To open long positions on EURUSD you need:

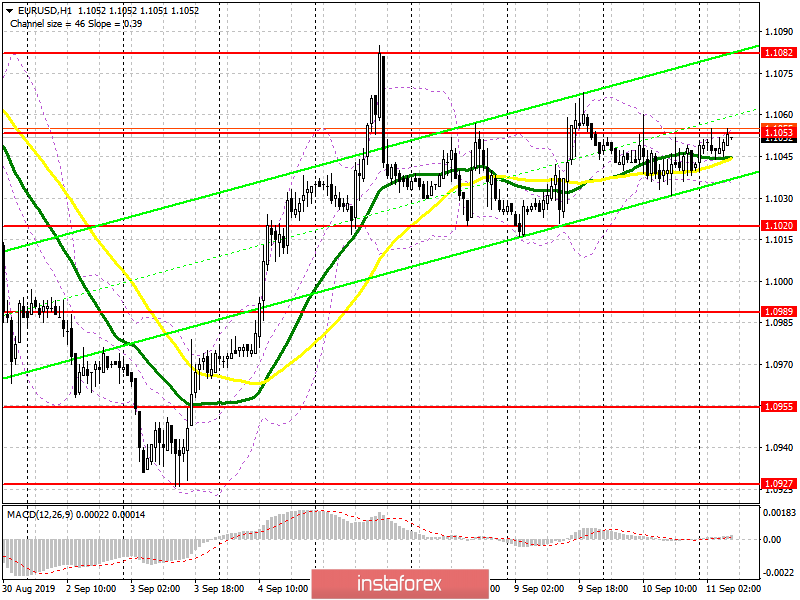

The lack of movement in the EUR/USD pair and low volatility are explained by the importance of the European Central Bank meeting, the results of which will be known tomorrow. The ECB is expected to lower interest rates. At the moment, the focus in the first half of the day will be concentrated at the same level of 1.1053, a breakdown of which will lead to an update of last week's high in the area of 1.1082, where I recommend taking profits. A larger growth should not be expected, since important fundamental statistics are not planned for the first half of the day. Under the scenario of EUR/USD decline, you can count on support in the region of 1.1020, however, opening long positions from there is best after a false breakdown, or buy the pair for a rebound from a low of 1.0989.

To open short positions on EURUSD you need:

Nothing has changed from a technical point of view. Euro sellers are activated after an update of resistance at 1.1053, and the formation of a false breakdown there will be the first signal to open short positions in the expectation of a return and correction to the support of 1.1020. However, a breakthrough and consolidation below this low remains a more important task, which will push EUR/USD to the area of large levels 1.0989 and 1.0955, where I recommend taking profits. In the event of further growth above the resistance of 1.1053, which can only happen closer to the beginning of the US session after the release of inflation data in the United States, it is best to count on sales as a rebound from the high of 1.1082, which kept the pair yesterday from further growth last week.

Signals of indicators:

Moving averages

Trade is conducted in the region of 30 and 50 moving averages, which indicates market uncertainty.

Bollinger bands

Volatility is very low, which does not provide signals on entering the market.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: Fast EMA 12, Slow EMA 26, SMA 9

- Bollinger Bands 20