Naturally, Britain is in the spotlight with its never-ending epic called Brexit. It has always been assumed that the British simply leave without notifying anyone. But what is happening completely breaks all the patterns. They said loudly - and did not leave at all. Thus, you can bring the situation to the point where everyone else leaves, and they remain alone. The next series of the highest grossing series of our time began with the fact that Boris Johnson threatened by early elections if the parliament rested and prevented him from making Brexit without a "divorce" agreement. True, he added that this is an extreme measure, and he himself does not want this, but if Europe rests and does not agree to the conditions of the United Kingdom, he will show them where the crayfish hibernate, slamming the door loudly, just no deal Brexit. After all, no one can predict the consequences. But at the same time, his support in the parliament is melting right before our eyes, and it came to the point that the conservatives lost their majority in the House of Commons by the evening, which now intends to consider the possibility of a new postponement of Brexit. However, not everything is so bad, since for speculators, prolongation of this story is the best option for the development of events. In conditions of total confusion and unpredictability, volatility just roll over, as well as the opportunity to earn extra money. Moreover, given how confidently the pound is going down, only occasionally demonstrating attempts to increase, it's quite easy to earn money - play banally against the pound, not paying attention to the periodically upward movements. They are more like dying pain and do not change anything.

This story also affects Europe, which, naturally, negatively affects the single European currency. However, there are enough problems on the continent without playful Britons. Just look at producer prices, whose growth rates have slowed from 0.7% to 0.2%. And, looking at this, it becomes clear that inflation simply has nothing to grow. This means that the European Central Bank has even more reasons for easing monetary policy. Also, taking into account the fact that less than two months remain before Christine Lagarde succeeds Mario Draghi as head of the European Central Bank, there are suspicions that the easing of monetary policy will happen in the near future. Let's just say that Mario Draghi can pretend to be a gentleman, and lower the refinancing rate right before his departure in order to divert criticism from the fragile lady.

However, the fascinating process of increasing the cost of portraits of the dead American presidents led to an unexpected overbought, and the market needed at least some reason to correct the imbalances. That is, a local correction was needed, which happened almost immediately after the auction opened in the United States. The reason for the rebound was the American statistics. True, not immediately, since the Markit data was treacherously better than predicted, and if the preliminary data on the index of business activity in the manufacturing sector showed a decrease from 50.4 to 49.9, then the final data showed a decrease to 50.3. And although this is still a decrease, the indicator turned out to be higher than 50.0 points, which means that all talk of an impending recession clearly does not hold water. Although similar data from ISM came to the rescue, showing a decrease in the index from 51.2 to 49.1. Thus, traders joyfully seized on such sad data and calmly carried out a long overdue correction, somewhat correcting the imbalances.

US Markit Manufacturing PMI:

Nevertheless, no correction does not change the general picture, which currently consists of the explicit desire of the European Central Bank to soften monetary policy and the explicit unwillingness to do so on the part of the Federal Reserve System. Yes, and no one will let forget about the confusion with Brexit. So the dollar will continue its confident move, especially since today, there will be a very good reason for this in the form of retail sales in Europe. The growth rate of which should slow down from 2.6% to 2.0%. It turns out that not only inflation is stably low, but sales are not growing properly. However, this alignment threatens the profits of companies, which should not be allowed, also no investor will buy shares in companies for which profit is not growing, and even shows a downward trend.

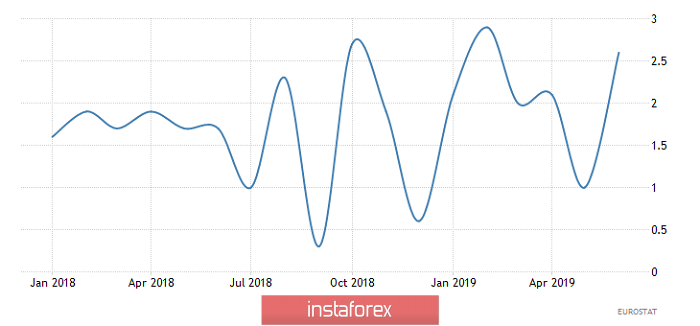

Retail Sales in Europe:

Thus, the single European currency can continue to decline today, and the reference point is 1.0925.

A purely British farce is also not going anywhere, so thanks to the titanic efforts of politicians, the pound may decline to 1.2050.