Eurozone data continues to come out pretty bad, and the euro ignores them all week. It is unlikely that one expectation that the Fed will lower interest rates will be enough to maintain the upward potential of risky assets, as the European Central Bank is about to announce the resumption of its asset repurchase program. Here, economists will recall the recent series of poor statistics on Germany and the eurozone, which will further aggravate the euro's position in the medium term.

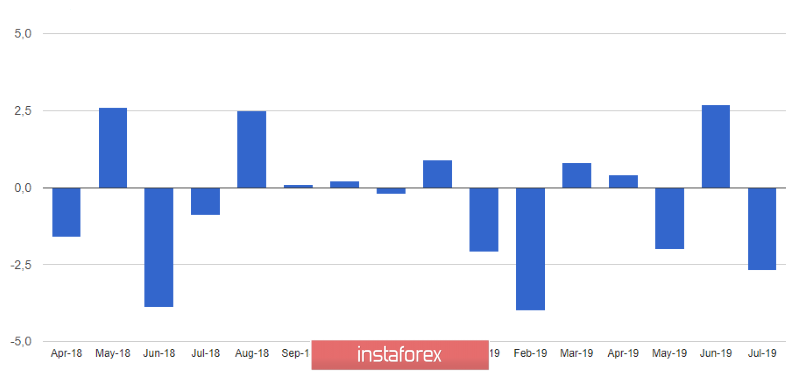

According to data, the volume of orders in the manufacturing sector in Germany continued to decline in July. A report by the German Federal Bureau of Statistics indicates that orders fell 2.7% in July from the previous month, while economists had expected a 1.5% drop. Compared to July 2018, orders fell immediately by 5.6%.

Considering the fact that at the beginning of the 3rd quarter the influx of new orders remains rather weak, there is no reason to talk about the restoration of the manufacturing sector in Germany amid growing trade conflicts.

The Ministry noted that the expectations of companies in the manufacturing sector also remain at a rather low level, and one should not expect improvement in industrial activity in the coming months. A decrease was observed even from the side of domestic orders, which fell by 0.5% in July this year in Germany, and external - by 4.2%. New orders from the eurozone countries grew by 0.3%, while new orders from countries outside the eurozone fell by 6.7%.

However, the euro is in demand, as speculative players were pleased with yesterday's speech by the future head of the European Central Bank, Christine Lagarde, as well as the situation around Brexit. She promised to study the positive and negative effects of a policy of negative interest rates, as well as bond purchases. However, Lagarde also made it clear that she does not intend to make changes to the central bank's policy, although all the necessary changes will most likely be made before she takes office this fall, which will necessarily affect the quotes of risky assets.

Christine Lagarde also stated that she was ready to heed Germany's fears and other European countries related to aggressive monetary stimulus measures and lower interest rates.

Today, news also appeared that trade negotiations between the US and China could resume in October this year, which supported risky assets in the morning. A statement by the Chinese Ministry of Commerce said Beijing was aiming for substantial progress in the October trade talks, and the recent telephone conversation between the US and China was quite good. The ministry also assured that China is strongly opposed to the escalation of the trade war and called on the United States to end the persecution of Huawei.

Let me remind you that this morning a telephone conversation took place between Chinese Prime Minister Liu He, US Trade Representative Robert Lighthizer and US Treasury Secretary Stephen Mnuchin. At the same time, new trade duties from the United States worth US $270 billion, as well as from China, which affect the automotive industry, where duties increased from 30% to 35%, began to operate.

As for the technical picture of the EURUSD pair, the short-term demand for the euro will still remain, but it is hardly worth counting on a bigger bullish trend. If the bears manage to return the trading instrument to the support level of 1.1050 by the end of the day, a small profit consolidation may begin at the end of the week, and the whole emphasis will be shifted to tomorrow's report by the US Department of Labor on the number of people employed in the non-agricultural sector. If the bulls continue to push the euro up, contrary to all logic, which also cannot be ruled out, then for those who wish to sell higher, larger resistance levels will be visible in the region of 1.1100 and 1.1150.