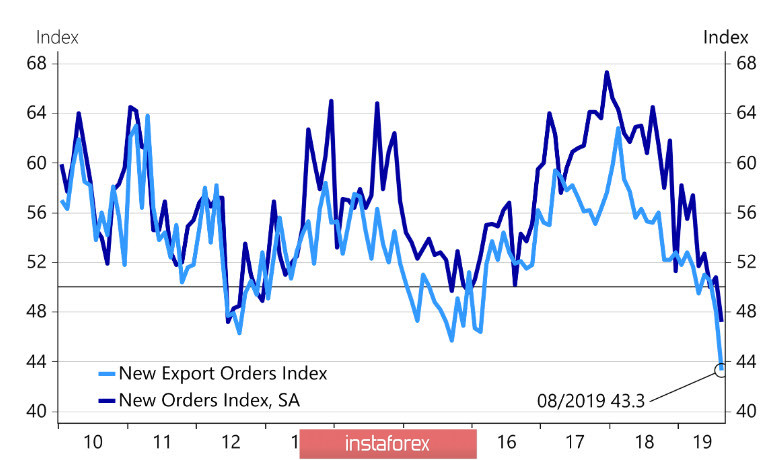

The ISM business activity index in the manufacturing sector fell below 50p. for the first time since the beginning of 2016, which was a surprise for the markets and led to a decline in the dollar. Meanwhile, the trend has remained negative for a long period, and there is no reason to believe that a reversal to growth is possible.

On the other hand, the sub index of new orders from abroad fell to 43.3p, which is the weakest indicator since the 2008 crisis, the total number of new orders at a minimum since 2012.

Thus, markets reacted quite sharply, the yield on 10-year treasures fell at the moment to 1.45%, and the quotes of the gold returned to a 6-year maximum once again. Today,the ISM report on the services market will be released, and if it turns out to be worse than expected, then the market reaction may be even stronger, since the probability of seeing good labor market data on Friday will decrease, and the Fed will lose room for maneuver.

At the same time, nothing surprising happens. The prerequisites for the failure of industrial production have been accumulating for a long time. The Congressional Budget Committee (CBO) of the United States published a study on August 29, in which it changed its traditional approach to forecast future budget indicators based on current legislation. The results were quite unexpected - if the planned changes in tax and trade policies are implemented, then the public debt level at the hands of the population will not be 95%, as in the baseline scenario, but 104% by 2029. In other words, the NEA directly indicates that the current policy of the Trump administration is leading the United States to ruin, not growth.

Meanwhile, the political struggle in the USA is entering a new stage. The scenario of the Fed's actions at the meeting on September 18 may include not only another 0.25% rate cut, but also the announcement of other measures if the current trends in the US economy decline develop.

Today, in addition to ISM, data on the labor market for the 2nd quarter will be published, as well as the ADP Private Sector Employment Report for August. Both indicators will allow to adjust expectations on non-farms on Friday, until recently, the Fed focused on external risks, a significant deterioration in internal indicators can greatly affect the position of the Fed.

EURUSD

Pressure on the euro declined after the publication of weak statistical data from the United States, but this decline is temporary, since the weakness of the euro is largely due to internal rather than external reasons. According to Markit, the PMI in production has been at a minimum since April 2013. Thus, there is no reason to believe that the dynamics can change, and there are no new rumors regarding the ECB's planned stimulus measures, which increases the likelihood of the euro moving into the consolidation zone in anticipation of Friday non-farms.

The minimum reached 1.0925 on the evening defines the lower limit of the range. In the case of weak ISMs in the services market, today's growth can continue up to 1.1020 / 30, however, the euro is still weaker in the long run and sales are likely to increase on growth.

GBPUSD

Today, the British Parliament will consider a law requiring the Johnson's government, if adopted, to ask the EU to postpone Brexit until January 31, 2020.

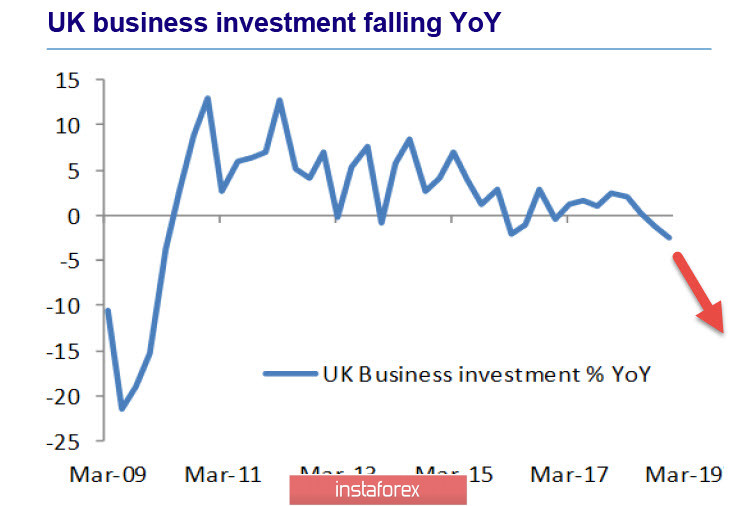

Meanwhile, the likely extension of Brexit's term will inevitably lead the UK economy into recession. Risks will be transferred next year. Due to this, high uncertainty for business will continue and investment will continue to decline.

This uncertainty will apply to everyone except the Bank of England - the scenario will be quite obvious. If the Brexit term is postponed to January, it will be forced to start its own incentive program, since any grounds for postponing it will disappear.

This scenario will also inevitably lead to powerful pressure on the pound, which will weaken at a rate much stronger than the dollar. Accordingly, the results of today's meeting will have a very strong impact on GBPUSD and its prospects. Until there is clarity in the outcome of the confrontation between Johnson and Parliament, the pound will be in equilibrium. The ban on leaving the EU without a deal, in turn, will support the pound in the short term. An attempt to test the local maximum of 1.2328 is possible, however, growth will need to be used to enter a short position, since the pound will go down in the long run amid prolongation of the period of uncertainty and the recession.