The Supreme Court of Great Britain ruled that the recent suspension of the work of the House of Commons was declared "illegal" and unfounded. This fact provoked increased volatility for the GBP/USD pair due to it being unprecedented. Indeed, having granted the request of Prime Minister Johnson, the final decision "de jure" on this issue was made by Queen Elizabeth II of England. Considering today's court decision, we can conclude that the head of government misled the monarch in seeking the conquest of parliament.

In other words, the opponents of the current prime minister have additional political trump cards. But speaking directly about Brexit, the indicated court verdict essentially does not change anything. If the deputies resume the session, depending on the speaker of the House of Commons, they will have more time to take appropriate legislative initiatives regarding the prospects of Brexit. However, among parliamentarians, certain disagreements arise on the eve of the court decision that could negatively affect the coordination of the opposition. This is not about conflicts between parties - even within the framework of a single political force, politicians cannot agree on a common position on the Brexit issue. This applies to both conservatives and Labor.

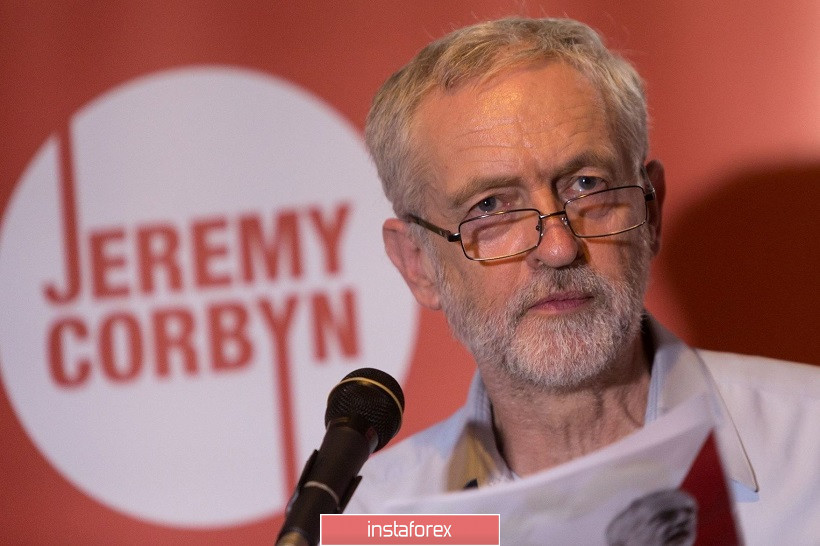

Therefore, according to the results of the conference of the Labor Party, its members will no longer defend the idea of abolishing Brexit. This decision was preceded by a stormy and lengthy debate that culminated in the actual victory of Jeremy Corbin. The Labor leader actively urged his colleagues not to play the "Brexit cancellation" card directly. In his opinion, the party should first get early elections, win the majority, agree with Brussels on "acceptable" conditions for leaving the EU and only then put Brexit's issue to a referendum. In other words, Corbin wants to ask the British people: are they suitable for the conditions that they could agree with the Europeans? If not, then Brexit's question will disappear "automatically".

As you can see, Corbin chose a rather complicated and difficult road, given the current rating of the Labor Party. According to the results of recent sociological studies, conservatives can not only maintain their positions in parliament but also form an independent majority. They are now constrained by a coalition alliance with unionists. If the Conservative Party now has a rating of more than 30%, then no more than 25% of British citizens surveyed are willing to vote for Labor. I note that the position of the conservatives has grown significantly after Boris Johnson came to power, and especially after his decisive action to prepare the country for a "tough" Brexit. On the contrary, the position of the Laborites is gradually declining, especially against the background of strife within the party and lack a common position about the prospects of "divorce process" with Brussels.

The fact is that many of the same party members of Corbin advocate the abolition of Brexit as such, relying on the support of a significant number of Britons who voted against the country's withdrawal from the Alliance. After three years of exhausting uncertainty and fruitless negotiations, there were practically no "undecided" citizens in the country. Some are in favor of an early exit from the EU, including without a deal, while others are actively opposing this step. The opponents of Corbin inside the Labor Party are counting on the votes of the latter. It is worth noting that other opposition parties, for example, liberal democrats, Scottish and Welsh nationalists, also advocate the abolition of Brexit.

Thus, the position of Jeremy Corbin complicates the situation for the British currency in general and particularly for GBP/USD traders. Despite the rare "bursts of optimism" among European and British officials, the negotiation process between London and Brussels is virtually frozen. Last week, representatives of the British government submitted written proposals to members of the European Commission regarding alternative options for certain provisions of the transaction, and the situation froze again. Only the German Foreign Minister, Heiko Maas, sparingly commented on these proposals of London. According to him, the ideas presented are a "step forward". But then he added that the border with Ireland should be "in any case open." Although Johnson has repeatedly stated that he will not allow a "transparent" border regime after Brexit. In other words, no breakthrough should be mentioned.

To summarize, it should be noted that GBP/USD traders should be wary of upward price impulses. On the one hand, today's court decision allows deputies to take advantage of the situation and continue the confrontation with the Johnson government. But will the opposition be able to consolidate their position? This question remains open so far.