To open long positions on GBP/USD, you need:

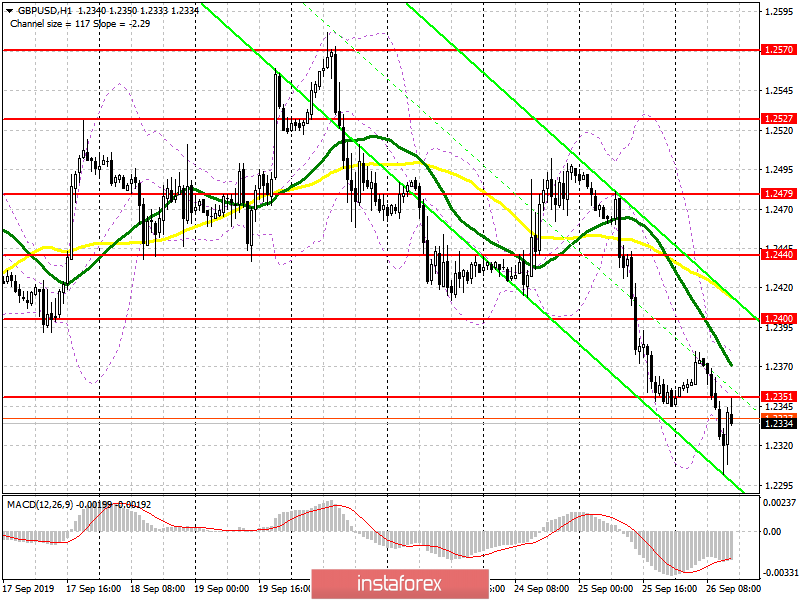

In the morning, I paid attention to the political risks within the UK Parliament, as well as to the divergence of the MACD indicator, which limited the short-term downward potential in the pair. At the moment, the task of the bulls is to return and consolidate above the resistance of 1.2351, which was formed in the first half of the day. Only after that, you can count on a larger upward correction to the maximum area of 1.2400, where I recommend taking the profit. In the scenario of a decline in the pound in the second half of the day, which may occur after the GDP data or the speech of the Governor of the Bank of England Mark Carney, it is best to consider new long positions on the rebound from a major support in the area of 1.2284 or after updating the minimum of 1.2238.

To open short positions on GBP/USD, you need:

Bears coped with the morning task, but the downward movement was limited by divergence, which led to the expected profit-taking and the upward correction of the pound. At the moment, the new target of sellers is the formation of a false breakdown in the resistance area of 1.2351, which will lead to the formation of additional pressure on the pair and a repeated wave of decline to the area of the minimum of 1.2284, where I recommend taking the profit. If the pressure on the pound is larger, after the release of the above fundamental statistics, we can expect to update the area of 1.2238. In the scenario of a breakthrough and a return of GBP/USD to the resistance of 1.2351, it is best to count on short positions on a false breakdown from the maximum of 1.2400 or sell on a rebound from 1.2440.

Signals:

Moving Averages

Trading is below 30 and 50 daily averages, which indicates a bearish trend.

Bollinger Bands

In the case of an upward correction, the upper limit of the indicator around 1.2385 will act as a resistance.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20