The euro ignored data on German export growth, while the British pound strengthened against the US dollar after data that the UK economy will be able to avoid a recession at the end of this year.

According to the data, German exports unexpectedly increased in July this year, which is the only positive news for the European Central Bank in the past two weeks, when a terrible series of fundamental statistics came out

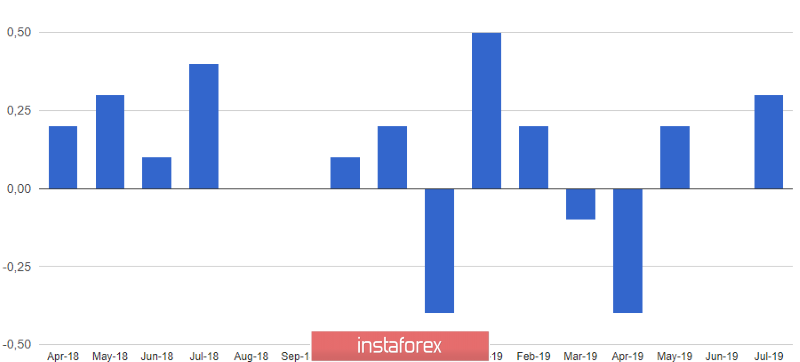

According to the report of the Federal Bureau of Statistics, exports grew by 0.7% in July compared with the previous month, amounting to 115.2 billion euros. Economists expected it to decline by 0.6%. Exports grew by 3.8% compared to July 2018. But imports, on the contrary, decreased by 1.5% compared with June, amounting to 93.7 billion euros. In general, the positive balance of foreign trade in Germany in July amounted to 21.4 billion euros.

Despite this, the likelihood of a recession continues to roll like a snowball. Therefore, the measures of the European Central Bank, which will be announced this Thursday, will be very helpful. Talking about a sharp depreciation of the European currency will also not be entirely correct, since the market has already partially laid down lower interest rates and a return to the asset repurchase program. The ECB is expected to lower its deposit rate by at least 10 basis points and announce the resumption of its quantitative easing program. If the actions of the European regulator are sharper, then in this case, the pressure on the euro will return.

Today, US Secretary of the Treasury Mnuchin made a statement, who, in an interview with Fox Business, said he did not expect a recession in the US in the foreseeable future and looked forward to a healthy and steady economic growth before the end of the year. Mnuchin also noted that he was ready to sign an agreement with China if it would be beneficial for the United States and that the continuation of trade negotiations should be positively assessed. Let me remind you that at the end of last week the demand for safe haven assets and gold fell sharply after it became known that the parties would continue negotiations in October this year.

As for the technical picture of the EURUSD pair, it remained unchanged.

At the beginning of the week you should not count on active movements. Most likely, the bears will attempt a return below the support of 1.1020, but the demand for the euro will resume after updating lows around 1.0990 and 1.0950. However, only a breakthrough of the 1.1055 range will strengthen the demand for the trading instrument and lead to the updating of local highs in the region of 1.1090 and 1.1120.

GBPUSD

Another thing is the British pound, the demand for which returned after an unsuccessful attempt to break through the lows in the region of 1.2260. The data on the growth of the UK economy, which has stabilized from May to July thanks to the services sector amid the risk of a hardBrexit scenario, led to a sharp increase in GBPUSD.

According to the report of the UK National Bureau of Statistics, UK GDP in July of this year grew immediately by 0.3% compared to the previous month and by 1.0% compared to July 2018. The growth of industrial production over the same reporting period helped to level weak data on the deficit in foreign trade in goods.

Thus, UK industrial production increased by 0.1% in July compared with June, while economists expected it to decline. Compared to July 2018, production decreased by 0.9%. The main decline was noted in the manufacturing industry, where production from May to July decreased by 1.1%, and in the construction sector - by 0.8%. But as I noted above, support was provided by the service sector, which grew by 0.2%.

Demand for the pound is also associated with a reduction in the fears of the hard Brexit scenario. It is expected that this week the queen will sign a decree that will not allow the country to exit the EU without a deal. However, this may not be enough for the British prime minister, and he will try to withdraw the country from the EU, even contrary to the above bill.

As for the technical picture of the GBPUSD pair, counting on such "cheerful" growth in the future will not be entirely correct. Updating the highs on one positive news is not a reason to increase long positions, since the political situation with Brexit has come to a complete standstill. It is best to wait for the correction of the trading instrument in the region of 1.2240, which could become the boundary of the side channel, and open long positions in this range.