EUR/USD – 4H.

On September 11, the EUR/USD pair performed a reversal in favor of the US currency on the 4-hour chart and consolidated under the correction level of 127.2% (1.1024). It is a day earlier than the start of the results of the ECB meeting, which traders are waiting since the beginning of the week. However, I wrote yesterday that this option is possible. Today's program starts not with the ECB meeting, but with the report on industrial production in the European Union for July. The forecasts are disappointing, the indicator is expected to fall by another 1.3% y/y after falling in June by 2.6%. Only after 2 hours 45 minutes, information will begin to come from the European Central Bank, where the decisions of the monetary committee will be announced first, and then a press conference will be held by Mario Draghi, at which he will explain in detail the reasons for the decisions taken on monetary policy, as well as report on their expectations of changes in the economic situation (in Europe and the world) and share forecasts. Simultaneously with the start of Mario Draghi's press conference, a report on inflation in the US will be released. Traders expect that inflation will remain in the range of 1.6% - 1.8%, but the value of + 1.8% y/y will be considered an acceleration and will support the US dollar, and + 1.6% – a slowdown, and will cause pressure on the US currency. I also note that there is an option in which the ECB meeting will be the least interesting event of the day. The fall of the euro/dollar yesterday was no coincidence. Most likely, traders began to open purchases of US currency in advance. Thus, if the ECB does not surprise today with too strong policy easing, then traders may not react to the summing up of the meeting.

What to expect from the euro/dollar currency pair?

On September 12, I expect the euro/dollar pair to fall further. The probability of this option is about 90%. The only question is how strong it will be. 10% – I leave the opposite reaction to the market. Sometimes it happens that the news says one thing, but the market is moving steadily in the opposite direction. That is why there is no 100% probability of a certain movement. Thus, a 10% probability – a surprise from the ECB and Mario Draghi, it is a weak report on inflation in the US. If everything goes according to the main plan, then I expect a fall in the direction of the corrective level of 161.8% (1.0918).

The Fibo grid is based on the extremes of May 23, 2019, and June 25, 2019.

Forecast for EUR/USD and trading recommendations:

I recommend selling the pair with the target of 1.0918 since it was consolidated below the level of 1.1024. A stop-loss order above the level of 1.1029.

You can buy the pair after closing above the levels of 1.1024 – 1.1029 with the target of 1.1106. A stop-loss order below the level of 1.1024. Purchases of the pair, given the information background, is not a priority.

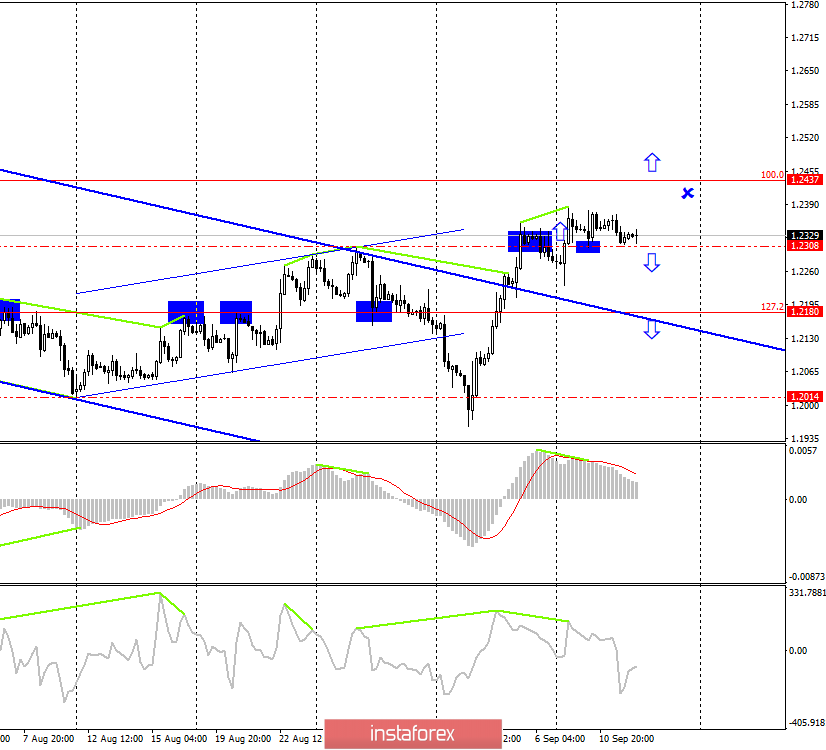

GBP/USD – 4H.

In the UK, passions are boiling over Boris Johnson's decision to suspend the work of parliament. As we see, the work of the parliament has been suspended since September 9, but the deputies themselves do not think to go to the sea and beaches. An initiative group of British deputies, consisting of representatives of different parties, made the court recognize the illegality of the decision of Boris Johnson to send parliamentarians on vacation. The court saw Johnson's decision as impeding the influence of deputies on Brexit. The court also believes that Johnson deliberately misled Queen Elizabeth II when he asked her to suspend the work of parliament, saying that this is a necessary measure, but not to prevent deputies from preventing him from implementing Brexit "No Deal". Thus, after the 17th, when the case will be considered by the Supreme Court, the parliament can return to its duties, and the Prime Minister himself has already said that he will decide on the judicial system, as he "respects the independence of this system". It sounds nice, but Johnson is unlikely to give up without a fight. Most likely, the prime minister's team is already preparing appeals. At the same time, a 5-page document was published on the website of the UK government, which defines Brexit's most critical scenario "No Deal". The deputies again forced the prime minister to take such a step, having adopted the corresponding bill before the parliament was closed. In short, the document called Yellowhammer contains a list of possible problems that the country will face in the case of Brexit without any agreements with the European Union. Boris Johnson would surely want this document to be kept a secret, but the deputies, on the contrary, would make it public. Now the population of the UK can more clearly understand what awaits the country in case of the implementation of Brexit by Johnson.

What to expect from the pound/dollar currency pair?

The pound/dollar pair has consolidated above the level of 1.2308, however, whether the pair will continue to grow is still a question. The bearish divergence of the CCI indicator has doubled the divergence of the MACD indicator, and both divergences remain valid. Thus, indicator analysis shows a higher probability of pair growth in the direction of the correctional level of 100.0% (1.2437). The probability of this is 55-60%. The consolidation of the rate pairs under the level 1.2308 work in favor of the US dollar and start falling of quotations in the direction of the correction level to 127.2% (1.2180).

The Fibo grid is based on the extremes of January 3, 2019, and March 13, 2019.

Forecast for GBP/USD and trading recommendations:

I recommend maintaining the pair's already open purchases with the target of 1.2437 and stop at 1.2308, but I do not recommend opening new purchases due to two bearish divergences.

I recommend selling a pair with the target of 1.2180, if the closing is performed under the level of 1.2308, with the stop-loss order above the level of 1.2308.