The British economy is blinking red, and the pound marks its fastest weekly rally since May and rightfully tops the list of the best performers of the G10 in this time period. This happens when politics rules the ball. Great Britain's Parliament is pushing Prime Minister Boris Johnson to commit suicide by prolonging the transitional period by 3 months until January 31, which reduces the risks of a messy Brexit. The prime minister said that he would rather die in a ditch than agree to a divorce from the EU later than October 31, and the sterling rises from the ashes, sincerely hoping thatJeremy Corbyn's rise to power would allow it to grow to $1.3, and then to $1.35.

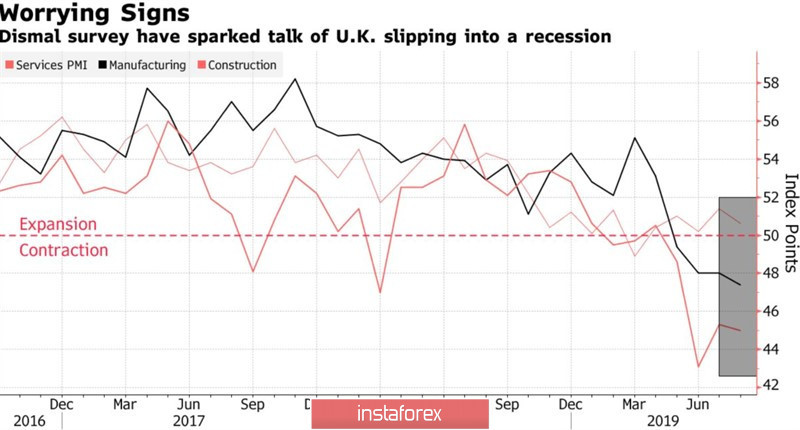

A strong economy is a strong currency. The pound has repeatedly violated this principle over the past few years. Once again in September, when business activity in the manufacturing and construction sectors fell below a critical level of 50, disappointing PMI statistics in the services sector and retail sales, as well as problems in the housing market, suggested that the recession was near. As a rule, in such a situation, central banks, seeking to pull the economy out of the abyss, lower rates, and the exchange rate of the national currency drops. In the case of sterling, everything happened just the opposite.

The dynamics of British business activity

The British Parliament did not just prolong the transition. It is opposed to Boris Johnson's desire to organize a snap election on October 14. According to the Labour Party, they should be held a couple of weeks later so that the current prime minister does not have the opportunity to bring his ploy to life and make messy Brexit a reality. The chances of the country's exit from the EU without a treaty are falling, and the pound continues to please its few fans.

According to State Street Bank, Societe Generale SA and MUFG, the GBP/USD pair will rise by about 5% to 1.3 if, as a result of early elections, Jeremy Corbyn takes over as prime minister. The ideas of the leader of the Labour Party about nationalization, increasing borrowings and budget spending are liked by few people, but of the two evils it is customary to choose the least. If with the participation of Corbyn, London succeeds in signing an agreement with the European Union, sterling has a good opportunity to jump to $1.35. UBS Wealth Management believes that for the growth to $1.3 pounds the mere fact of prolonging the transition period until January 31 will be enough.

The British currency comes back to life, although uncertainty has not disappeared. History repeats itself, and the extension of the transitional period from March 29 to October 31 showed that sterling's successes were temporary: in March, it rose to 9-month highs, and then it fell to a 3-year low. It will be even more interesting to observe the upheavals of the political struggle and the release of data on the labor market of Great Britain during the week of September 13.

Technically, quotes going beyond the short-term downward channel and activating the inverted "Shark" pattern increase the chances of the "bulls" to realize its target by 88.6%. It is near the 1.27 mark.