The British pound won back more than 250 points amid expectations that the bill, which does not allow Britain to leave the EU without a deal, will be approved today.

Large purchases of the pound are also confirmed by the fact that traders completely ignored the report, which indicates that the UK economy in August 2019 came even closer to the recession.

The contraction in economic growth and now even weaker growth in the service sector, which accounts for almost 80% of GDP in the UK, growing uncertainty around Brexit and the reduction in company investments mean a recession for the UK economy in the 3rd quarter of this year.

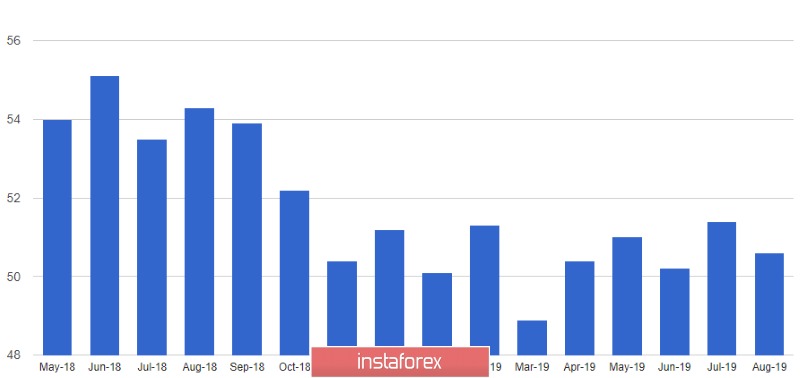

According to IHS Markit, the PMI Procurement Managers Index for the UK services sector fell to 50.6 points in August from 51.4 points in July. Values above 50 indicate an increase in activity, while lower values indicate a decrease in activity. At the beginning of the week, data were released that indicated a decline in activity in the manufacturing sector, as well as in the construction sector. As a result, the UK composite PMI in August dropped to 49.7 points from 50.3 points in July. This suggests that in the 3rd quarter of this year, the UK economy may contract by 0.1%.

Today, British Prime Minister Boris Johnson said that if the situation around Brexit leads to early elections, the date of their holding will be October 15. Johnson, meanwhile, once again called for a vote to be rejected in favor of a bill preventing Britain from leaving the EU without reaching an agreement. The bill is aimed at the inadmissibility of the toughest scenario that is likely to await Britain, since neither side is ready to make concessions to each other. Today, the European Commission published a report stating that residents and businesses of the European Union should not expect another Brexit delay and it is best to prepare for the toughest "divorce" of Britain and the EU.

Meanwhile, the Treasury secretary of the UK said that everything was ready for the hard Brexit scenario. Next year it is planned to increase the additional costs of 2 billion pounds associated with Brexit. The Treasury will also coordinate its fiscal policy with the Bank of England under a tough scenario.

As for the technical picture of the GBPUSD pair, the large support levels in the 1.2220 area have been updated, which limits the upward potential, the preservation of which will directly depend on the voting results. When the resistance breakthrough of 1.2220, the bulls will rush to new highs in the areas of 1.2340 and 1.2430.

EURUSD

The euro continued its upward correction against the US dollar, even against the backdrop of a weak report on a reduction in retail sales, which could seriously affect the eurozone economy. Most likely, ignoring the report was directly related to the fact that it completely coincided with the forecasts of economists. According to data, retail sales in the eurozone in July fell immediately by 0.6% compared with June and increased by 2.2% compared to the same period in 2018. June data was revised to + 1.2% m/m and + 2.8% y/y, respectively.

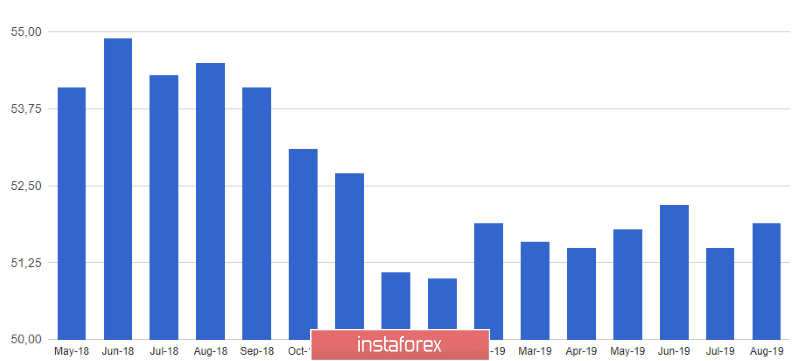

The index of PMI procurement managers for the eurozone services sector rose slightly in August and amounted to 53.5 points compared to 53.2 points in July. Economists had expected growth to 53.4 points. Given the manufacturing PMI, the eurozone compound PMI also rose to 51.9 points in August against 51.5 points in July.

As for the technical picture of the EURUSD pair, the further growth of risky assets will depend on whether the bulls manage to stay above the level of 1.1000 or not. If the trading instrument returns for this support, it is best to wait for a downward correction to lows of 1.0980 and 1.0950 and open long positions from there. The key target of the bulls today will be a high of 1.1050.