09, updating lows since May 2017, and the DAX is rebounding after a recent decline. For four sessions, the euro slumped against the dollar by 1.3%, while German bonds rose 2.7%.

Demand for German shares strengthened just as the euro fell below August lows, pointing to a shift from consolidation to decline. It seems that the stock markets are positive about the weakening of the euro and the pound, considering it a measure that can restore economic growth.