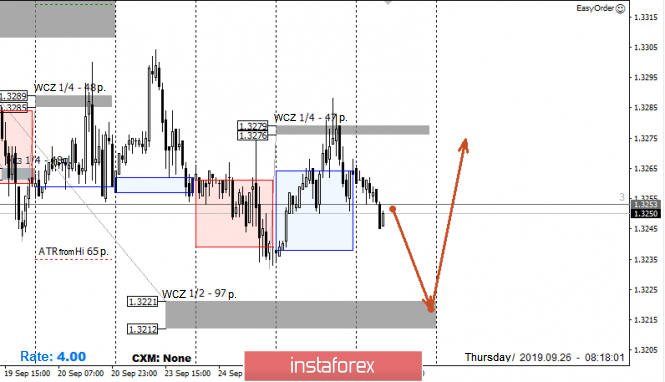

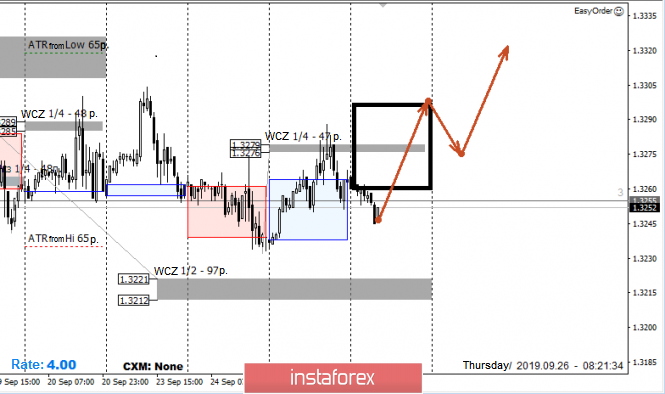

Yesterday's test of 1/4 WCZ at 1.3279-1.3276 allowed to go on sale. The first goal of the decline is 1/2 WCZ of 1.3221-1.3212. Working within the framework of the flat is the main one, so any test of these zones will require full or partial fixation. If the demand appears in the lower zone, it will be necessary to open purchases after the formation of the "false breakdown" pattern.

In terms of long-term dynamics, the probability of a further decline in early September is higher, so some sales may be left in the event that the closing of the trading occurs below the 1/2 refinery.

An alternative model will be developed if today's trading closes above the 1/4 refinery. This will indicate the resumption of upward momentum and allow you to look for purchases after a correctional decline.

Daily CZ - daily control zone. The area formed by important data from the futures market, which changes several times a year.

Weekly CZ - weekly control zone. The area formed by marks from the important futures market, which changes several times a year.

Monthly CZ - monthly control zone. The area is a reflection of the average volatility over the past year.