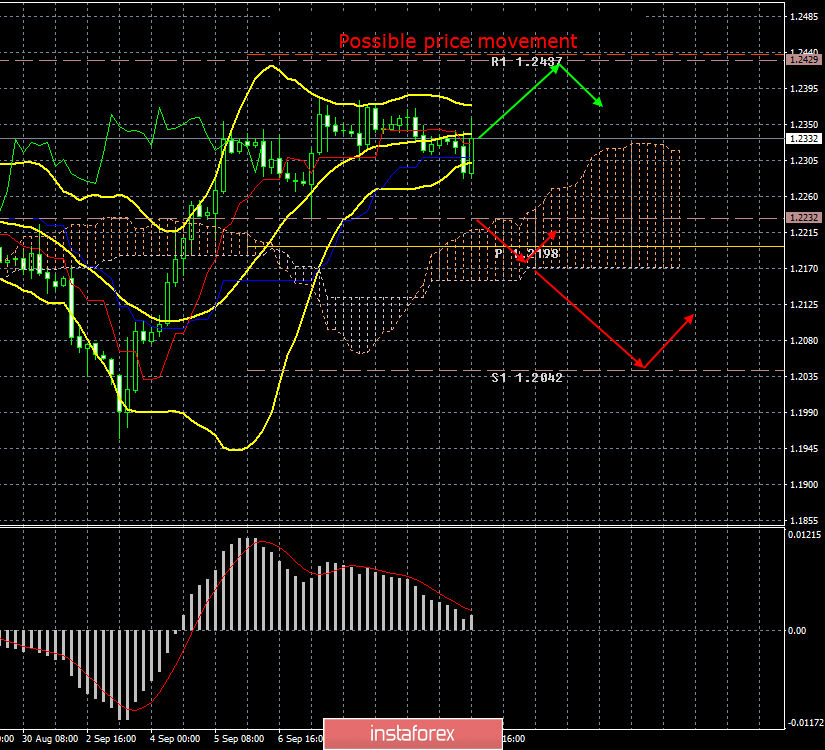

4-hour timeframe

Amplitude of the last 5 days (high-low): 144p - 65p - 151p - 73p - 58p.

Average volatility over the past 5 days: 98p (high).

The EUR/USD currency pair had a very fun day today, which has not yet ended. If you look at the GBP/USD pair's chart for today's movement, you get the impression that nothing interesting has happened in the UK and the United States. However, this is not the case. Firstly, we already wrote in another article that the consumer price index in the US unexpectedly failed in August and amounted to only +1.7% y/y. What does it mean? the fact that inflation is slowing down and is moving further from the target level of the Federal Reserve, and also the fact that at its next meeting, which will be held on September 17-18, it will most likely take this slowdown into account and also lower the key rate. Against the background of this report and the considerations associated with it, the pound has grown in the US trading session.

However, all the most interesting events were again associated with Brexit. Either Boris Johnson had not yet managed to send a second letter to Brussels, in which he wanted to ask EU leaders NOT to grant UK deferment for Brexit, or EU leaders simply ignored Johnson's request, however, European Parliament President David Sassoli said that the EU is ready to grant an extension to the UK, if it helps to avoid the "hard" Brexit or helps to hold parliamentary elections in the UK. However, Sassoli emphasized, an agreement on Brexit is still impossible without a "back-stop" clause. In principle, if the European Parliament does provide a respite until January 31, this will mean the fifth consecutive defeat of Boris Johnson. Earlier, the British Parliament blocked the hard Brexit without its consent (1), twice rejected the prime minister's offer to hold parliamentary re-elections (2 and 3), after which the Scottish court ruled that Johnson's decision to send deputies for vacation was illegal (4). The European Parliament can now approve the Brexit postponement, at least showing its readiness for this (5).

This is certainly good news for the pound, since all of Boris Johnson's policy, all his actions were aimed at the speedy implementation of the hard Brexit, to which the pound reacted negatively. Now, when Boris Johnson suffers one defeat after another, the pound is resurrected before the eyes, as the chances of delaying the hard Brexit are growing, and given the general dissatisfaction with Johnson's actions in Parliament and in the European Union, one can safely count on the adoption of a vote of no confidence in the prime minister is coming soon. First you need to wait for the Supreme Court to issue an official ruling on the annulment of Johnson's decision on the forced vacation of MPs until October 14. And after that, the second stage of the Parliament's war against its prime minister will begin, the goal of which will undoubtedly be the displacement of Boris Johnson from his position. Perhaps this is a bit of a bold assumption, but what other goals should the Parliament set up, which is waging an open war against a politician who is trying hard to implement a scenario that is destructive for the country?

From a technical point of view, the pound/dollar pair failed to consolidate below the critical line and the US inflation report arrived in time. Thus, the upward trend has continued and in the near future the British currency may continue to grow.

Trading recommendations:

The GBP/USD currency pair remains within the upward trend, therefore long positions remain relevant with the target level of 1.2429, obtained based on the average volatility of the pair. To open them, it is recommended to wait until the MACD indicator turns up or the price rebounds from the Kijun-sen critical line (it may take place on the current bar). Small pound sales can be seen below the Kijun-sen line with the first targets of 1.2232 and Senkou Span B line.

In addition to the technical picture, fundamental data and the time of their release should also be taken into account.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicator window.