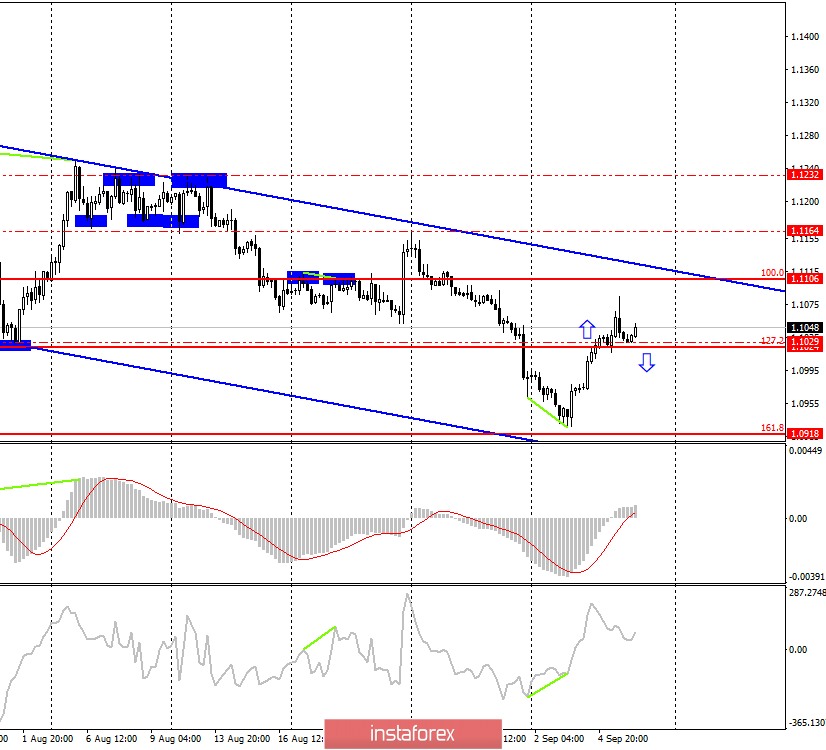

EUR/USD – 4H.

As seen on the 4-hour chart, the EUR/USD has completed the consolidation above the correction level of 127.2% (1.1029). Thus, the growth of quotations of the euro/dollar pair may continue today in the direction of the next correction level of 100.% (1.1106), which wonderfully coincides with the upper line of the downward trend channel in which the pair continues to be. Based on this, we can assume that around the level of 1.1100, there will be a reversal in favor of the US currency. At least around this level, I will consider the new sales of the pair. Euro can also be sold by the signal "closing under the Fibo level of 127.2% (1.1024)". The information background in recent days was on the side of the European currency, but yesterday, the ISM business activity index in the US services sector unexpectedly for many turned out to be higher than the expectations of traders, which caused profit-taking on previously opened purchases. The index of business activity ISM blocked two unsuccessful business activity index from Markit. But the report on the change in the number of people employed by ADP also supported the US dollar, as it showed an increase of 195K.

What to expect from the euro/dollar currency pair on Thursday?

On September 6, I look forward to continued correctional growth of the pair in the direction of the upper area of the downward channel and the correction level of 100.0% (1.1106). Near this level, I expect a reversal and consider this option as the main one, and closing above it as a secondary one. Today will be a very interesting day, as the level of GDP for the second quarter (forecast + 1.1% y/y) will be known in the European Union, and after lunch – Nonfarm Payrolls, unemployment, change in average wages in the United States. The trading day and week will end with a speech by Fed Chairman Jerome Powell, who can once again "direct" traders, indicating what the Fed plans at its next meeting.

The Fibo grid is built on the extremes of May 23, 2019, and June 25, 2019.

Forecast EUR/USD and trading recommendations:

I recommend selling the pair with a target of 1.0918 if consolidation below the level of 1.1024 is completed. Stop Loss – Over 1.1029.

It is possible to buy the pair now, as it closed above the level of 1.1029 with a target of 1.1106.

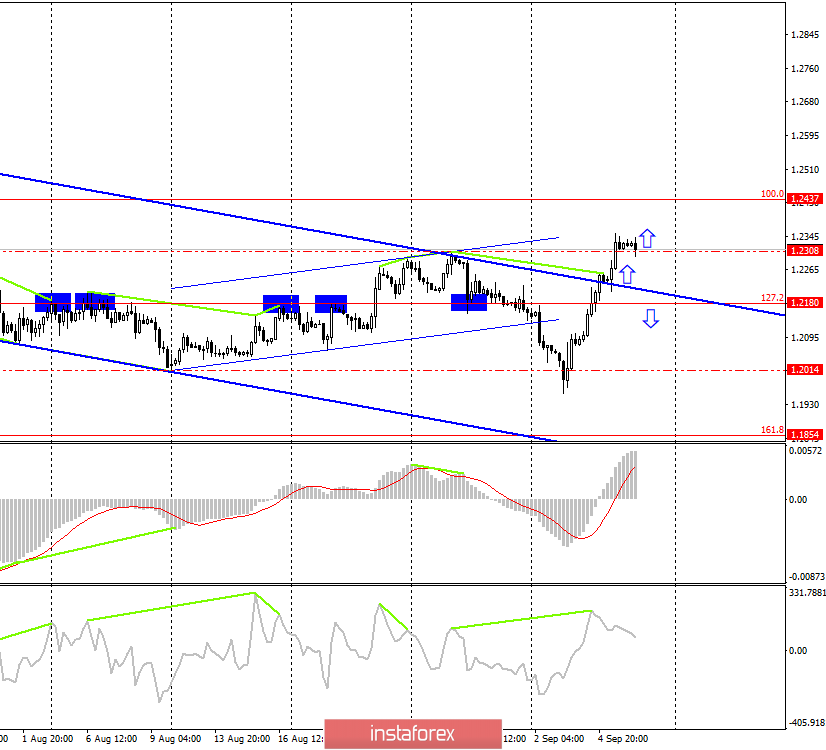

GBP/USD – 4H.

The latest developments and news from the British Parliament are discouraging. It seems that Boris Johnson was not going to make any deals with the European Union, and this moment casts a strong shadow on the Prime Minister. Although the Parliament decided to postpone Brexit until January 31, 2020 and blocked the country's possible exit from the EU on Johnson's initiative, Boris himself still refuses to ask the EU for a delay. It is the Prime Minister who should now contact EU leaders and ask for a postponement of the Brexit date until January 31. However, Johnson said: "I would rather lie dead in a ditch than ask for a postponement of Brexit." What does this mean? Johnson already questioned the principles of "legality", "democracy" by his decision to send parliament to forced leave. Now that the majority of deputies decided to postpone Brexit, Johnson refuses to perform their duties? Labor and opposition leader Jeremy Corbyn accused the Prime Minister of "not planning to conclude a new agreement." I believe that I did not plan earlier. The question is Boris Johnson's motivation; why should the Prime Minister clearly show that it is important for him to withdraw the country from the EU, and the agreement is a secondary issue? After all, we are talking about the future of the country, and the future of the UK will be very vague with Brexit "No Deal". But Johnson doesn't seem to care. That is why more and more often the name of Boris is associated with the name of Donald Trump, who is almost the only one actively supports Britain's hard exit from the EU. Trump's motivation is clear – it's profitable for the US president to quarrel between the EU and Britain, but why is this for Boris Johnson? The pound rose on the latest reports from Parliament, but the flow of information recharge stopped, so the pound/dollar pair may fall.

What to expect from the pound/dollar currency pair on Thursday?

Now, the pound/dollar pair has completed consolidation over the peak on August 27 – 1.2308. Thus, traders can count on the continued growth of the pair in the direction of the correction level of 100.0% (1.2437). However, a close below the level of 1.2308 will work in favor of the US dollar and a slight fall in the pair in the direction of the correction level of 127.2% (1.2180). Today, the divergence is not observed in any indicator.

The Fibo grid is based on the extremes of January 3, 2019, and March 13, 2019.

Forecast for GBP/USD and trading recommendations:

I recommend buying the pair very cautiously with the target of 1.2437 as close was performed on the level of 1.2308 with the stop-loss order under the level of 1.2308.

I recommend selling a pair with the target of 1.2180, if it closes below the level of 1.2308, with the stop-loss order above the level of 1.2308.