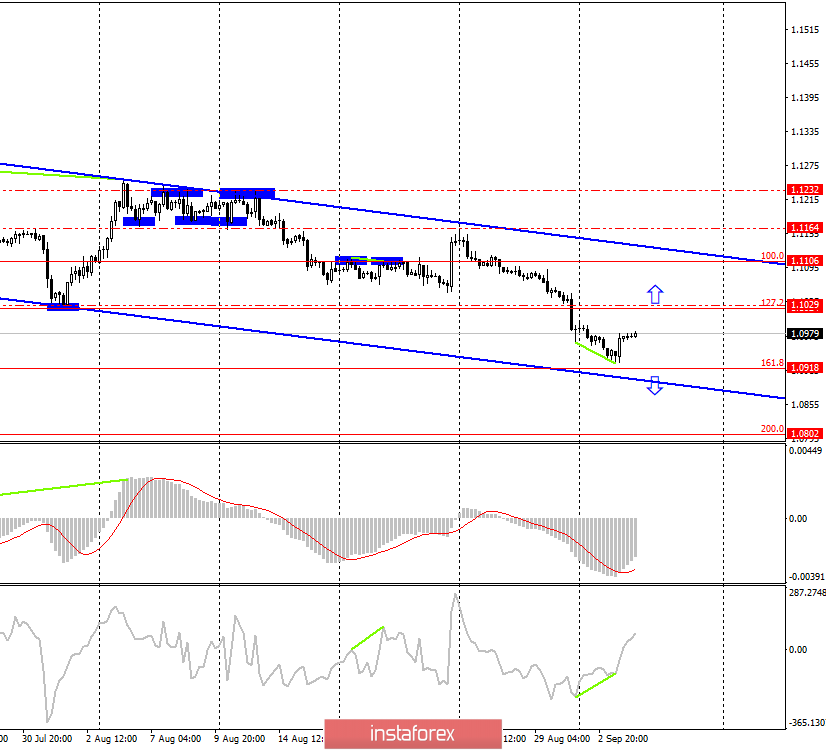

EUR/USD – 4H.

On September 4, the EUR/USD pair performed a reversal in favor of the European currency on the 4-hour chart after the formation of a small bullish divergence at the CCI indicator and began the growth process towards the correction level of 127.2% (1.1024). Thus, to the level of 161.8% (1.0918), which was designated as the target, for the last sell signal, there were not enough points. Yesterday, the most significant economic report was released in the United States, and it concerned business activity in the sphere of production. According to the ISM index, business activity in the US manufacturing sector began to slow down, as the value was 49.1. The second index of business activity, Markit, remained in the "positive zone". Nevertheless, the ISM index was enough for traders to stop buying the US dollar and take profits, not reaching the Fibonacci level of 161.8%. Based on this, traders can count on the corrective growth of the pound/dollar pair within the trend downward channel.

What to expect from the euro/dollar currency pair on Wednesday?

On September 4, I expect the pair to continue its corrective growth in the direction of the correction level of 127.2%. The rebound of quotations from this Fibo level will allow traders to expect a reversal in favor of the US currency and the resumption of the fall in the direction of the correction level of 161.8% (1.0918), according to the direction of the trend channel. If traders make a close above the Fibo level of 127.2%, then the growth of the pair can continue in the direction of the upper area of the channel and the correction level of 100.0% (1.1106). Further growth of the euro is not yet considered, as the information background for the euro as a whole remains negative. This is understood by traders and is in no hurry to buy the EU currency. Today in the morning, I recommend following the indices of business activity in the service sector, composite indices of Germany and the EU, as well as the report on retail sales in Europe. Strong data will support the demand for the euro.

The Fibo grid is built on the extremes of May 23, 2019, and June 25, 2019.

Forecast for EUR/USD and trading recommendations:

I recommend selling the pair with a target of 1.0802 if fixing is performed under the correction level of 161.8%. Stop-loss order above the level of 1.0918.

It is possible to buy the pair after closing above the level of 1.1029 with the target of 1.1108. In this case, the pair will remain inside the downward trend.

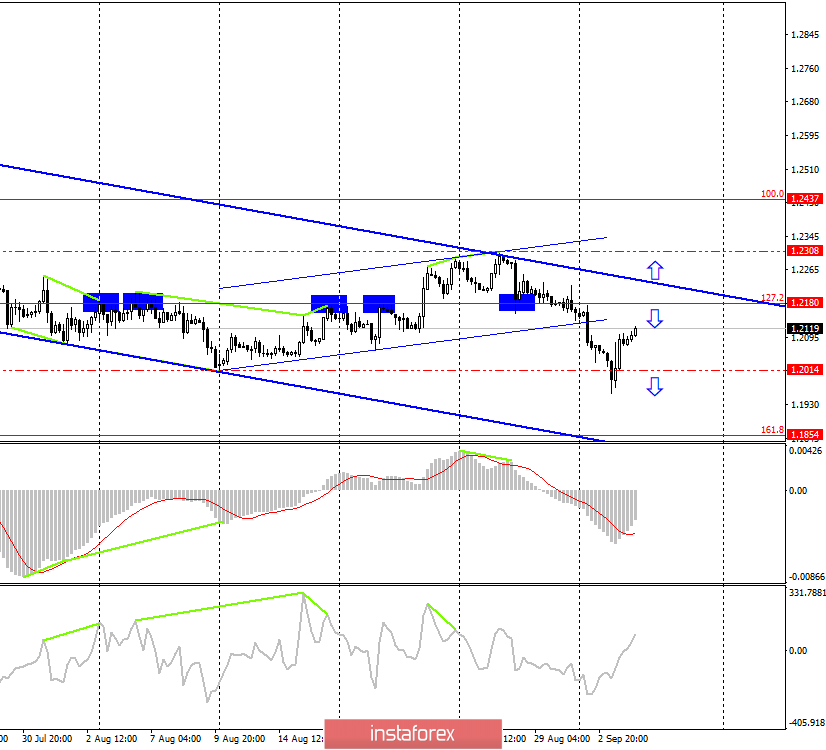

GBP/USD – 4H.

Yesterday was very eventful in the UK, and more specifically in the British Parliament. To begin with, the opposition movement led by Jeremy Corbyn once again criticized Prime Minister Boris Johnson, calling his actions absurd and illegitimate. This was followed by a vote for the initiation of a bill to block Brexit No Deal. If this bill is adopted, then Boris Johnson will have to look for workarounds to exit the European Union on October 31. In other words, the war with parliament will continue. Trumps of Boris Johnson are threats to party members about the deprivation of their deputy mandates if they support the laws on the ban on Brexit according to Johnson's plan, as well as the threat of re-election to parliament if the majority of deputies passes the No Deal ban on leaving the EU. Also, there is no unity of opinion even within the Conservative Party itself, which, according to many experts, is split into several camps. Thus, Boris Johnson has no corresponding support, and militant political forces may well provide him with fierce resistance, and not just formal. Do not forget that parliament will go on its second vacation on September 9, 2019, if the courts that are now considering claims regarding Johnson's decision to "pause" the parliament's work will not block this decision, having declared it illegal. Although there is little hope. There are more chances to succeed in parliament, and today traders will know the outcome of the first battle between deputies and the prime minister.

What to expect from the pound/dollar currency pair on Tuesday?

Now, the pound/dollar pair is in corrective growth to the upper area of the downward channel. The rebound from the correction level of 127.2% (1.2180), from which there were rebounds earlier, will work in favor of the US dollar and the resumption of the fall of the pair in the direction of levels 1.2014 and 1.1854. But in the case of a close above the level of 127.2%, the chances of a resumption of the downward trend in the coming days will decrease sharply, but it will still not be enough to buy the British pound, the purchases of which I recommend considering after leaving the downward channel and after the end of all wars in the British parliament.

The Fibo grid is based on the extremes of January 3, 2019, and March 13, 2019.

Forecast for GBP/USD and trading recommendations:

I recommend buying the pair very cautiously (or not buying at all) with a target of 1.2437 if the closing above the top line of the trend channel (downward) is performed.

I recommend selling the pair with a target of 1.2014, if the rebound from the level of 1.2180 is performed, with the stop-loss order above the correction level of 127.2%.