Hello, dear colleagues.

For the Euro/Dollar pair, a key upward reversal is expected from the range of 1.0922 – 1.0897. For the Pound/Dollar pair, the continuation of the downward movement is possible after the passage of the range of 1.1977 – 1.1946. For the Dollar/Franc pair, we expect the upward movement to continue after the breakdown of the level of 0.9920 and the level of 0.9856 is the key support. For the Dollar/Yen pair, we are following the development of the upward structure from August 26 and the further upward movement is expected after the breakdown of 106.52 and the level of 105.37 is the key support. For the Euro/Yen pair, we expect the continuation of the downward trend from August 26 after the price passes the range of 115.81 – 115.59. For the Pound/Yen pair, the price for subsequent targets for the bottom was determined from the downward structure on August 23.

Forecast for September 3:

Analytical review of currency pairs on the H1 scale:

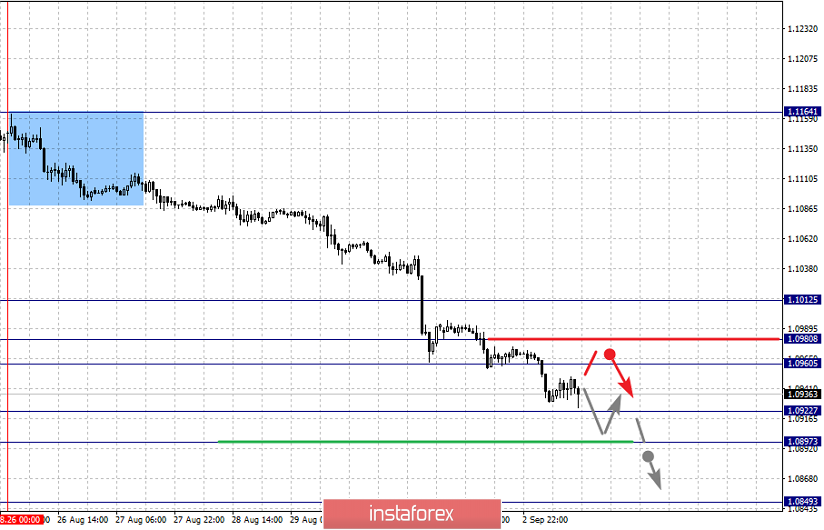

For the Euro/Dollar pair, the key levels in the H1 scale are 1.1025, 1.0980, 1.0960, 1.0922, 1.0897 and 1.0849. We continue to follow the downward structure of August 26. The short-term downward movement is expected in the range of 1.0922 – 1.0897, hence there is a high probability of a reversal in the correction zone. The breakdown of the level of 1.0897 will be accompanied by a volatile downward movement to the potential target – 1.0849.

The short-term upward movement is expected in the area of 1.0960 – 1.0980 and the breakdown of the last value will lead to an in-depth correction. The target is 1.1012 and this level is the key support for the downward structure.

The main trend is the downward cycle of August 26.

Trading recommendations:

Buy 1.0960 Take profit: 1.0980

Buy 1.0982 Take profit: 1.1012

Sell: 1.0922 Take profit: 1.0902

Sell: Take profit:

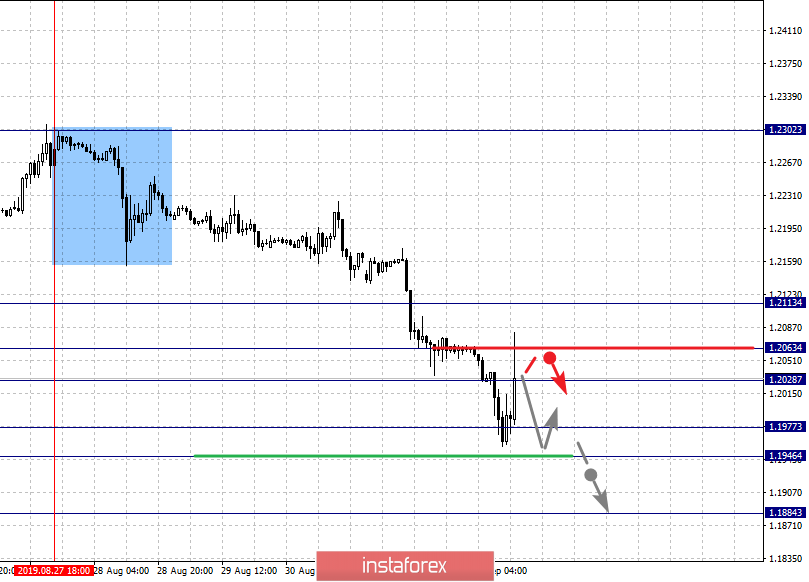

For the Pound/Dollar pair, the key levels in the H1 scale are 1.2113, 1.2063, 1.2028, 1.1977, 1.1946 and 1.1884. We follow the development of the downward structure of August 27. A short-term downward movement is expected in the range of 1.1977 – 1.1946 and the breakdown of the latter value will allow us to count on movement to a potential target – 1.1884, upon reaching this level, we expect a pullback upward.

The consolidated upward movement is expected in the range of 1.2028 – 1.2063 and the breakdown of the last value will lead to an in-depth correction. The target is 1.2113 and this level is the key support for the downward structure.

The main trend is the downward structure from August 27.

Trading recommendations:

Buy: Take profit 1.2030: 1.2060

Buy: 1.2065 Take profit: 1.2110

Sell: 1.1977 Take profit: 1.1948

Sell: 1.1944 Take profit: 1.1886

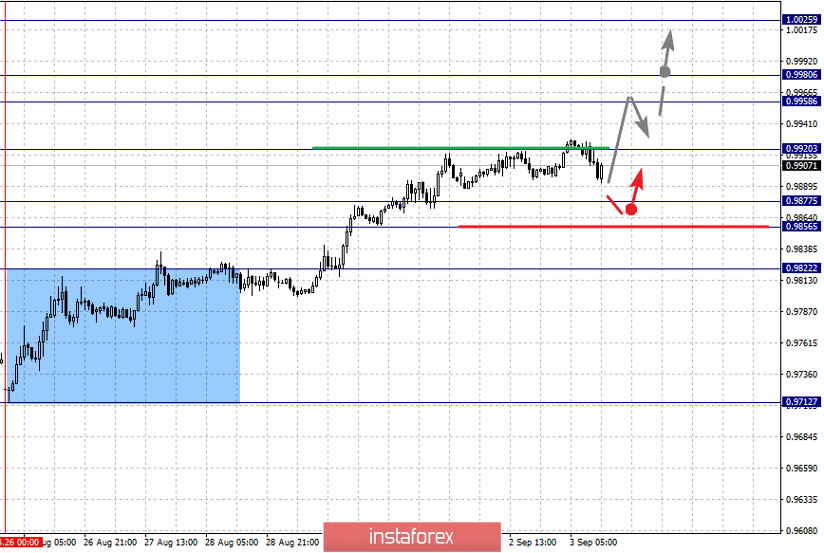

For the Dollar/Franc pair, the key levels in the H1 scale are 1.0025, 0.9980, 0.9958, 0.9920, 0.9877, 0.9856 and 0.9822. We continue to follow the upward structure of August 26. The continuation of the upward movement is expected after the breakdown of the level of 0.9920. In this case, the target is 0.9958 and in the area of 0.9958 – 0.9980 is the price consolidation. The potential value for the top is level 1.0025, after reaching this value, we expect a rollback downwards.

The short-term downward movement is possible in the area of 0.9877 – 0.9856 and the breakdown of the last value will lead to an in-depth movement. The target is 0.9822 and this level is the key support for the top.

The main trend is the upward structure of August 26.

Trading recommendations:

Buy: 0.9920 Take profit: 0.9958

Buy: 0.9980 Take profit: 1.0025

Sell: 0.9877 Take profit: 0.9857

Sell: 0.9854 Take profit: 0.9822

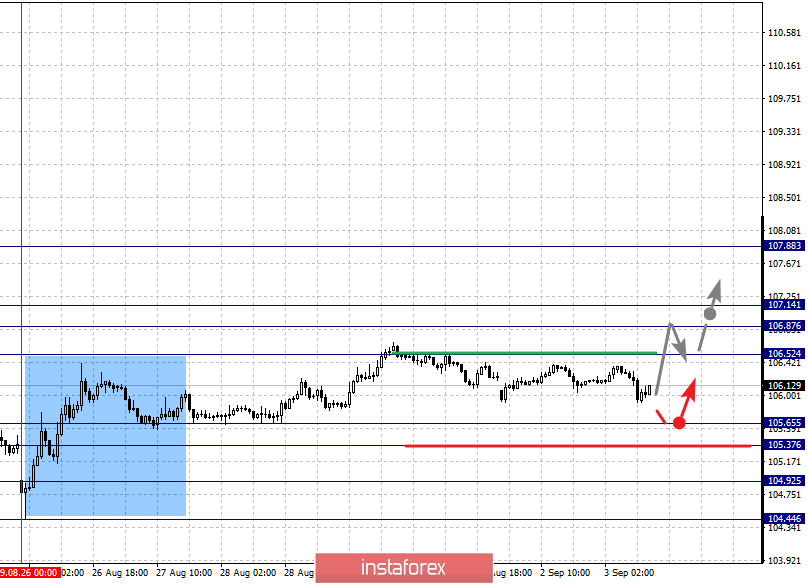

For the Dollar/Yen pair, the key levels in the H1 scale are 107.88, 107.14, 106.87, 106.52, 105.65, 105.37, 104.92 and 104.44. We follow the development of the upward structure of August 26. The continuation of the upward movement is expected after the breakdown of 106.52. In this case, the target is 106.87 and near this level is the consolidation. The passage at the price of the range of 106.87 – 107.14 shall be accompanied by a strong upward movement. The potential target – 107.88 and consolidation is near this level.

The short-term downward movement is possible in the area of 105.65 – 105.37 and the breakdown of the last value will lead to the development of a downward structure. In this case, the first target is 104.92. The potential value for the bottom is the level of 104.44 and consolidation is near this level.

The main trend: the upward structure of August 26.

Trading recommendations:

Buy: 106.52 Take profit: 106.85

Buy: 107.15 Take profit: 107.88

Sell: 105.35 Take profit: 104.94

Sell: 104.90 Take profit: 104.46

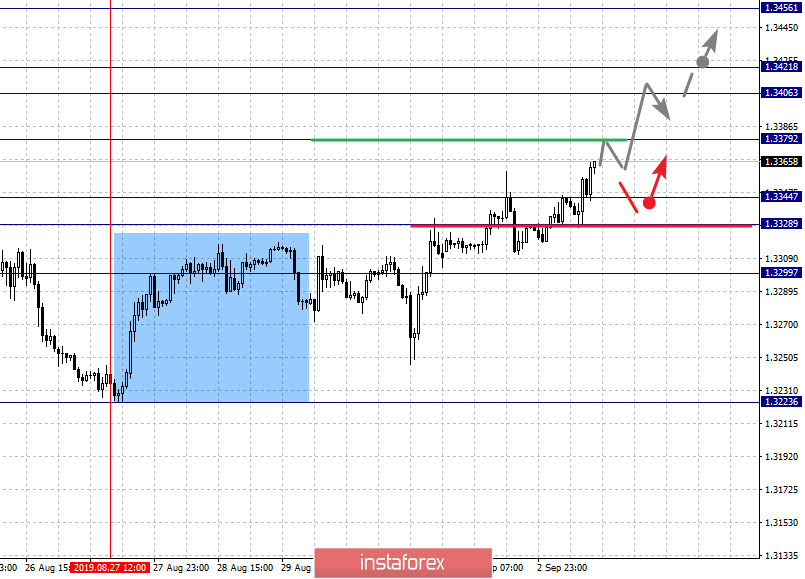

For the Canadian dollar/Dollar pair, the key levels in the H1 scale are 1.3456, 1.3421, 1.3406, 1.3379, 1.3344, 1.3328 and 1.3299. We follow the development of the upward cycle of August 27. The continuation of the upward trend development is expected after the breakdown of the level of 1.3379. In this case, the target is 1.3406 and in the area of 1.3406 – 1.3421 is the price consolidation. The potential value for the top is level 1.3456, after reaching this value, we expect a rollback downwards.

The short-term downward movement is possible in the area of 1.3344 – 1.3328 and the breakdown of the last value will lead to a protracted correction. The target is 1.3299 and this level is the key support for the upward structure.

The main trend is the upward structure of August 27.

Trading recommendations:

Buy: 1.3380 Take profit: 1.3404

Buy: 1.3422 Take profit: 1.3455

Sell: 1.3344 Take profit: 1.3328

Sell: 1.3326 Take profit: 1.3300

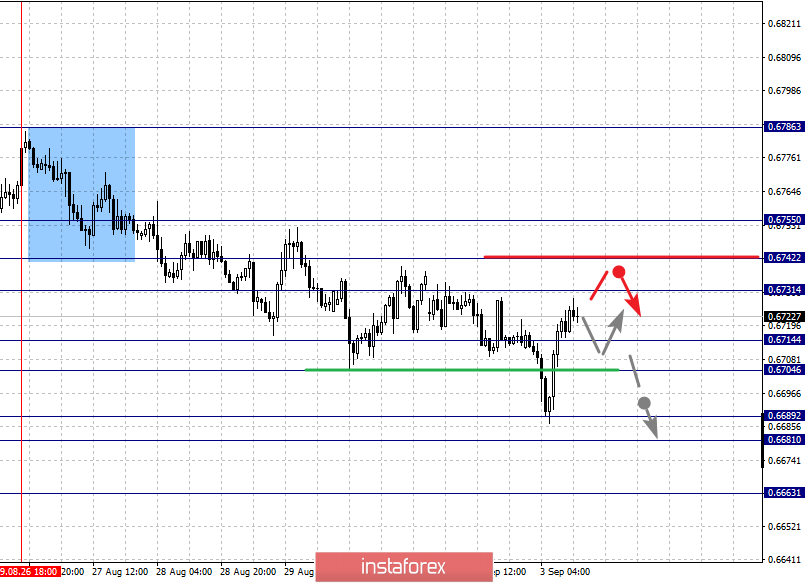

For the Australian dollar/Dollar pair, the key levels in the H1 scale are 0.6755, 0.6742, 0.6731, 0.6714, 0.6704, 0.6689, 0.6681 and 0.6663. We follow the development of the downward cycle of August 26. At the moment, the price is in the correction zone. The short-term downward movement is expected in the range of 0.6714 – 0.6704 and the breakdown of the latter value will lead to a pronounced movement. The target is 0.6689 and in the area of 0.6689 – 0.6681 is the price consolidation. The potential value for the bottom is level 0.6663, after which we expect a rollback up.

The short-term upward movement is possible in the area of 0.6731 – 0.6742 and the breakdown of the last value will lead to a protracted correction. The potential target is 0.6755, up to this level, we expect the formation of pronounced initial conditions for the upward cycle.

The main trend is the downward structure of August 26, the stage of correction.

Trading recommendations:

Buy: 0.6732 Take profit: 0.6742

Buy: 0.6742 Take profit: 0.6755

Sell: 0.6704 Take profit: 0.6690

Sell: 0.6680 Take profit: 0.6664

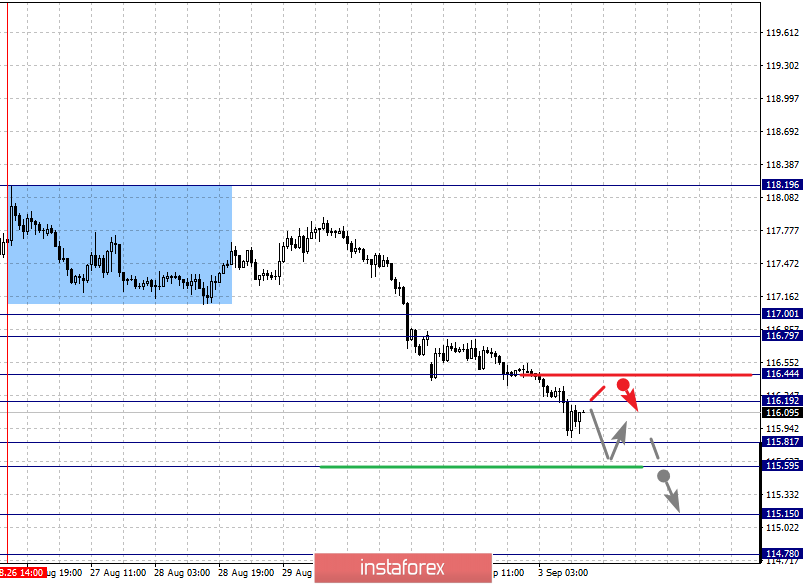

For the Euro/Yen pair, the key levels in the H1 scale are 117.00, 116.79, 116.44, 116.19, 115.81, 115.59, 115.15 and 114.78. We continue to follow the development of the downward structure of August 26. We expect further downward movement after the price passes the range of 115.81 – 115.59. In this case, the target is 115.15 and the price consolidation is near this value and hence a rollback to correction is also possible. The potential value for the top is considered to be the level of 114.78, upon reaching which, we expect a rollback up.

The short-term upward movement is expected in the range of 116.19 – 116.44 and the breakdown of the last value will lead to an in-depth correction. The target is 116.79 and the range of 116.79 – 117.00 is the key support for the bottom.

The main trend is the downward cycle of August 26.

Trading recommendations:

Buy: 116.19 Take profit: 116.43

Buy: 116.45 Take profit: 116.79

Sell: 115.81 Take profit: 115.60

Sell: 115.57 Take profit: 115.15

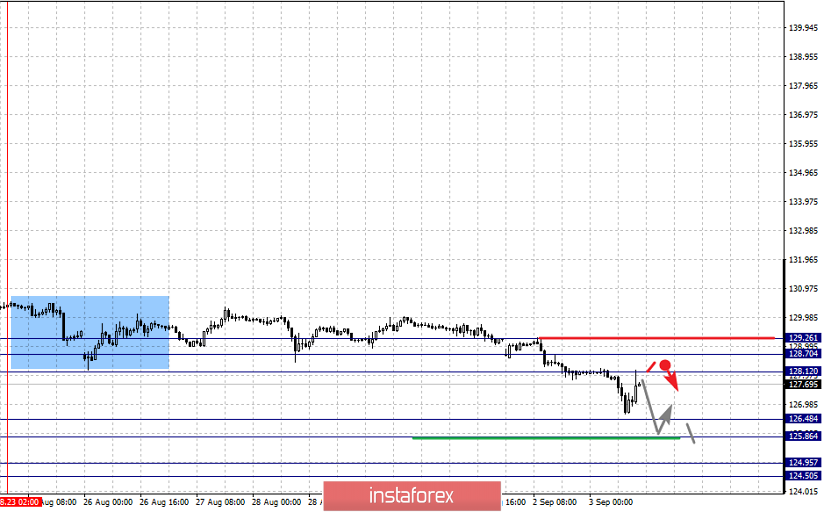

For the Pound/Yen pair, key levels in the H1 scale are 129.26, 128.70, 128.12, 126.48, 125.86, 124.95 and 124.50. We determined the subsequent targets for the downward movement from the descending structure on August 23. We expect a short-term downward movement in the range of 126.48 – 125.86 and the breakdown of the last value should be accompanied by a pronounced downward movement. The target is 124.95 and in the area of 124.95 – 124.50 is the price consolidation and hence the expected key reversal up.

The short-term upward movement is possible in the range of 128.12 – 128.70 and the breakdown of the last value will lead to an in-depth correction. The target is 129.26 and this level is the key support for the downward structure.

The main trend is the downward structure from August 23.

Trading recommendations:

Buy: 128.12 Take profit: 128.70

Buy: 128.72 Take profit: 129.26

Sell: 126.48 Take profit: 125.87

Sell: 125.83 Take profit: 124.95