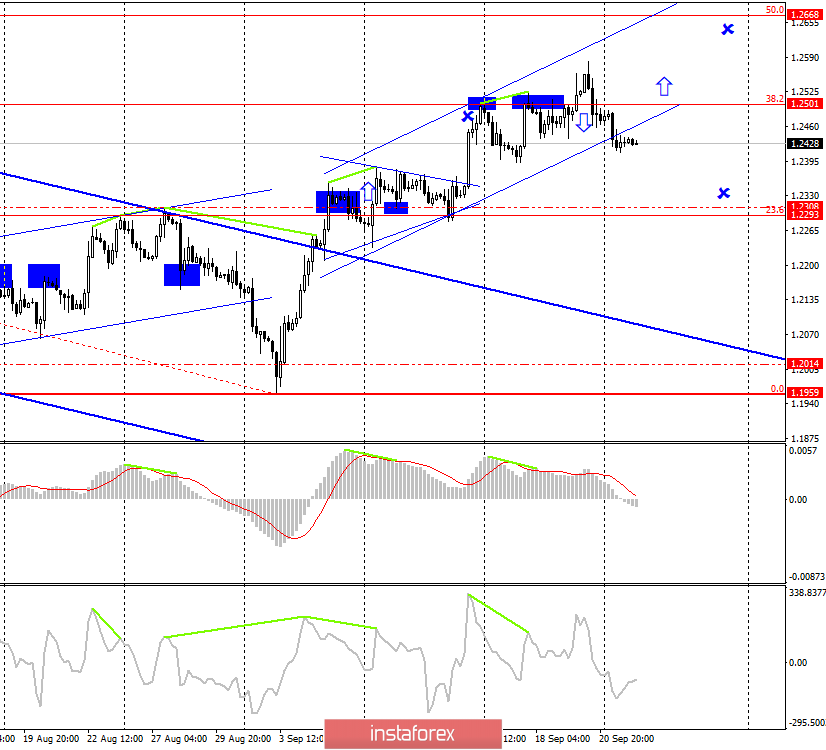

GBP/USD – 4H.

The British pound has completed the first closing under the retracement level of 38.2% (1.2501), and under a weak upward channel, which allows traders to expect a continued fall in quotations in the direction of the initial target correction level of 23.6% (1.2293 or 1.2308). At the moment, there is a brewing divergence in the CCI indicator, but the second price low does not look convincing. Yesterday, the pound/dollar pair cannot be entered either in the asset or in the liability. The pair fell slightly during the day, but it can only be a pullback movement. As before, everything for the pound/dollar pair will depend on the information background. And on September 24, two urgent topics need to be analyzed.

The first topic: the media found that US President Donald Trump and Prime Minister Boris Johnson agreed to conclude a volume trade agreement until July 2020. No details were given. Earlier, there were rumors of a trade agreement between the UK and the US, but they were served under the sauce of Donald Trump's promises to conclude a similar deal as soon as Britain completes its exit from the EU. Does this mean that Boris Johnson has promised Trump an exit from the European Union in the coming months? After all, as we all know, the UK Parliament has blocked the possibility of Brexit "No Deal" without its consent. It turns out that if the information is correct, Boris Johnson is not worried about this and in any case, intends to withdraw Britain from the EU on October 31. Accordingly, it has several jokers up its sleeve.

The second topic: this morning, the British Supreme Court is due to rule on the legality of Boris Johnson's actions when he suspended Parliament for 5 weeks. Earlier, the Scottish Court had already issued its decision, which said that Johnson's actions were illegal. But now it's up to the highest authority. The decision of the court on September 24 will determine how soon the war between parliamentarians and the Prime Minister will resume. And the outcome of Brexit directly depends on this, since, as discussed in the previous paragraph, there are serious reasons to assume that Boris Johnson has a surprise for deputies on the implementation of his version of Brexit.

It is the figure of Boris Johnson that causes the greatest concern for the pound. You don't know what to expect from the leader of the Conservative Party. He can calmly disobey the will of parliament and is not afraid to go against the opinion of the majority. It seems that he has even more influential people behind him than himself. Too zealous desire of the prime minister to withdraw the UK from the EU, no matter what.

What to expect from the pound/dollar currency pair today?

The pound/dollar pair closed below the Fibo level of 38.2% (1.2501) and under the channel. Thus, today I expect a further fall in the direction of the correction level of 23.6% (1.2293). There will be no economic reports in the UK today, but the information background may still be saturated.

The Fibo grid is based on the extremes of March 13, 2019, and September 3, 2019.

Forecast for GBP/USD and trading recommendations:

I recommend buying the pair with the target of 1.2668 and a stop-loss below the level of 1.2501 if a new close is performed above the Fibo level of 38.2%.

I recommend considering selling a pair with a target of 1.2308 now with targets in the range of 1.2308 – 1.2293, with a stop-loss level of 38.2% Fibo.