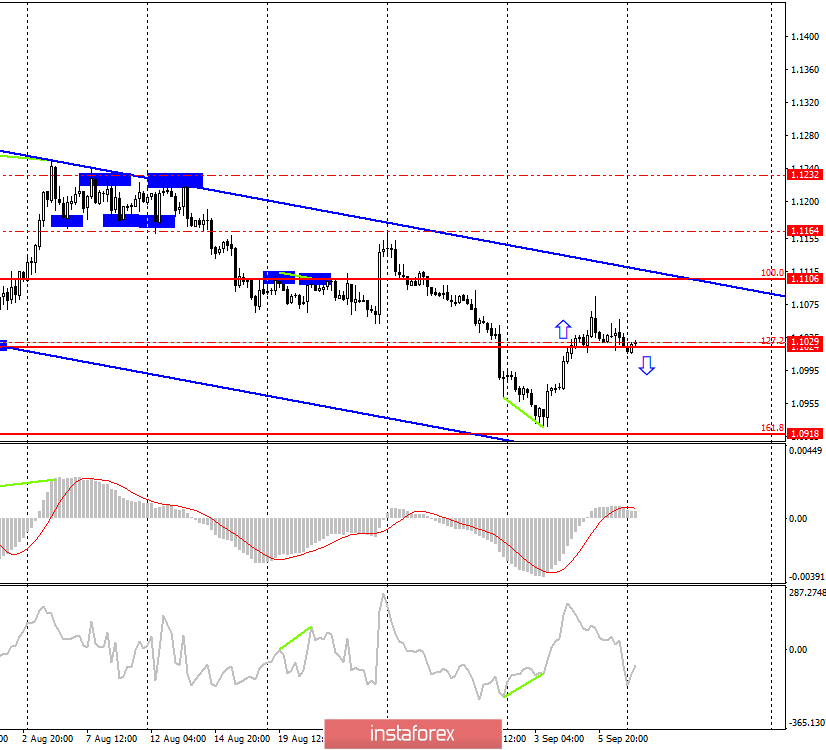

EUR/USD – 4H.

As seen on the 4-hour chart, the EUR/USD pair returned to the correction level of 127.2% (1.1024). So, the next pair from this level of correction will allow traders to expect a reversal in favor of the European currency and the resumption of growth towards the correction level of 100.0% (1.1106), which is located in the upper area of the downward trend channel. Friday was very much expected by traders because of the powerful information background planned for this day. It all started quite positively for the EU currency. Gross Domestic Product grew by 1.2% in the second quarter instead of the expected + 1.1% y/y. However, if you look at this report from the other side, it turns out that a very low forecast was exceeded. The GDP growth of 1.1% y/y is weak. For example, on the evening of the same day, Jerome Powell said he expected GDP growth of 2.0% - 2.5% in 2019. American statistics can be interpreted in different ways. On the one hand, average hourly wages rose in August by 3.2%, which is again higher than the expectations of traders, while the unemployment rate remained unchanged at 3.7%. On the other hand, Nonfarm Payrolls was a little disappointing, showing that the number of new jobs in August was only 130K instead of the expected 158K. Well, in the evening, Powell made a statement, which, firstly, said that the growth rate and the state of the US economy remain at a good level. Secondly, he did not expect a recession in the world economy and the US economy. Thirdly, the uncertainty due to trade wars and weak inflation remains a headache for the Fed. Thus, it was difficult to understand from his speech whether the Fed is preparing to lower the rate at the next meeting, or is the "economy in good condition" and does not require additional stimulation?

What to expect from the euro/dollar currency pair on Thursday?

On September 9, I am waiting for a clarification of the situation around the levels of 127.2% - 1.1024 and 1.1029. The rebound of the euro/dollar pair from these levels will work in favor of the euro, and traders will be able to count on the resumption of growth. Closing quotations under the correction level of 1.1024 will allow expecting the continuation of falling of pair in the direction of the correctional level of 161.8% (1.0918). Divergence is not observed in any indicator today. Today, I do not expect statistics from either Europe or America. Thus, trading activity today may leave much to be desired. You can use today to determine the mood of most traders in the forex market. If growth resumes with an empty calendar, then traders intend to end the downward trend.

The Fibo grid is based on the extremes of May 23, 2019, and June 25, 2019.

Forecast for EUR/USD and trading recommendations:

I recommend selling the pair with the target of 1.0918 if the consolidation is made below the level of 1.1024. A stop-loss order above the level of 1.1029.

You can buy a pair in the event of a rebound from the levels of 1.1024 - 1.1029 with a target of 1.1106. A stop-loss order below the level of 1.1024.

GBP/USD – 4H.

As we have all become accustomed to, all the most interesting happens in the UK and does not even touch on the economic theme. This, of course, is about Brexit, which risks being delayed for an additional 3 months, if the EU approves the delay, and Boris Johnson will ask the EU for this delay. Briefly, the latest developments are as follows. Boris Johnson lost both important votes in parliament. 21 members left the Conservative Party. A vote of no confidence in Johnson was not announced. The Parliament ordered Johnson to request the postponement on Brexit until January 31, 2020; the British Prime Minister refused this option, without explaining how he could step over the law that had just been passed prohibiting him from implementing Brexit on time. However, details have come to light today that illustrate well that Johnson can indeed avoid Brexit's transfer in a "roundabout way". One such option is Brussels's refusal to grant an extension. The British Prime Minister is going to send a letter to Brussels in which he will detail his thoughts about the lack of the need to postpone Brexit to a later date, and also inform the EU government that he, as head of the country, is against the postponement. In this case, the only thing left to the British Parliament is to vote for the extraordinary elections to the House of Commons. The vote will take place tonight, after which the deputies will go on leave for 5 weeks, until October 14. Unfortunately, for the pound, this news is "black". Last week, the pound was actively growing on the expectations of traders that Johnson would certainly not be able to implement the Brexit "No Deal", which, according to the majority, would be destructive for the country's economy, and could also lead to referendums on the independence of Scotland and Ireland. Now, it turns out that Johnson can easily circumvent the law. Well, we are waiting for the end of the evening vote in Parliament.

What to expect from the pound/dollar currency pair on Thursday?

Now, the pair pound dollar performed the rebound from the level of 1.2308 and despite the trend channel, can resume the fall. All the fault, as I said above, Johnson's ability to "bypass" the law on blocking Brexit "No Deal". If Johnson succeeds, then Brexit's probability will again increase sharply by October 31, and for the pound, this means a new fall. Today, there will also be reports on GDP and industrial production in July. It is recommended that traders pay attention to them, but Brexit and voting in parliament remain the number one topic today.

The Fibo grid is based on the extremes of January 3, 2019, and March 13, 2019.

Forecast for GBP/USD and trading recommendations:

I recommend buying the pair very carefully with the target of 1.2437 if the closing is performed above the level of 1.2308 with a stop-loss order at 1.2308.

I recommend selling a pair with the target of 1.2014 if the closing is performed under the level of 1.2180, with the stop-loss order above the Fibonacci level of 127.2%.