Today's meeting of the ECB, chaired by M. Draghi, will be the last in his career as president of the European Central Bank. He has held this high post since November 2011, and his powers expire on October 31 of this year. Over the course of his work, he showed himself to be a balanced leader and launched an unprecedented in scope for Europe program with him to stimulate the economy of the euro region to support economic growth, which was almost completely stopped in December last year.

And on the eve of the ECB meeting, markets continue to wonder what the regulator will do in the face of these difficult economic conditions in large Europe.

Three options are being considered. The first one contains a slight decrease in the deposit interest rate by 0.10% with the repurchase of corporate bonds by 5 billion euros within 6 months. The average option, which most market participants are inclined to, is to reduce the deposit interest rate by 0.20% with the repurchase of corporate bonds by 5 billion euros within 9 months and government bonds in the amount of 25 billion euros within 9 months. the last most radical option reflects the possibility of cutting the deposit interest rate by 0.40% with the repurchase of corporate bonds worth 5 billion euros for 9 months and government bonds worth 75 billion euros for 9 months.

It is extremely difficult to assume what option will be taken or it will be mixed. But based on the fact that market expectations are based on (conditionally speaking), the second option and the dynamics of the Euro currency, as it depended on this, the first option may have a supporting effect on the euro. The third will significantly weaken it. But if a mixed option is undertaken, then, in our opinion, a lot will depend on how much government bonds will be redeemed in terms of volume and time period. Recall that earlier, the decision was to buy out state assets against the background of cutting interest rates that caused the weakness of the euro exchange rate.

But another option is possible - the fourth, when M. Draghi simply confines himself to promises, transferring all the responsibility of actions to the new leader C. Lagarde, who takes office on November 1. In this case, we expect a sharp increase in the single currency.

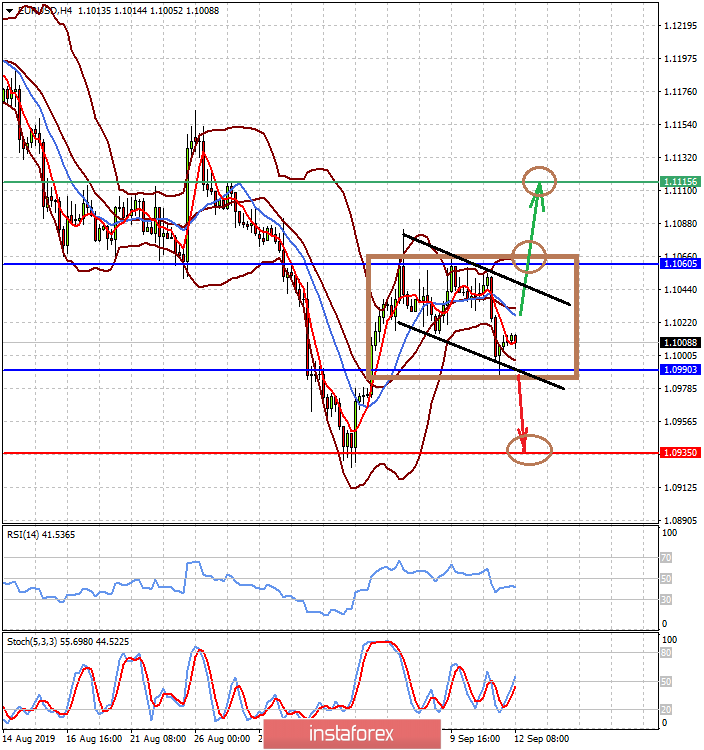

Forecast of the day:

The EUR/USD pair is consolidating in the range 1.0990-1.1060 in anticipation of the ECB's final monetary policy decision. We are waiting for the ECB's decision on monetary policy and proceed from the variability of ECB decisions. Minor incentives or simply promises of Draghi will lead to the growth of the pair, in which case it may rush to 1.1115. The reverse actions coupled with large-scale incentives will exert pressure on the pair, and it may fall to 1.0935.

The AUD/USD pair is trading above 0.6875. Fixing above this level against the backdrop of the US decision to postpone the introduction of new customs duties on Chinese imports until October 15 may stimulate a price increase -first to 0.6915, and then to 0.6935.