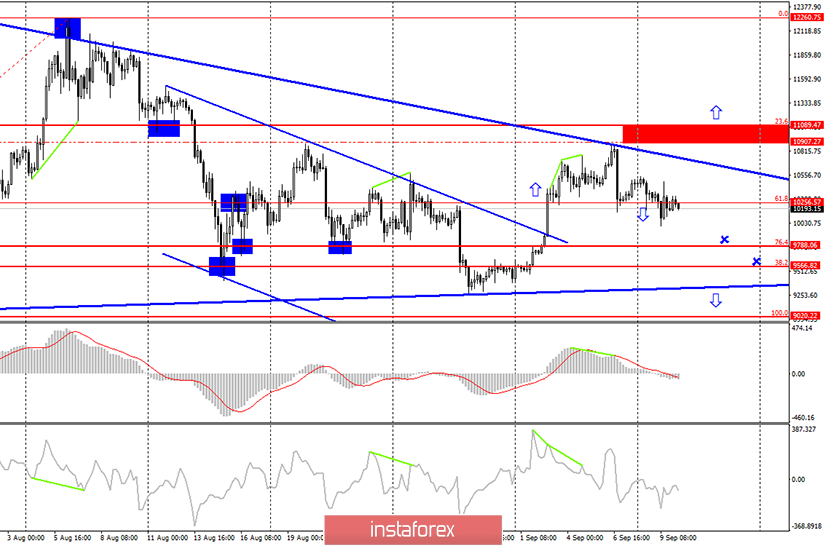

Bitcoin – 4H.

On September 9, the BTC rate continues to fall in the direction of the corrective level of 76.4% ($9788), which is the first target on the way to the lower line of the tapering triangle or the upward trend line, to which I expect to descend in the coming days and weeks. A signal to drop BTC was received yesterday morning, as cryptocurrencies closed at Fibo level of 61.8% ($10256). I still do not consider buying "cue ball" before closing quotes over the area of $10907 - $11089 and, accordingly, over the downward trend line. This is the technical picture of the "cue ball" on September 10.

Now, as for the news from the cryptocurrency segment. An interesting study was conducted to find out what is the period between buying bitcoin and guaranteed profit for absolutely every investor. It turned out that this period takes about 3 years and 8 months. Of course, we are talking about every investor who has at least one bitcoin in his portfolio. Those who sold BTC for $19500 made profits a few days later. And those who bought for $ 19,500 are not the fact that they will ever receive it at all. Nevertheless, current research provides such averages.

Meanwhile, in Japan, at the 6th international conference on the regulation of cryptocurrencies, it was proposed to transfer the forex market to stablecoins. It is assumed that such a solution can save banks liquidity, which in the context of a possible recession of the world economy is a useful solution for the banking systems of many countries. At the moment, the forex market is a decentralized market that does not have a single control center. And the exchange rate of a particular currency is determined by many transactions in the interbank network, access to which only very large financial institutions have access to.

Even more interesting news is coming from the Bitcoin network itself. According to the statistics website Blokchain.info, the hash rate will soon reach three digits. This suggests that miners are increasing production capacity since in 2020 the so-called halving will take place, which will halve the profit for one mined block. Accordingly, if the price of bitcoin does not grow twice by that time, then bitcoin mining will become twice less profitable. Moreover, since the reward will be reduced by half, some of the equipment (mostly old) can be thrown into the landfill, since, using it for mining, the costs will exceed revenues. Therefore, more miners want to have time to get as many "cue balls" as possible, while the price is high enough, and halving is not soon.

Overall results:

Bitcoin continues to fall in price, although at a low pace. Based on the picture in the illustration, the most likely option is a decrease in the area of $ 9300 - $9400. I don't see any prerequisites for other development of an event now. I still recommend considering Bitcoin purchases after the appearance of trend change signals.

The Fibo grid is based on the extremes of July 17, 2019, and August 6, 2019.

Forecast for Bitcoin and trading recommendations:

Bitcoin performed consolidation under the Fibo level of 61.8%. Thus, I recommend selling a cryptocurrency with the goals of $9788 (76.4% of Fibonacci),$ 9566 (38.2% of Fibonacci) and $9400 (the bottom line of the triangle).

I do not recommend buying bitcoin now, as the cryptocurrency remains in a narrowing triangle.