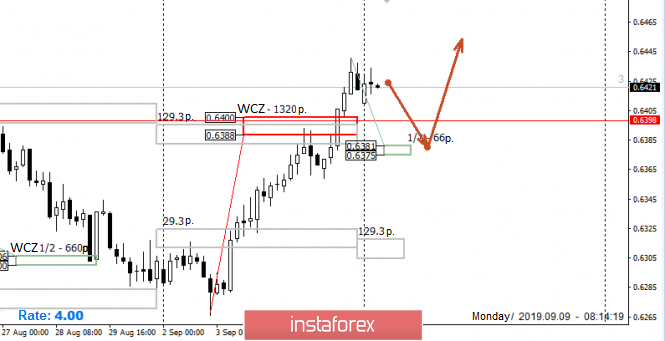

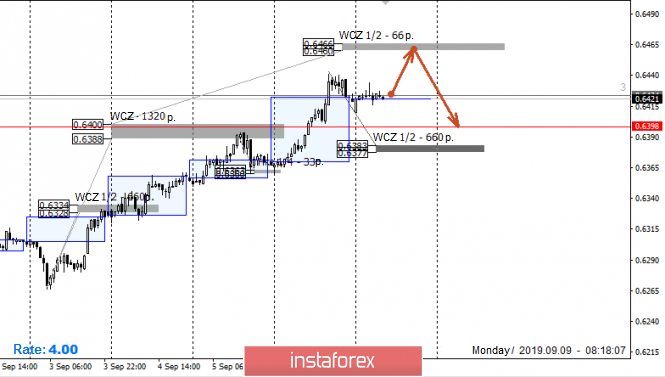

Closing last week's trading occurred above the average move. This makes it possible to obtain favorable prices for purchases when forming a downward correctional model. The main support will be 1/2 WCZ of 0.6383-0.6377. Testing this zone will allow you to consider the pattern of a "false breakdown" to enter the purchase.

The upward movement is already an impulse. Therefore, sales during the formation of the "false breakdown" pattern will have a correctional character and will require partial or full fixation on the main support areas.

An alternative model with a low probability is to continue to grow from current levels. If the New Zealand dollar continues to strengthen, then the probability of a return to the level of 0.6398 will remain 90%. For this reason, purchases of the instrument will become profitable only below the indicated mark even if a retest of the maximum of the previous week occurs first.

Daily CZ - daily control zone. The area formed by important data from the futures market, which changes several times a year.

Weekly CZ - weekly control zone. The area formed by marks from the important futures market, which changes several times a year.

Monthly CZ - monthly control zone. The area is a reflection of the average volatility over the past year.