The British pound rose after the likelihood of avoiding the hard Brexit scenario without an agreement increased sharply. Also yesterday, it became known that the administration of Boris Johnson lost the majority of votes in the House of Representatives of Great Britain. The US dollar also weakened against most world currencies after reports showing problems in the manufacturing sector of the United States.

Yesterday, British deputies spoke out in the evening for changing the agenda of parliament. This is a bill related to the postponement of Brexit, as well as the inadmissibility of the UK leaving the EU without a deal. The vote on the bill will be held today, and in the case of a positive outcome, the British pound could further strengthen its position against the US dollar. 328 parliamentarians voted for changing the agenda yesterday, against – 301. Let me remind you that the deadline for the UK's exit is set for October 31, and many parliamentarians fear that Prime Minister Boris Johnson might withdraw the country without an agreement, which will seriously affect the economy.

The pound also received support after the news that the administration of Boris Johnson had lost the majority of votes in the House of Representatives of Great Britain. This happened after Conservative Philip Lee joined the opposition pro-European Liberal Democrats Party, which allows Parliament to block Brexit's tough script.

However, Johnson, although he lost one battle, but has not yet lost the war. The Prime Minister has one trump card – holding of early elections, which, in his opinion, is now the only way to resolve the situation around Brexit. The proposal will be considered today if his colleagues in Parliament vote for a delay on Brexit.

As for the current technical picture of GBPUSD, the further upward correction will be limited to the resistance of 1.2160, the breakthrough of which will take place only in case of a positive outcome in the vote and the victory of the opposition. The purpose of the bulls will be highs in the area of 1.2220 and 1.2290. If Boris Johnson gets approval for early elections, which is unlikely, the pressure on the pound will again increase significantly, as it will lead to another political impasse in the situation with Brexit. Support for the pound, in this scenario, will have the levels of 1.2020 and 1.1970.

EURUSD

Data on the eurozone producer price index helped the euro hold its position at the lows of the month, and a weak report on US manufacturing activity led to a strengthening of risky assets in the afternoon.

According to the report, the eurozone producer price index ( PPI) rose by 0.2% in July after a 0.6% decline in June this year. Compared to the same period in 2018, the index also strengthened by 0.2%. The data was slightly worse than economists' forecasts, which had expected growth of 0.3%. The eurozone's core producer price index excluding energy rose by 0.1% and 0.6% in July, respectively.

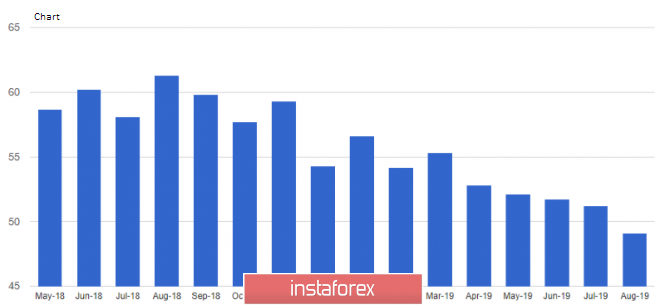

As noted above, activity in the US manufacturing sector lost momentum in August. According to the Institute of Supply Management, the PMI for the US manufacturing sector in August fell to 49.1 points from 51.2 points in July, and the index values below 50 indicate a decrease in the activity. Economists had expected the August index to be 51.0 points. The ISM noted that foreign trade remains the most significant problem.

According to IHS Markit, the indicator of production activity in the United States also decreased in August. It happened for the same reason because of the reduction in orders of foreign customers. The report indicated that the purchasing managers' index (PMI) for the US manufacturing sector in August 2019 fell to 50.3 points from 50.4 points in July.

As for the technical picture of the EURUSD pair, the upward correction may continue after the breakdown and consolidation above the level of 1.0990, which will lead to an update of the highs in the area of 1.1020 and 1.1050. If the pressure on risky asset returns and this may happen after the release of a weak report on the volume of retail sales in the eurozone, which should be reduced, buyers can find support only at the low of this month in the area of 1.0925.