To open long positions on GBP/USD, you need:

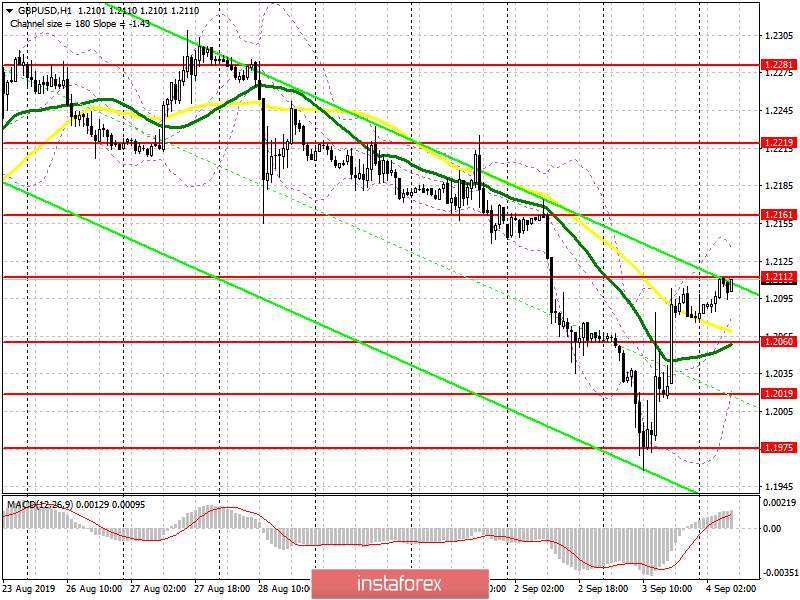

Yesterday, the pound rose sharply after it became known that parliamentarians voted to amend the Brexit agenda, which opens the possibility of approving a bill that does not allow the UK to leave the EU without an agreement. At the moment, buyers are focused on breaking the resistance of 1.2112, which will lead to the continuation of the upward correction of the pound to the highs of 1.2161 and 1.2219, where I recommend fixing the profit. However, there will be a major increase only if the above-mentioned bill is passed today, which will be voted on in the afternoon. In the case of GBP/USD decline, which is also possible, you can count on long positions after the formation of a false breakdown in the support area of 1.2060, or a rebound from a larger level of 1.2019.

To open short positions on GBP/USD, you need:

The sellers need a victory for Boris Johnson, who will also put the general election to a vote today. This will be done to block the opposition's attempt to pass through Parliament a bill on the inadmissibility of Brexit without an agreement. If Johnson wins, the pressure on the pound will increase, and the formation of a false breakdown in the support area of 1.2112 will be the first signal for opening short positions, the purpose of which will be the lows of 1.2060 and 1.2019, where I recommend taking the profit. In the scenario of the continued growth of the pound in the first half of the day, it is best to return to short positions after updating the maximum of 1.2161 or to rebound from the larger resistance of 1.2219.

Signals of indicators:

Moving Averages

Trading is above 30 and 50 moving averages, indicating a possible continuation of the pound's growth.

Bollinger Bands

In the case of the pound growth, the upper limit of the indicator in the area of 1.2130 will limit the upward potential. The downward movement of the pound will be stopped by the lower border at 1.2025.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20