The euro-dollar pair updated the annual (and at the same time two-year) price low yesterday, reaching 1.0926, but it is trying to gain a foothold in the 10th figure today. Although there is no talk of a turning point in the trend, the pair may develop a fairly large-scale correction if rumors about the aggressive easing of the monetary policy of the Fed continue to intensify. The dollar index, which recently was in the region of 99 points, is gradually "descending from heaven", reflecting the general negative dynamics. The European currency, in turn, shows character, although it itself is under the burden of fundamental problems. Given the contradictory fundamental background, the corrective growth of EUR/USD is given to bulls of the pair with great difficulty. Nevertheless, traders are clearly discouraged by the intentions of the Federal Reserve, while similar intentions of the European Central Bank have been discussed for a long time.

However, it is too early to talk about any obvious intentions of the Federal Reserve. Only a few members of the Fed expressed their point of view, which, however, have the right to vote this year. Their position has significantly softened relative to previous speech. The same James Bullard, who has consistently advocated easing monetary policy, announced in early July that "rates are at an optimal level" and there is no need for their further reduction. But yesterday, he shocked the market with a proposal to reduce the rate immediately by 50 basis points. In this case, according to Bullard, the regulator will "adequately respond" to the current situation. According to him, the stakes are currently "too high", so the Fed should act decisively and not move "in small steps."

Bullard's position was unexpectedly supported by the head of the Federal Reserve Bank of Boston, Eric Rosengren. He also has the right to vote on the Committee this year, so his comments caused no less excitement in the market. Rosengren expressed concern about the inversion of the yield curve and the weakness of the global economy. And although he did not voice any specific values in the context of the prospects for the interest rate, he also noted that the Federal Reserve should resort to "aggressive measures" if the voiced risks begin to materialize.

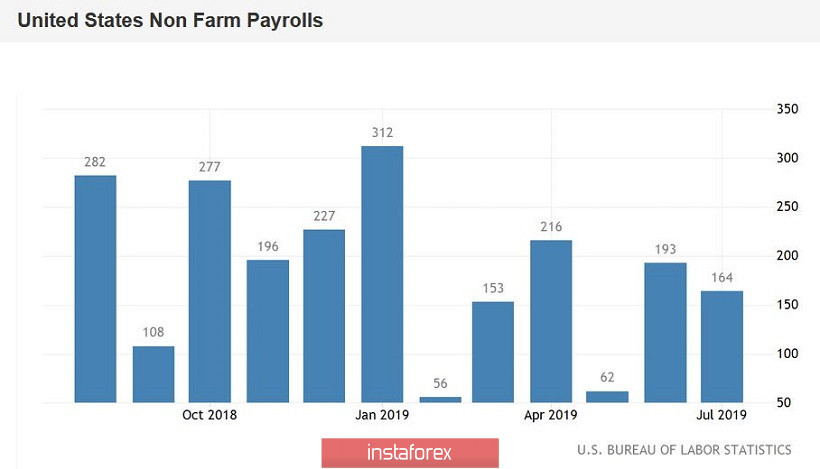

In this context, tomorrow's US labor market data has gained particular importance for the US currency. Nonfarm data, as a rule, support dollar bulls, so if key indicators do not meet the expectations of traders, the greenback will continue to move downward, as the likelihood of a 50-point rate cut at the September meeting will increase. According to preliminary forecasts, data on the labor market will again support the US currency, but the optimism of traders may be restrained due to weak growth in the level of wages. Thus, the unemployment rate should remain at the lowest level of 3.7% with a sufficiently significant increase in the number of employees (+160 thousand). But here a separate line is worth noting the growth rate of the average hourly wage. Analysts expect the indicator to slow down - in annual terms, it should fall to a three percent mark (after reaching 3.2%). If the stated figures are confirmed, the dollar will receive some support, but at the same time, a weak increase in salaries can smear the overall positive picture.

If the release as a whole comes out in the "red zone", then the panic regarding the possible results of the September meeting of the Federal Reserve will only intensify, which will undoubtedly affect the dynamics of the EUR/USD pair.

By the way, the US currency fell yesterday not only because of the "dovish" comments of the Fed representatives. Traders reacted quite rapidly to the publication of the ISM manufacturing index, which plunged to three-year lows. This figure was below the 50th level, which indicates a slowdown in this sector of the economy. It sharply fell to 49.1 points in August, despite good forecasts by analysts. This fact put additional pressure on the US currency, fueling interest in buying the EUR/USD pair.

The political events in Italy also indirectly supported the pair. In Rome, the two parties finally reached a coalition agreement, approving the composition of the new government, which will later be led by Giuseppe Conte. He was the prime minister even before the political crisis in the country, therefore this news was positively received by investors. The "coup" by Matteo Salvini ended in failure - although if he had achieved a re-election, he would surely have been at the helm of the government. The Brexit issue also contributed to the correctional recovery of the pair. At the moment, the British Parliament is still discussing a bill that will actually block the implementation of the "hard" scenario, at least by October 31. This solution, of course, will not solve the problem as a whole - but the foreign exchange market will still breathe a sigh of relief and stop counting the days until the "X-hour".

Thus, tomorrow's Nonfarm data can either strengthen the correctional growth of the pair or return the price to the bottom of the 10th figure, followed by testing the 9th price level. To be more precise, now the question is as follows: either the bulls of the pair by the end of Friday will be able to "pull out" the price above the 11th figure (in the range of 1.1090-1.1210), or the downward trend will continue - to the middle of the seventh figure , where the most powerful support level is 1.0750 (the lower line of the Bollinger Bands indicator on the monthly chart).