In spite of the risks of promising inflation growth due to higher customs tariffs, the Federal Reserve will not only have to lower interest rates once but proceed to a cycle of their reduction.

The data on the index of production activity of the Institute for Supply Management (ISM) published on Tuesday showed a decrease in the indicator below the key mark of 50 points to 49.1 points in August from 51.2 points in July. This is a negative signal, which indicates that the troubled manufacturing sector in the United States is beginning to show full-fledged signs of a slide into recession. Moreover, interestingly, the value of the indicator is approaching the local minimum of August 2016, which was formed before the election of Donald Trump by 45 US Presidents.

At that time, the situation in the economy stabilized at a positive level but gradually began to lose the momentum received by the three incentive programs called quantitative easing (QE). The picture began to improve after President Trump decided on a new incentive through tax cuts and government subsidies. But just as with the application of quantitative easing, the new support measures have actually fizzled out, and the United States trade war last year only intensified the weakening of economic growth. America is facing a recession.

The negative value of the index of production activity contributed to the weakening of the US dollar, which, incidentally, fully coincided with its considerable technical overbought. The dollar fell against major currencies on Tuesday with the exception of the Japanese one. But the question is if it is a local correction or the beginning of a global reversal?

We believe that this is only a correctional decline so far. It's too early to talk about a possible change in the global trend. It seems to us that markets can only get a hint of the real future of monetary policy following the results of the September Fed meeting on monetary policy, from which investors are almost 100% likely to expect a 0.25% reduction in the key interest rate.

Forecast of the day:

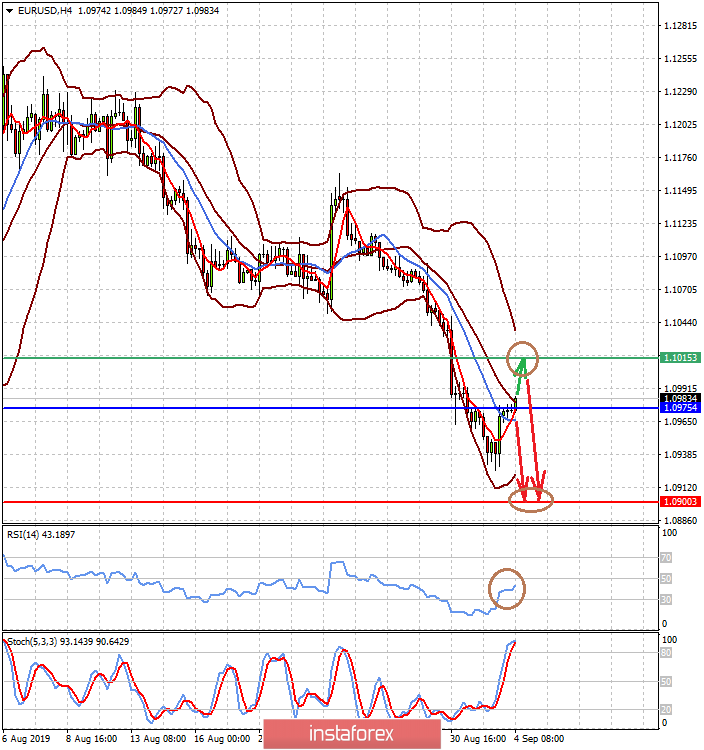

The EUR/USD pair is correcting upward in the wake of the local weakening of the dollar. It can grow to 1.1015 if it holds above 1.0975. But in general, we believe that the pair needs to be sold on growth from 1.1015 or after its decrease below 1.0975. The pair may turn around today due to the publication of weak data on retail sales in the eurozone.

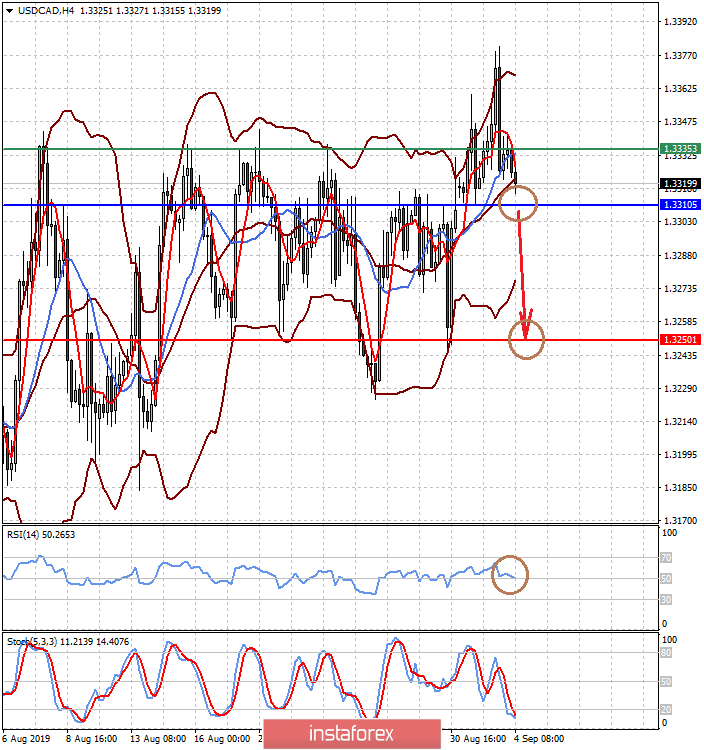

According to the results of the meeting of the Central Bank of Canada, the USD/CAD pair may decrease locally if not only the key interest rate is lowered, but the regulator does not give a specific signal about its future monetary policy. The fall in the pair may also be supported by a limited increase in crude oil prices. A price decline below the level of 1.3310 may serve as the basis for its fall to 1.3250.