The British pound managed to regain its position against the US dollar after another attempt at a downward correction, which was undertaken by sellers at the beginning of the European session. Good activity in the UK labor market is a direct signal that the economy will be able to avoid a recession by the end of the year, having begun its active recovery, despite the unforeseen Brexit scenario.

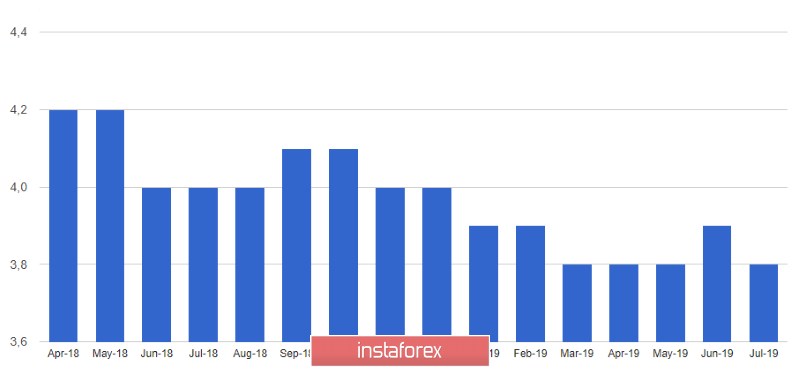

According to the National Bureau of Statistics, unemployment in the UK from May to July 2019 decreased and amounted to 3.8%. The last time such a low mark was recorded was back in 1974.

The ILO report also indicated that over the same period, the number of unemployed in the UK fell by 11,000 compared with the previous three-month period, to 1.294 million people. The number of applications for unemployment benefits rose by 28,000 in August against 19,000 in July. Economists predicted growth of 29,000. It is worth noting that, despite the weakening economy, the pace of employment remained quite high.

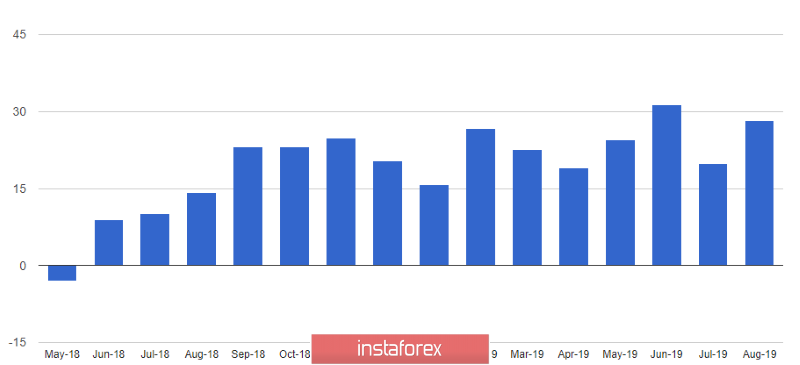

In addition, a report was released today, which indicated a rise in wages in the UK, which would certainly spur inflation and allow the Bank of England to maintain a tendency to raise rates. The average earnings in the UK from May to July increased by 3.8%, while economists had expected this indicator at the level of 3.7%.

Let me remind you that recently the Bank of England paid attention to the labor market, on which the further scenario of increasing interest rates depends, if Brexit goes smoothly.

A statement by the Governor of the Bank of England also supported the demand for the British pound in the morning. Among the risks, Carney drew attention to the likelihood of a global economic downward turn, which has recently increased significantly. However, in his opinion, central banks have the most tools to counter the recession, and the United States has the greatest free monetary policy potential to respond to possible problems, although the ECB will find it difficult to respond to the usual recession.

As for the UK economy, despite the downside risks to the outlook, the core of the UK financial system is ready for Brexit. Mark Carney believes that even if the scenario of hard Brexit slows down the UK economic growth, it will spur inflation, which will lead to higher interest rates in the future. The governor of the Bank of England made it clear that negative interest rates in the UK would not be used as a tool, which led to sharp purchases of the British pound.

As for the technical picture of the GBPUSD pair, it remained unchanged. Buyers can not cope with resistance at 1.2390, and only its breakdown will provide the trading instrument with a new surge of strength. If trading continues to be below this range, a repeated downward correction to the lower boundary of the 1.2240 channel, which was formed yesterday after the bears' unsuccessful attempt to return to the market, is not ruled out. The lack of clearer benchmarks for Brexit, of course, will scare away large buyers, but the demolition of a number of sellers' stop orders above 1.2390 and a return to this level should not be ruled out either.

EURUSD

There are few data on the eurozone countries at the beginning of this week. Today there was only a report on industrial production in France, which in July this year grew by only 0.3% compared with June, while growth was projected at 0.2%. In Italy, a similar indicator was completely reduced by 0.7%, which once again indicates problems in this sector of the economy.

Traders are in no hurry to return to the market due to a very important meeting of the European Central Bank. As some economists expect, the ECB is unlikely to restart the bond purchase program this fall and will limit itself to only lowering interest rates by 10 points in the negative direction.

First of all, there is no consensus among leaders regarding the need for a new round of quantitative easing, as the ECB has not many instruments in the conditions of zero interest rates to influence a slowing economy.

As for the technical picture of the EURUSD pair, it remained unchanged compared to previous forecasts, since market activity before the important decision of the European Central Bank is quite low. Most likely, the bears will again try to return to the area below the support of 1.1020, but the demand for the euro will resume after updating lows around 1.0990 and 1.0950. A break in the range of 1.1055 will increase the demand for the trading instrument and lead to the updating of local highs in the region of 1.1090 and 1.1120, which was not done yesterday.