Today, the European Central Bank will decide on monetary policy. Although many expect the regulator to leave interest rates unchanged, there is a fairly high probability of a softer approach in the future.

If the European Central Bank lowers the key interest rate, there will be no serious pressure on risky assets, as the market already partially takes into account the 10-point rate cut. It is another matter if the regulator announces the resumption of the QE asset purchase program. This will weaken the euro's position more seriously, as it will indicate a rather long-term soft approach of the ECB to monetary policy. It is expected to return to the program of monthly asset purchases in the amount of 20 billion euros to 30 billion euros.

Another option that is expected is the introduction of a system of differentiation that will mitigate the impact of reducing the already negative deposit rate on the profitability of commercial banks. In any case, the ECB's decision could seriously affect the position of the European currency, especially against the US dollar and the Japanese yen.

Also, ECB President Mario Draghi can make such a decision in order to leave his successor Christine Lagarde the opportunity to act from a "clean slate" and prove himself on the positive side in a slowing global economy.

Yesterday's data on the growth of the producer price index in the US helped the dollar to strengthen its position against a number of world currencies. According to a report by the US Department of Labor, producer prices rose by 0.1% in August this year, indicating the likelihood of a return of inflationary pressure in the economy. Economists had expected inflation to remain unchanged from July. The Federal Reserve has repeatedly said that the interest rate cut that many traders expect next week will depend on inflation figures. Federal funds rate futures now estimate the probability of keeping the interest rate unchanged at 11%, with a probability of a quarter of a percentage point – 89%.

However, there is a report on the US consumer price index today, which can significantly change the expectations of investors if the data will be higher than economists' forecasts.

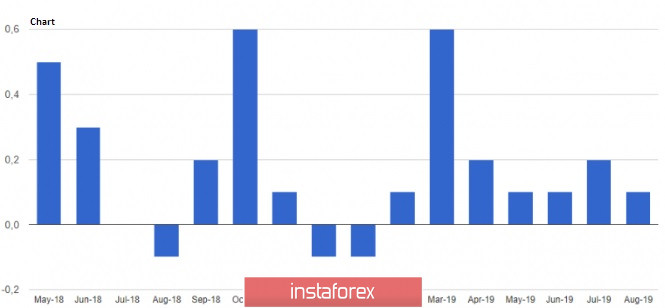

The report that companies in the US wholesale trade in July increased inventories was ignored by the market. According to the US Department of Commerce, inventories in the US wholesale trade in July rose by 0.2% compared to the previous month, which fully coincided with the forecasts of economists. Compared to the same period in 2018, inventories increased by 0.3%.

Yesterday's statements of the American President were once again sent to the Fed.

It seems that Donald Trump seriously does not like the situation with the fact that many countries lower interest rates, while the US Central Bank acts more restrained. Yesterday, Trump said that the Fed should lower interest rates to zero or even lower, and the US should always pay the lowest rates. Also, the US leader expects that the US will begin to refinance the debt. In his view, the US is missing a once-in-a-lifetime opportunity due to illiterate Fed leaders.

As for the technical picture of EURUSD, it is extremely difficult to predict anything in the conditions of such important economic events. In case of a sharp fall of the euro, the lows of the month around 1.0950 and 1.0925 will come to the aid of buyers of risky assets. With their breakthrough, we can safely talk about the resumption of the bearish trend.

However, the pressure on the euro, even in the case of lower interest rates by the ECB, may be short-term, as traders will switch to the Fed meeting next week. If the demand for risky assets intensifies, and, as a rule, the market always goes against the general expectations, then large levels of resistance will be seen around 1.1080 and 1.1120.

GBPUSD

The British pound remains to trade in a narrow side channel, and even the news that a Scottish court recognized the decision of the British Prime Minister to suspend the parliament's work illegally did not lead to a resumption of demand. The focus is on the US inflation report, as only weaker indicators can lead to the second wave of growth in GBPUSD with another attempt to break through the resistance at 1.2380. In the scenario of the breakdown of the minimum of 1.2310, the trading instrument will surely return to the lower border of the side channel of 1.2235.

As for the situation with the decision of the court of Scotland, the case will be sent to the Supreme Court of Great Britain, which will be held next Tuesday.