The Korean export-oriented economy is going through hard times and the country is a leading global exporter of computer chips, ships, automobiles, and petroleum products. The collapse of exports clearly indicates that consumption in the world is experiencing significant problems and this decline is clearly gaining momentum, which investors cannot help but worry about it.

Against the background of the increased risks of the recession, the board member of the Central Bank of Japan Takako Masai announced the regulator's readiness to hesitate in softening the monetary policy if the prospects of inflation growth to 2.0% remain unattainable.

It seems that we are again witnessing an attempt by the world's largest Central Banks including Japan, the ECB, and in the future, the Fed to "treat" the long-standing problems that caused the global economic crisis of 2008-09 and a wide flow of liquidity. That is why extremely uncertain dynamics are now observed in all markets without exception. Stock markets are in a fever on a wave of conflicting signals about the growth prospects of national economies in the face of an impending global economic downturn. The commodity market is also nervously twitching in one direction or the other, not understanding how the tense situation in the Middle East and the protracted US-Chinese negotiations on terms of trade will end.

The foreign exchange market also does not stand aside. The expectation of new incentives from the ECB, the Fed, as well as the Central Bank of Japan and most likely, several other major world banks, has led major currency pairs to move in no particular direction, responding to local economic statistics or news and rumors.

The common currency paired with the US dollar was stuck in a "sideways", from which it would break out only after the Fed's position with respect to possible American incentives became known. Sterling is completely subordinate to Brexit's theme and new scandals in the British government. Commodities and commodity currencies are traded while eyeing the dynamics of crude oil prices and the trade negotiations between the United States and China.

In general, we can say that the markets are in a pre-chaotic state. On this wave of uncertainty, investors remain interested in protective assets - gold, the Japanese yen, the Swiss franc and government bonds of economically developed countries.

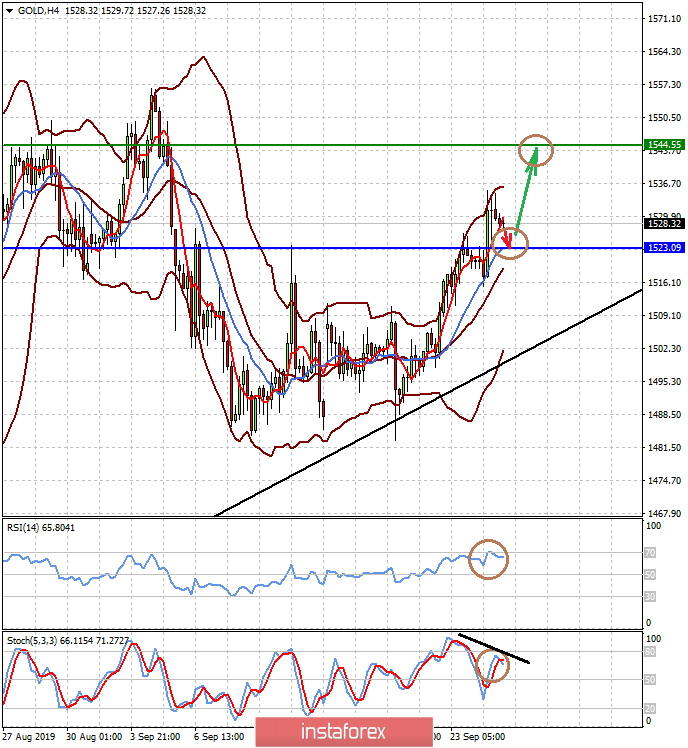

Forecast of the day:

We believe that maintaining a general degree of uncertainty in global markets will push gold prices up in the short term. We consider it possible to buy gold at a decline of 1523.00 with a local target of 1544.55.

The NZD/USD pair is trading above 0.6255 after the decision of the RBNZ to leave interest rates unchanged. But you should pay attention to the fact that the regulator outlined for the first time the topic of the likely start of stimulating the local economy. This is a strong obstacle to the growth of the New Zealand dollar. Given these prospects, we consider it necessary to sell the pair after it drops below 0.6310 with a probable target of 0.6255.