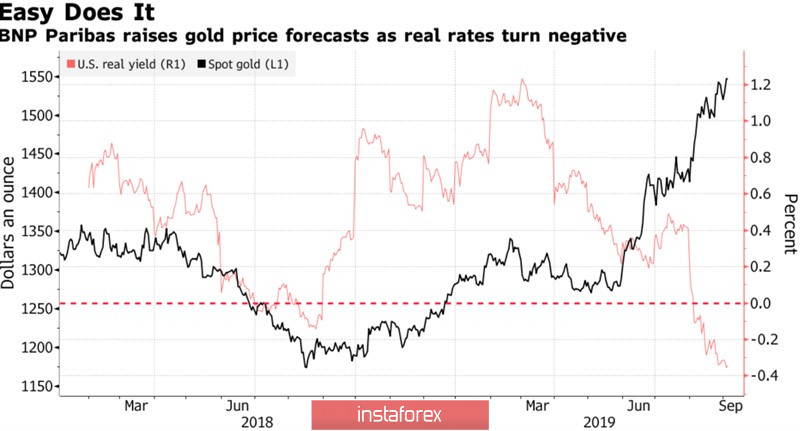

Several events such as the first fall in business activity in the US manufacturing sector below the critical level of 50 since 2016, the escalation of the trade conflict in Washington and Beijing, the protests in Hong Kong, as well as the intensification of the political struggle in Britain, quickly returned gold quotes to 6-year highs. The weakness of the purchasing managers' index, paired with the growth of international risks, increased the likelihood of a weakening Fed monetary policy. According to BNP Paribas, the Fed will cut the rate by 25 bp four times before June 2020, which will drop the US dollar and allow the precious metal to soar above $1,600 an ounce.

This forecast looks extremely conservative since only in August that XAU/USD quotes added 8%, and even 19% since the beginning of the year. Gold is one of the most highly effective instruments of both the commodity and financial markets as a whole. It reacts sharply to a decrease in the yield of US treasury bonds and to the correction of American stock indices. In turn, Treasuries and the S&P 500 showed increased sensitivity to news about the trade conflict in Washington and Beijing. Moreover, if the dollar grew in August due to the stability of the American economy, then a fall in business activity in the manufacturing sector below 50 seriously changed the situation. Also, if the dollar grew in August due to the stability of the American economy, then a fall in business activity in the manufacturing sector below 50 seriously changed the situation. The States are affected by Donald Trump's protectionist policies as other countries and if US macro statistics continue to deteriorate, the Fed will have to aggressively cut rates.

The dynamics of gold and yield on US Treasury bonds

This is supported by one of the main "hawks" FOMC, Boston Federal Reserve President Eric Rosengren. In his opinion, there is no sense in further weakening the monetary policy but if the state of the US economy worsens, the Central Bank may reduce the rate not by 25 but by 50 bp. It is possible that the first sign of the implementation of a pessimistic scenario was the release of data on business activity in the manufacturing sector. If the August labor market report for August disappoints, Jerome Powell's "dovish" rhetoric following the September FOMC meeting can be considered a fait accompli.

A favorable external background allows ETF fans to increase stocks. The indicator in August rose by more than 100 tons and exceeded the mark of 2450 tons, which was the highest since the beginning of 2013. Given the combined 154 tons in June-July, we can say that gold scatters like hotcakes but it could have been otherwise if the scale of the negative debt global debt market is approaching $17 trillion. Also, there are risks of the S&P 500 correction due to the inversion of the recession yield curve are growing by leaps and bounds? It remains only for the US dollar to confidently go down and the BNP Paribas forecast of $1,600 per ounce will be realized before the end of autumn.

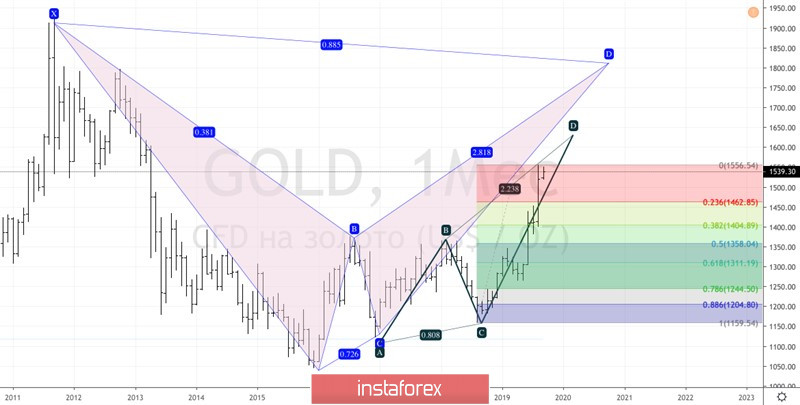

Technically, the precious metal continues the victorious procession and approaches the target by 161.8% according to the AB = CD pattern. It corresponds to the mark of $ 1630 per ounce. In the long run, bulls are set to move higher by 88.6% towards the target, based on the Bat model.

Gold monthly chart