To open long positions on GBP/USD, you need:

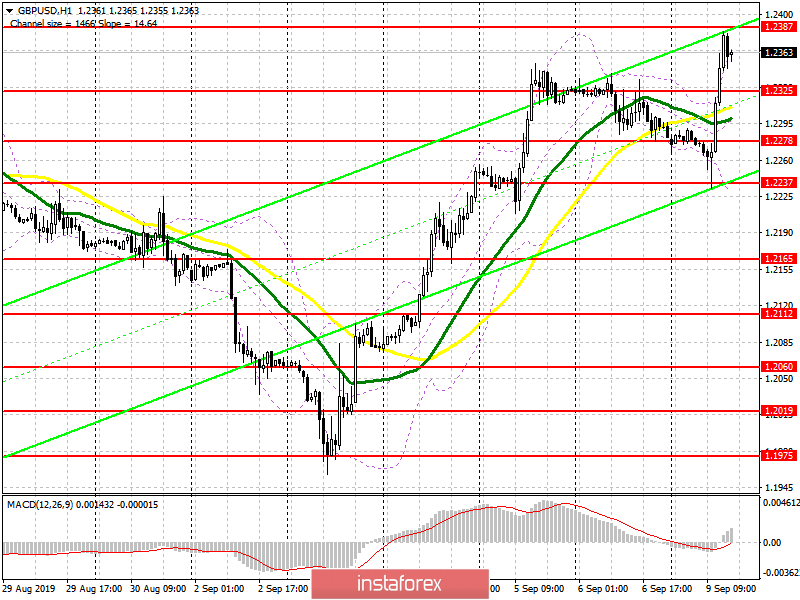

The British pound rose in the first half of the day after a more than excellent report indicating the growth of the UK economy in July this year by 0.3% compared to June. Given that economists had hoped for a minimum growth of 0.1%, bulls quickly returned to the market, which allowed them to break above the highs of last week and gain a foothold. At the moment, the task of buyers is to break the resistance of 1.2387, which limited the upward potential and which I pointed out in my morning forecast. This will allow you to keep the bullish market, which will target the highs of 1.2427 and 1.2460, where I recommend fixing the profits. If the bears build a downward correction in the second half of the day, the support will be provided by the level of 1.2325, and it is possible to open long positions for a rebound near the minimum of 1.2278.

To open short positions on GBP/USD, you need:

Sellers will actively protect the maximum of 1.2387, and the formation of a false breakdown there in the second half of the day will lead to a correction of GBP/USD to the support area of 1.2325, where I recommend fixing the profits. With a larger closing of long positions, the pair can test the area of 1.2278. If the bullish momentum in the North American session leads to a breakthrough of the resistance of 1.2387, it is best to consider new short positions after updating local highs in the areas of 1.2427 and 1.2460. However, without Brexit news, and preferably positive, counting on a larger growth of GBP/USD will be very problematic, as the market is in balance and a new informational occasion is required.

Signals of indicators:

Moving Averages

Trading is above 30 and 50 moving averages, indicating a further bullish scenario.

Bollinger Bands

In the case of a decline in the pair in the second half of the day, the average border of the indicator around 1.2295 will provide support.

Description of indicators

- MA (moving average) 50 days– yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20