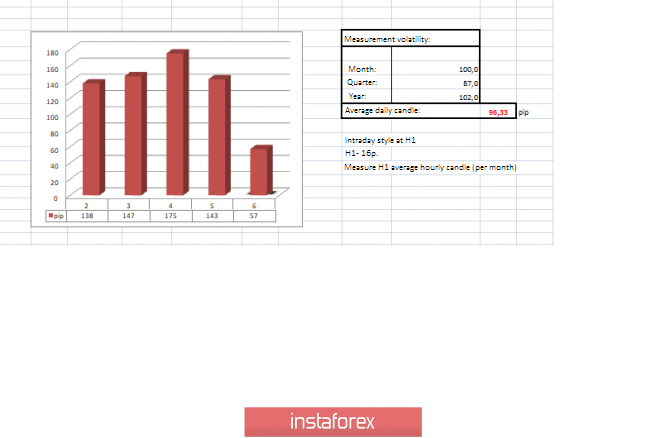

The pound/dollar currency pair for the last trading day showed ultra-high volatility of 143 points and this is the fourth day in a row; how can you not be happy when the average daily volatility is around 150 points.

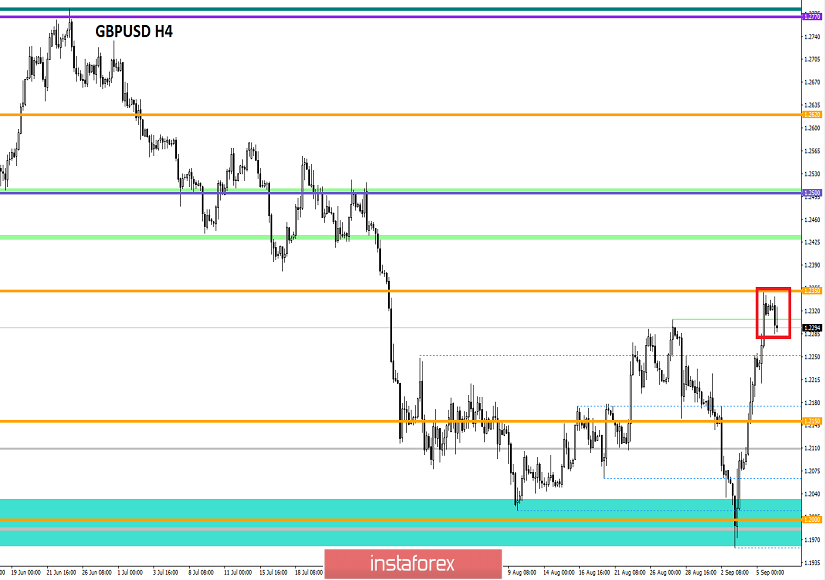

From technical analysis, we see just a vertical line. It is more than 360 points of upward movement without any rollbacks or stagnation. It is hard to imagine how much the long positions were overheated, it's hard to imagine the slightest rustle to destroy this tower of Babel. The level of 1.2350, there is a distinct slowdown with the formation of consolidation. What to say – FOMO works wonders.

As discussed in the previous review, only speculators work now, as everyone else is wary of such fluctuations. The tactics are the same, we monitor the information and news flow and try to identify the information as soon as possible. I'll open a little secret, in the era of the Internet and social networks, monitor Twitter and you will be happy. Examining the trading chart in the general plan (day time period), we see that the quotation managed to go just above the correction peak on August 27 (1.2307), which, frankly, is a little worrying if there will be a repetition of the period from the end of 2016 and the beginning of 2017. While I attribute everything that is happening to the panic of the market and do not exclude the possibility of a global downward trend, still nothing has changed in Britain, but the problems have only increased.

The news background of the past day had the report of the ADP on employment in the private sector of the United States, where, without exception, everyone expected a decrease in growth from 156K to 149K, and as a result, they got the opposite picture. According to the report, employment increased by 53 thousand and amounts to 195 thousand (Aug). At the same time, a lot of summary statistics came out in the States, and surprisingly, all of it was only in bright colors. Nothing happened to the US dollar at that point. The quote stood still, so high that it would be a sin not to fall. As you may have guessed, the fault, as always, was the information background, which cut the entire news stream to the root. So again, the same thing happened, floundering in a puddle of "Scandals, Intrigues, Investigations" dedicated to the divorce proceedings. Our beloved Prime Minister Boris Johnson managed to suffer two crushing defeats in just a few days of autumn: Postponement of Brexit; Loss of conservative votes. So this show did not end, yesterday Boris's brother announced his resignation from parliament, as well as from the post of minister for university and science.

Joe Johnson said on his twitter – "In recent weeks, I have been torn between family loyalty and national interests. These are insoluble contradictions. It's time for someone else to take my place as MP and Minister." @JoJohnsonUK.

In turn, Michel Barnier, the EU's chief negotiator for Brexit, said the talks were "paralyzed." According to Barnier, the party interested in replacing the "backstop" clause has not yet submitted any proposals. At the same time, information was received from EU deputies regarding the delay. The EU is ready to consider postponing Brexit, but France and other countries are likely to want clear explanations from Britain about how much longer it may take for a positive result, and legal guarantees that the UK will not undermine EU business.

Today, in terms of the economic calendar, we are waiting for the report of the United States Department of Labor, where, according to forecasts, they expect a reduction in the number of people employed in the non-agricultural sector from 164K to 160K. But if you refer to the ADP report, then it could be the other way around, and the indicators will come out pretty good. Maybe this time, the GBPUSD pair will not ignore the statistics and there will be a reaction on the dollar.

The upcoming trading week in terms of the economic calendar expects to be no less hot. There will be a considerable package of data on Britain and the United States but the main round of volatility will be tied to a spontaneous information background, and it is scheduled for Monday. So, on September 9, two votes were scheduled in the British Parliament at once. The first vote on the bill, excluding the possibility of Britain's exit from the EU without a deal, forcing to take a delay. The second vote on the initiative of Boris Johnson in early elections. Thus, we are waiting for the continuation of the banquet and high volatility.

The most interesting events displayed below:

Monday, September 9th

United Kingdom 09:30 London time – Production in the manufacturing industry (y/y) (July): Forecast. -1.1%

United Kingdom 09:30 London time - Volume of construction in the UK (YoY) (July)

Tuesday, September 10th

United Kingdom 09:30 London time – Average wage excluding bonuses (July): Prev 3.9% – 3.8% forecast

United Kingdom 09:30 London time – Average wage including bonuses (July): Prev 3.7% – 3.7% forecast

United Kingdom 09: 30 London time – Unemployment rate (July): Prev 3.9% – 3.8% forecast

USA 15:00 London time – The number of open vacancies in the labor market JOLTS (July): Prev. 7.348M

Wednesday, September 11th

USA 13:30 London time – Producer price index (PPI) (y/y) (Aug): Prev 1.7% – 1.7%

Thursday, September 12th

ECB meeting, followed by a press conference

USA 13:30 London time – Core consumer price index (CPI) (y/y) (Aug): Prev 2.2% – 2.2% forecast

Friday, September 13th

USA 13:30 London time – Retail sales (y/y) (Aug): Prev 3.4% – 3.2% forecast

Further development

Analyzing the current trading chart, we see that the pound froze in anticipation, is not just in a substantial overbought, but in a stunning one. The fluctuation within the level of 1.2350, followed by consolidation, clearly reflects the uncertainty and the desire to adjust as soon as possible. Traders took a waiting position, preparing to jump into the descending candles.

It is likely to assume that if the data on the number of employed in the non-agricultural sector of the United States will be better than forecasts and the pound/dollar pair will not ignore them, then against the background of the excessive overbought, a recovery process can occur with considerable amplitude. Traders are considering a primary recovery towards the level of 1.2150. There is one more plot, this complete "ignore" of everything that is happening and freezing within the level of 1.2350 (+/- 70 p.), where the pair will continue to work exclusively on incoming information. Thus, be prepared for this development of the plot.

Based on the above information, we derive trading recommendations:

- Buy positions are considered in case of a clear price-fixing higher than 1.2350 (not a puncture), where the information background and the subsequent FOMO will reappear.

- We consider selling positions in the form of quotes recovery towards the level of 1.2150. We consider entry points according to circumstances, some traders have already entered the market. Others are waiting for an inertial move.

Technical analysis

Analyzing the different sector of timeframes (TF), we see that the indicators in the short term variably signal a downward interest, but are still in stagnation. The intraday and medium-term outlook signal an upward interest due to the stunning leap of days past.

Volatility per week/Measurement of volatility: Month; Quarter; Year

The measurement of volatility reflects the average daily fluctuation, with the calculation for the Month / Quarter / Year.

(September 6 was based on the time of publication of the article)

The volatility of the current time is 57 points, which is a low indicator for this period. If we refer to the indicators from the beginning of the month, we have an average daily level of about 150 points, wherein the case of maintaining at least the slightest mood, the volatility of the current day will exceed the average daily figure.

Key level

Resistance zones: 1,2350**; 1,2430; 1,2500; 1,2620; 1,2770**; 1,2880 (1,2865-1,2880)**.

Support zones: 1,2150**; 1,2000***; 1,1700; 1,1475**.

* Periodic level

** Range level

*** The article is based on the principle of conducting transactions, with daily adjustments.