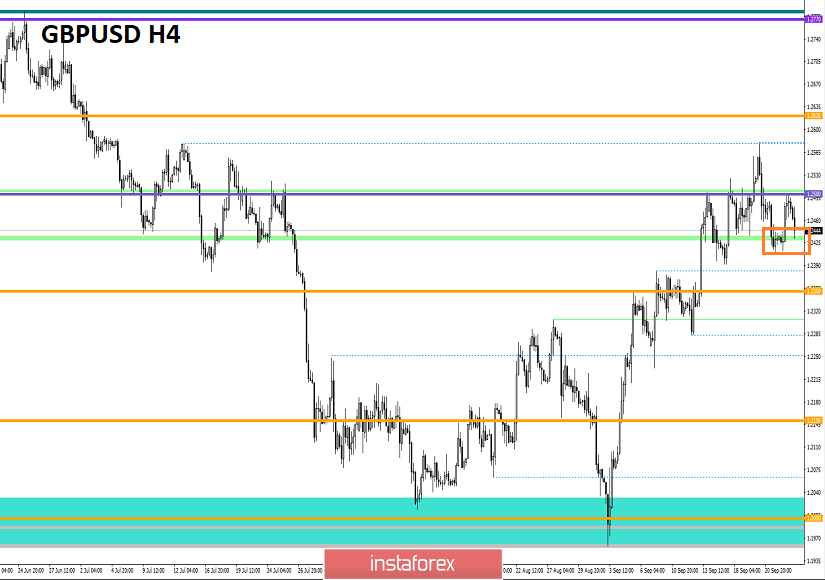

Over the past trading day, the pound / dollar currency pair showed volatility below the average daily value of 89 points, but this was enough to earn on the initial surge of quotes. From the point of view of technical analysis, we see that the consolidated slowdown of 1.2412 / 1.2450 served as an excellent platform for trade transactions, where the method of trading on the breakdown of borders played an excellent tactic to enter the market in the short term. The impulse move in question led to a local surge, temporarily returning the quotation to the level of 1.2500, where resistance was again found.

As discussed in the previous review, speculators were already working in the market, but the formed stop in the form of remarkable consolidation did not disregard any traders, since everyone wants to make money on a local surge with a relatively low risk. Thus, I do not exclude the possibility that, even with the main transactions, traders opened short-term purchase transactions taking 30-50 points from the market.

Considering the trading chart in general terms (the daily period), we see that the oblong correction has a range level in front of us with variable boundaries of 1.2500 / 1.2550 / 1.2580, where, after all, there is a certain ceiling, expressed in slowdown corrective course. The recovery process relative to the main trend has not yet arrived, but it is likely that the current platform in the form of deceleration and range level will serve as a platform for sellers to return to the market.

The news background of the past day contained only housing prices in the United States, where S & P / CaseShiller forecasts did not materialize in terms of acceleration from 2.1% to 2.2%. As a result, we got a slowdown to 2.0%. I doubt that not the best statistics for the States somehow strongly affected the dollar in terms of considering the GBPUSD pair, since there was a strong information background on Britain yesterday. In addition, the Supreme Court of Great Britain also issued its verdict regarding the actions of the Prime Minister regarding the suspension of parliament yesterday. In short, the court ruled that the decision of Boris Johnson to send parliament to forced vacations was unlawful. An hour after the announcement of the court decision, some deputies symbolically took their seats in the lower house of parliament. What can I say, Johnson's next crushing defeat,

"I invite Boris Johnson, in historical terms, to weigh his position and become the prime minister who was least in power!" Said Labor leader Jeremy Corbyn at the time of his speech in Brighton.

The Prime Minister's response regarding the court's decision was not long in coming, and while he was in New York at the UN General Assembly at that moment, he was indignant at the court's verdict.

"I completely disagree with the decision of the Supreme Court! I have great respect for our judicial system, but I do not think that such a verdict was justified. The dissolution of the parliament took place over the centuries without the difficulties that have arisen now, "said Boris Johnson.

Johnson subsequently stated that we will comply with the court ruling, but we must continue to work and exit on October 31.

Today, in terms of the economic calendar, we have data on the sale of new homes in the United States, where they expect a significant increase in sales from 635K to 660K. Statistics can provide a local incentive for the US dollar. In terms of informational background, the work of the British Parliament should resume today, and if you refer to the media, Her Majesty the Queen will deliver a throne speech. The opposition, in turn, is already planning to discuss a vote of no confidence in the prime minister and early elections. As you understand, the information background can again give a new round of volatility to the market.

Further development

Analyzing the current trading chart, we see that the downward interest is actively pouring into the market, returning the quote back to yesterday's consolidation 1.2412 / 1.2450. The inertial move against the background of the information flow is clearly stimulated by the emotions of the crowd, which can play into the hands of speculators. What are the actions of those speculators, so they are already in short positions, which were opened on Monday and were added yesterday within the level of 1.2500.

It is likely to assume that the consolidation range of 1.2412 / 1.2450 will hold back sellers for a while, but it is unlikely to last long. Here, the key point is the informational background, which is desirable to monitor, since it can give local bursts. Thus, if we still do not have any deals for sale, it makes sense to wait for the price consolidating below 1.2400, where the entry will be already in terms of inertial movement.

Based on the above information, we concretize trading recommendations:

- Positions to buy are considered in the case of price fixing higher than 1.2500, with the supply of an informational background.

- Positions for sale, if we do not have, then we are waiting for the fixing of the price lower than 1.2400. The prospect of running in the form of steps is 1.2350 --- 1.2300 --- 1.2150.

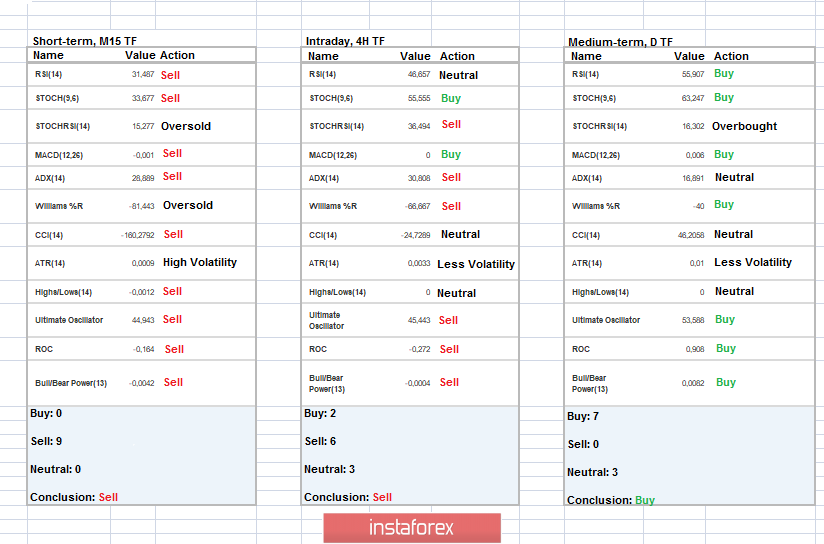

Indicator analysis

Analyzing a different sector of timeframes (TFs), we see that indicators in the short and intraday perspective signal a downward interest due to the general mood of the crowd. On the other hand, the medium-term outlook still retains upward interest amid an elongated correction.

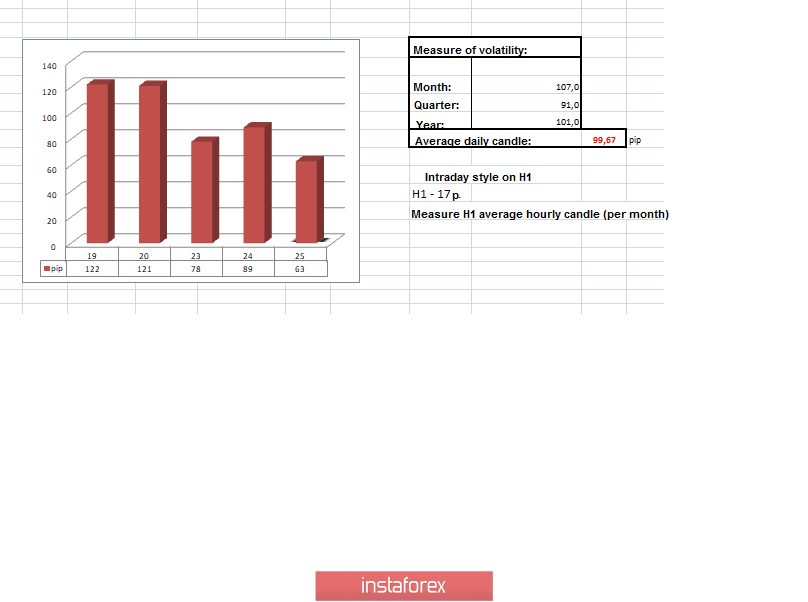

Volatility per week / Measurement of volatility: Month; Quarter; Year

Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year.

(September 25 was built taking into account the time of publication of the article)

The volatility of the current time is 63 points, which is already good for this time section. It is likely to assume that, against the background of the information flow, volatility may still increase, exceeding as a result the daily average.

Key levels

Resistance zones: 1.2500 **; 1.2620; 1.2770 **; 1.2880 (1.2865-1.2880) **.

Support areas: 1.2350 **; 1.2150 **; 1,2000 ***; 1.1700; 1.1475 **.

* Periodic level

** Range Level

*** The article is built on the principle of conducting a transaction, with daily adjustment