To open long positions on EURUSD you need:

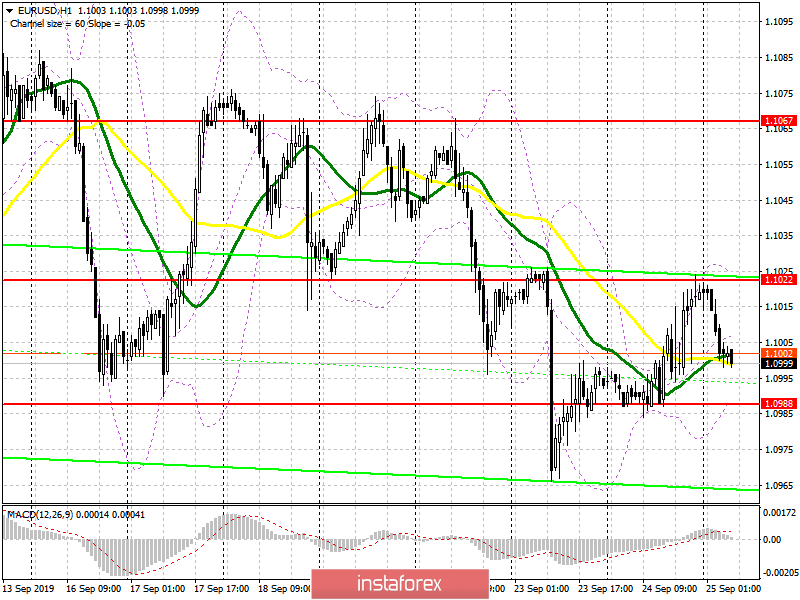

Yesterday's weak report on the US Consumer Confidence Index, which fell, only temporarily put pressure on the US dollar, but the news that the US president was being prepared for an impeachment, on the contrary, returned the demand for the US currency today. Currently, buyers need to protect the support level of 1.0988, which was formed yesterday. Only the formation of a false breakdown there will make it possible for us to count on another wave of EUR/USD growth with an update of yesterday's resistance in the area of 1.1022. However, a more important task is to break through this range, which will provide the pair with a new rising wave to the area of a high of 1.1067, where I recommend taking profits. In case the euro further declines and bulls are absent at 1.0988, it is best to consider new long positions at the rebound from support at 1.0955, or at the month's low -1.0925.

To open short positions on EURUSD you need:

Given that no important fundamental statistics are planned for today, the market is likely to return to a bearish scenario. A number of representatives of the European Central Bank and the Federal Reserve are speaking today, which may lead to some surge in the pair's volatility. An unsuccessful consolidation in the morning above the resistance of 1.1022 will put pressure on the euro, and a break below the support of 1.0988 will be a clear signal to open short positions in order to further pull down EUR/USD to the low of 1.0955 and the low of 0.09925, where I recommend taking profit. If the bulls find the strength in themselves and return the level of 1.1022 at the European session, then it is best to consider selling the ruo by rebounding from a high of 1.1067.

Signals of indicators:

Moving averages

Trade is conducted in the region of 30 and 50 moving averages, which indicates another market uncertainty with the direction.

Bollinger bands

A break of the lower boundary of the indicator in the region of 1.0988 will increase pressure on the euro, while going beyond the upper boundary in the region of 1.1022 will lead to the pair's growth.

Description of indicators

- MA (moving average) 50 days - yellow

- MA (moving average) 30 days - green

- MACD: Fast EMA 12, Slow EMA 26, SMA 9

- Bollinger Bands 20