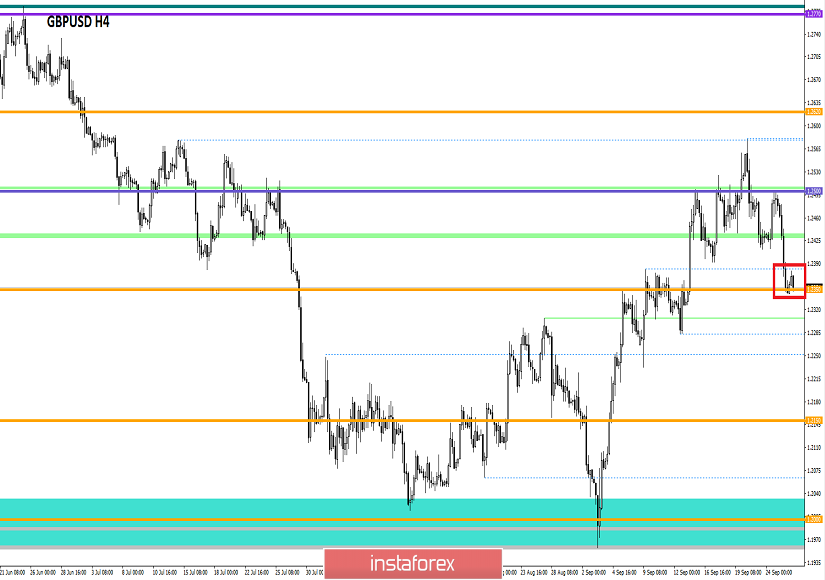

On the pound / dollar currency pair, volatility returned again, having a fluctuation of 150 points, where we saw an impulse - inertial move as a result.. From the point of view of technical analysis, we see that a return to the level of 1.2500 led to a reverse flooding of short positions, where we saw not just movement, but a full-fledged inertial - impulse move, overcoming periodic values on the way and going down to the next level of 1.2350. Meanwhile, subsequent development already took place during the Pacific and Asian trading sessions, where there was a slight slowdown.

As discussed in the previous review, speculators worked perfectly in a downward move. The previously set forecast coincided 100%, in terms of laying short positions since Monday and subsequent topping up in the region of the level of 1.2500. As a result, a solid profit was formed, where the initial forecast coordinate in the face of the 1.2350 level was achieved.

Considering the trading chart in general terms (the daily period), we see that there are prerequisites for the restoration of the initial downward trend after a prolonged elongated correction. It is too early to draw conclusions, but in the case of a further movement below 1.2350, we can get a clear confirmation of this theory. Let me remind you that in the oblong correction, the pivot point is the range 1.1957 / 1.2020 and the resistance point is 1.2500 / (1.2550) / 1.2580.

The news background of the past day contained data on sales of new homes in the United States, where they were already waiting for growth, but the data came out even better than the forecast. Thus, sales growth was from 666K to 713K, which, obviously, played into the hands of the already growing dollar.

The main fluctuation of the market was triggered by the information background, and so, after the decision of the Supreme Court of Great Britain, the parliament began to work again, and here the shock began. Prime Minister Boris Johnson returned urgently from New York, who, in an artistic manner, called on the parliament to pass a vote of no confidence in the government.

"If the opposition does not trust the government, they have time until the evening to propose a vote of no confidence, and we can vote tomorrow." Come on, come on, man! "- as Boris Johnson turned to Labor leader Jeremy Corbyn.

This kind of move led to a flurry of criticism from the deputies, but the opposition has much wider plans, where Boris Johnson is still destined to take on a number of crucial moments in terms of deferring Brexit, and after an extraordinary election can erase the already thinning voices of the current government.

Today, in terms of the economic calendar, we have data on US GDP for the second quarter, where they are waiting for confirmation of a slowdown in economic growth from 2.7% to 2.3%, which may put pressure on the US currency. At the same time, the hysterical mood in the United States regarding the impeachment of incumbent President Donald Trump triggers the interest of speculators in terms of spontaneous fluctuations against the dollar.

Further development

Analyzing the current trading chart, we see that the quote seemed to freeze within the 1.2350 level, forming a slight slowdown in the region of 40-50 points. Local overheating of short positions is clearly felt, but the pressure of sellers is felt much more. Thereby, if nothing changes in terms of information background, we are provided with a further decrease. Speculators, in turn, can't get enough of having a profit, and they have a lot of it. The early positions were fixed in full, in the form of safety net, but subsequent transactions are just around the corner, here the method of work is conducted on two fronts at once - "Breakdown / Rebound" relative to the existing level.

It is likely to assume that the chatterbox within the existing 1.2350 level will not last very long, and the work on the Breakdown / Rebound method is the most relevant tactic. Thus, the indicative levels for positions relative to the current hour are 1.2400 - Buy and 1.2325 - Sell. In any case, we monitor the behavior of quotes and incoming information, since the volatility of the day can be high.

Based on the above information, we concretize trading recommendations:

- Positions to buy are considered in the case of price fixing higher than 1.2400, with the prospect of a move to 1.2450.

- Positions to sell are considered in the case of price fixing lower than 1.2325, with the prospect of a move to 1.2300 --- 1.2150.

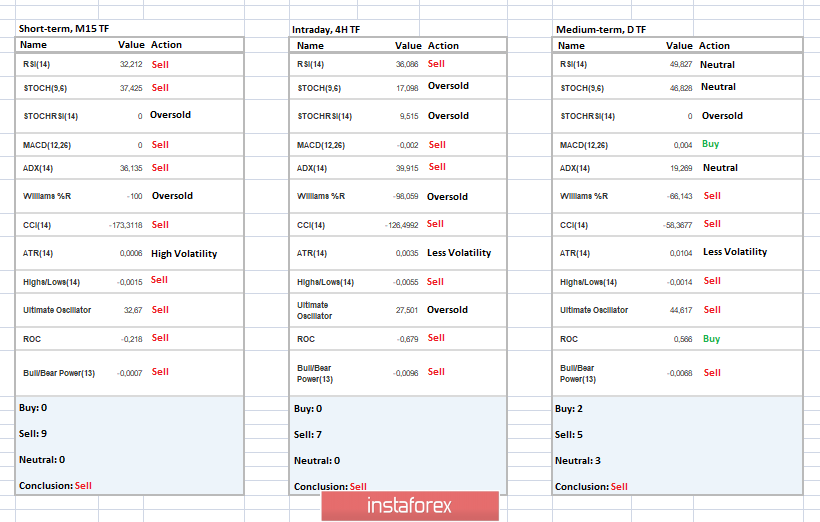

Indicator analysis

Analyzing a different sector of timeframes (TF), we see that indicators on all the main time sections signal a further downward trend, which confirms the general market background. In the case of tightening the chatter within the level of 1.2350, indicators for shorter periods can jump changefully, misleading us.

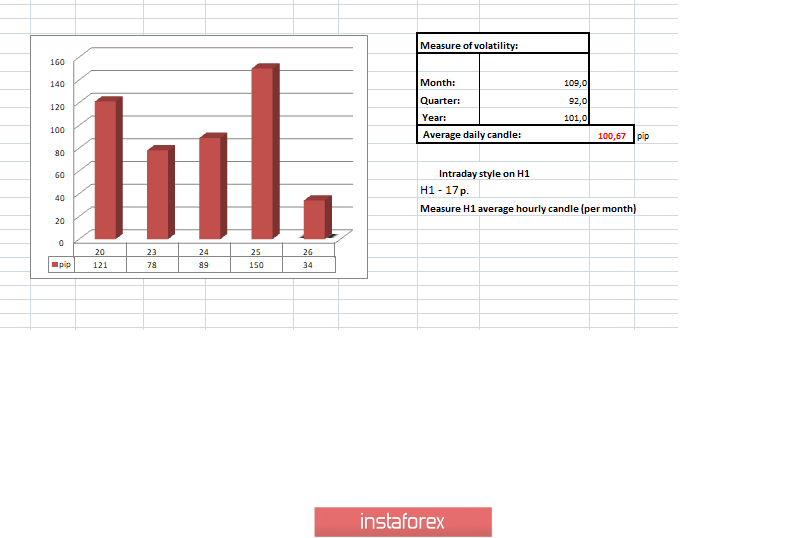

Volatility per week / Measurement of volatility: Month; Quarter; Year

Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year.

(September 26 was built taking into account the time of publication of the article)

The volatility of the current time is 34 points, which reflects the existing slowdown. It is likely to assume that amid the information and news flow, volatility will still increase, possibly exceeding the average daily indicator.

Key levels

Resistance zones: 1.2350 **; 1.2500 **; 1.2620; 1.2770 **; 1.2880 (1.2865-1.2880) **.

Support areas: 1.2350 **; 1.2150 **; 1,2000 ***; 1.1700; 1.1475 **.

* Periodic level

** Range Level

*** The article is built on the principle of conducting a transaction, with daily adjustment