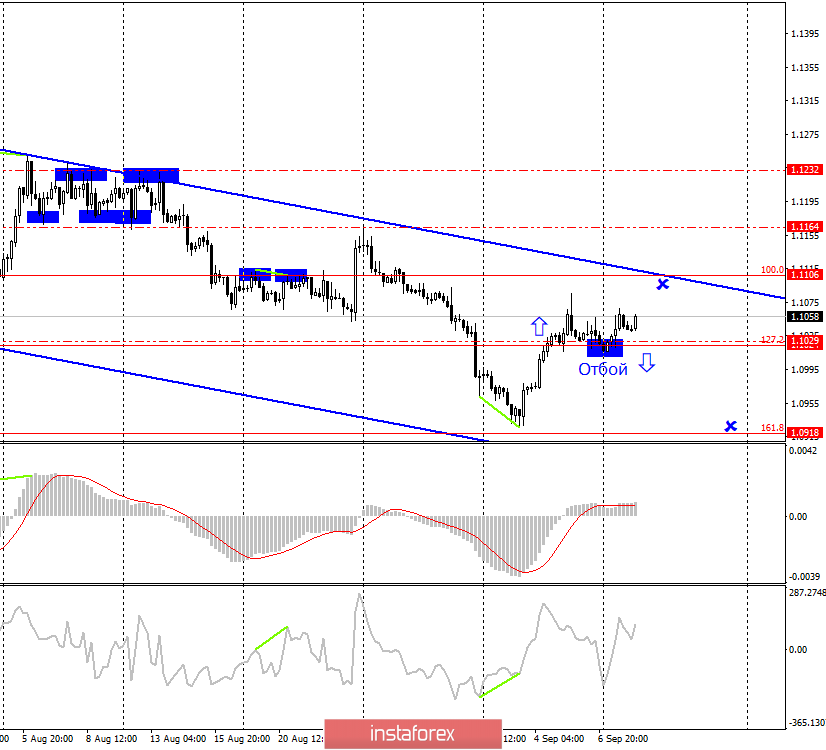

EUR/USD – 4H.

As seen on the 4-hour chart, the EUR/USD pair rebounded from the corrective level of 127.2% (1.1024) with a reversal in favor of the European currency. Thus, the growth process may be resumed today in the direction of the correction level of 100.0% (1.1106), which is located in the upper region of the downward trend channel. Yesterday there is nothing special to note if you specifically analyze the euro/dollar pair. There were no interesting news from America, Donald Trump, Jerome Powell, or economic reports. The situation in the European Union was no better. A couple of reports on the German economy (imports, exports, trade balance) showed nothing special. It is a weak information background that explains the relatively low activity of traders. The key topic remaining on the agenda is the ECB meeting. It is the results that traders are waiting for and it seems that they do not intend to force events before they get a clear idea of the ECB's actions. And for the euro, the ECB meeting is like a "sword of Damocles", since nothing is expected to support the euro currency at this meeting. The best deal for the euro is if Mario Draghi decides that now is not the time to change the parameters of monetary policy. It sounds very unlikely, as the eurozone's economic performance continues to fall, and Mario Draghi has only two chances to soften monetary policy before he transfers his responsibilities to Christine Lagarde on October 31, 2019.

What to expect from the euro/dollar currency pair on Thursday?

On September 10, I do not expect sharp movements and high activity of traders. Quotations rebound from the Fibo level of 127.2% allows us to expect growth in the direction of the level of 1.1106, but the information background will be zero until Thursday. And the fact of the upcoming ECB meeting, which is unlikely to be positive for the euro, does not give traders any reason to buy the euro. Most likely, if we hear something optimistic at the meeting, then the euro will be bought after it. Until Thursday, I expect weak and boring movements of the euro/dollar pair with a possible close under the correction level of 127.2%, which will indicate the preferences of traders for the current week and their expectations following the meeting of the European Central Bank.

The Fibo grid is based on the extremes of May 23, 2019, and June 25, 2019.

Forecast for EUR/USD and trading recommendations:

I recommend selling the pair with the target of 1.0918 if the consolidation is made below the level of 1.1024. A stop-loss order above the level of 1.1029.

You can buy the pair now, as the rebound from the levels of 1.1024 – 1.1029 with the target of 1.1106 was made. A stop-loss order below the level of 1.1024. Buying a pair, given the information background, is not a priority.

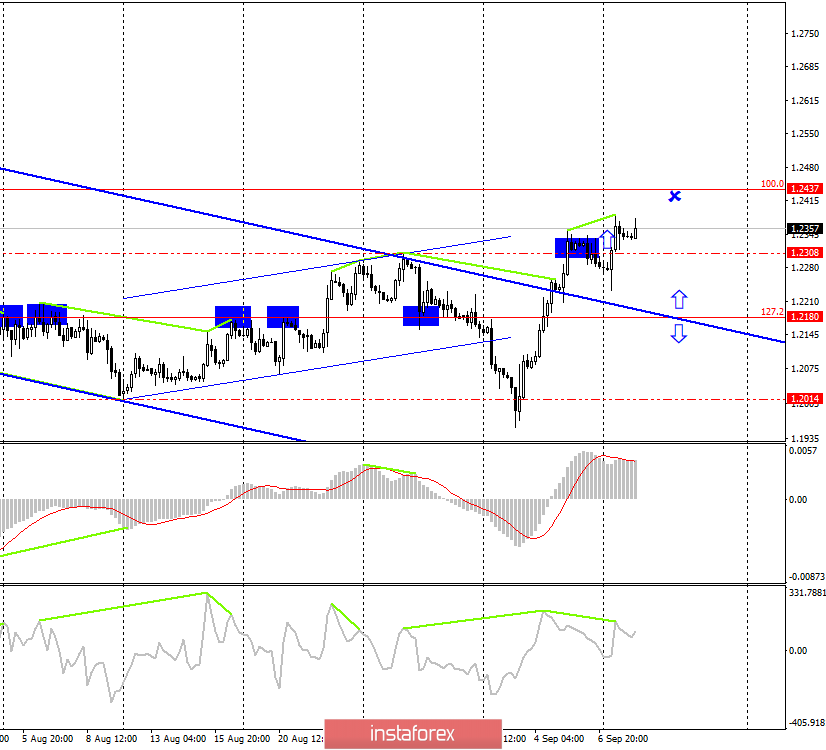

GBP/USD – 4H.

Yesterday, the British parliament officially set off for a new vacation, in which Boris Johnson sent them to avoid interference with Brexit's implementation of "No Deal". However, Boris Johnson miscalculated, and this miscalculation could cost him dearly. Few believed that in 6 working days, the Parliament will be able to pass a bill that prohibits the Prime Minister to leave the European Union without an agreement and obliges him to ask for a delay until January 31. But parliamentarians showed amazing unity and passed the law described above in one day, and blocked the re-election to parliament, which Johnson also tried to initiate. Boris Johnson's policy, by the way, is becoming more similar to the way Donald Trump does business. The American President also tries to bypass all the "sharp corners" on the way to his goals, dismiss all those who do not obey him and have a different opinion and accuses all those who contradict him of all mortal sins. Johnson's latest insinuations were directed at Jeremy Corbyn, whose party did not support parliamentary re-election 2 times. Previously, according to Johnson, the Laborites wanted re-elections, but now, at a key moment (for Boris Johnson himself, author's note), they refused to support the prime minister's proposal. Corbyn immediately replied that he agreed to an early parliamentary election if there would be guarantees that the country would not leave the EU without an agreement. The government cannot provide such guarantees, moreover, everyone understands that Johnson wants to implement exactly Brexit "No Deal" and is not very keen to negotiate with Brussels. Also, Johnson is trying to circumvent the newly adopted law and persuade the EU not to extend the terms of Brexit. Boris Johnson did not hear about the "fair play", and even the most ardent opponents of the British Prime Minister stopped talking about the principle of democracy.

What to expect from the pound/dollar currency pair on Thursday?

Now, the pound/dollar pair has completed consolidation over the level of 1.2308, however, whether the pair continues to grow is a big question. Firstly, there is a bearish divergence in the CCI indicator, which itself indicates a possible fall to the level of 1.2308. If the pair closes below the level of 1.2308, it will significantly increase the probability of further fall in the direction of the correction level of 127.2% (1.2180). Secondly, today in the UK, there will be data on wages, and if it turns out that this figure is weaker than traders expect to see, it will be a good enough reason for selling the pound, which has just begun to revive. Thirdly, the last two days have passed without a sharp increase in the British currency, which means a decrease in the interest of traders in new purchases of the pound.

The Fibo grid is based on the extremes of January 3, 2019, and March 13, 2019.

Forecast for GBP/USD and trading recommendations:

I recommend stopping from buying the pair, as a bearish divergence has formed in the CCI indicator.

I recommend selling a pair with the target of 1.2180, if the closing is performed under the level of 1.2308, with the stop-loss order above the level of 1.2308.