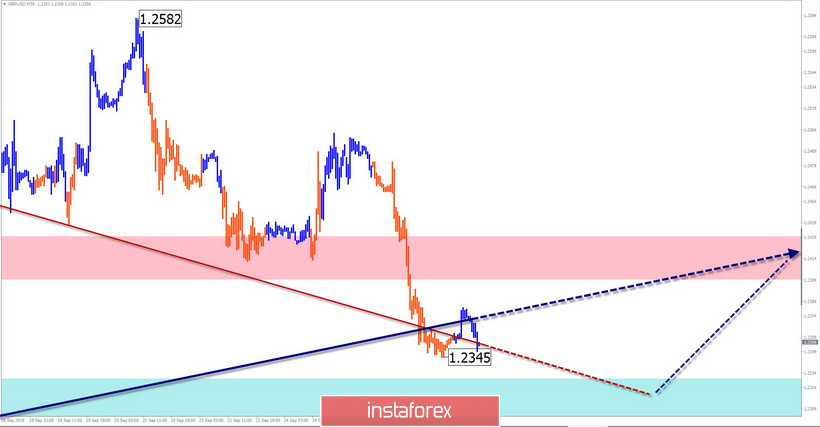

GBP/USD

Analysis:

The unspent bullish wave potential of July 30 indicates a continuation of the current upward trend. In the unfinished section of September 3, the price in the last 2 weeks rolls down. The correction looks like a stretched plane.

Forecast:

During the day, it is expected to complete the current decline, the formation of a reversal and the beginning of the price increase. In the next session, the price may briefly roll back to the resistance zone.

Potential reversal zones

Resistance:

- 1.2400/1.2430

Support:

- 1.2330/1.2300

Recommendations:

Sales of the pound can be successful within the intraday trading style. In the support area, it is recommended to close short positions and start tracking the pair's buy signals.

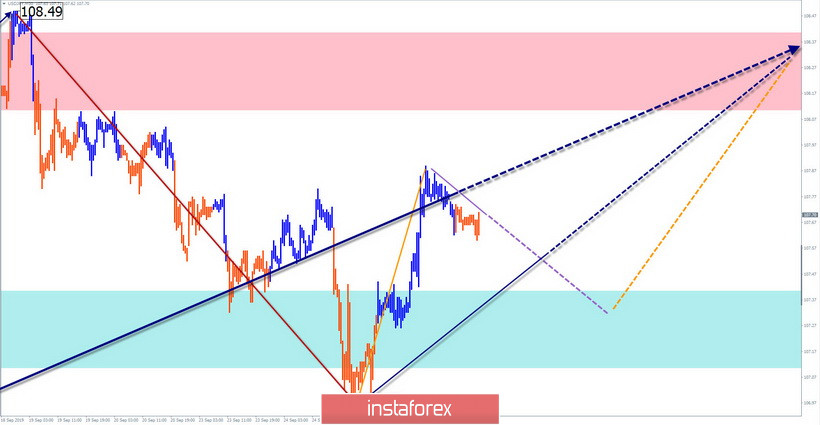

USD/JPY

Analysis:

The direction of the short-term trend of the Japanese yen is given by the algorithm of the rising wave of August 26. The first 2 parts (A+B) are completed in the wave structure. From strong support 2 days ago, an upward section with a high wave level started. Before the main rise, the price of the pair forms a reversal structure.

Forecast:

In the first half of the day, there is a high probability of a flat "sideways", a rollback of the course to the support zone is possible. The increase in volatility and the beginning of price growth is expected by the end of the day or tomorrow.

Potential reversal zones

Resistance:

- 108.10/108.40

Support:

- 107.40/107.10

Recommendations:

Sales of the yen today are unpromising. It is wiser to allow this section of the price movement. At the end of the current decline, it is recommended to search for entry signals into long positions.

USD/CHF

Analysis:

Since the end of June, the direction of the main trend of the price movement of the franc is set by an upward wave. The wave structure has the form of a standard plane. For the past month, the final section (C) has been developing. Since September 18, the price has been adjusted in the horizontal price range.

Forecast:

There are no signals of correction completion on the chart. The most realistic scenario today will be the continuation of the movement with the price channel that has formed. The upward vector is more likely in the next session, by the end of the day the price is expected to decline.

Potential reversal zones

Resistance:

- 0.9960/0.9990

Support:

- 0.9900/0.9870

Recommendations:

Before the appearance of clear signals of the beginning of the rising wave, trade transactions in the franc market can only be carried out as part of intra-session trading, according to the expected sequence. A lot more sensible to reduce.

Explanations: In the simplified wave analysis (UVA), the waves consist of 3 parts (A-B-C). The last unfinished wave is analyzed. The solid background of the arrows shows the formed structure, dotted – the expected movement.

Attention: The wave algorithm does not take into account the length of time the tool moves!