The euro continued to decline on Thursday against a number of world currencies amid growing pessimism associated with an increased risk of recession in the eurozone. The fundamental data released in the morning on the growth of German consumer sentiment did not affect risky assets.

Most likely, the medium-term pressure on the euro will continue further, since the fears that the eurozone will soon face a recession are not unfounded. The economy of Germany alone is close to a technical recession, and weak production activity in a number of countries in the eurozone, which is likely to continue to decline further, pulling down other sectors. At the same time, the US economy retains its strength, which today will once again be convinced by the report on GDP growth for the second quarter of this year.

Today, the president of the European Central Bank will also make an announcement, which will certainly make a number of statements on the topic of interest rates and provide a forecast on monetary policy. The pessimism of euro buyers is due to the fact that the European Central Bank, compared with the US Federal Reserve, has little room to lower rates in order to stimulate the economy, which once again confirms the likelihood of a real recession in the eurozone economy in the coming years. A number of economists expect eurozone GDP growth to be only 1% in 2019 and only 0.7% in 2020. Thus, the long-term bearish trend in the euro, which strives for the lows of 2017, will continue further, albeit with slight upward corrections.

As I noted above, consumer sentiment in Germany will improve in October this year, and this will happen due to the launch of measures to stimulate economic growth, which were announced during the September meeting of the European Central Bank.

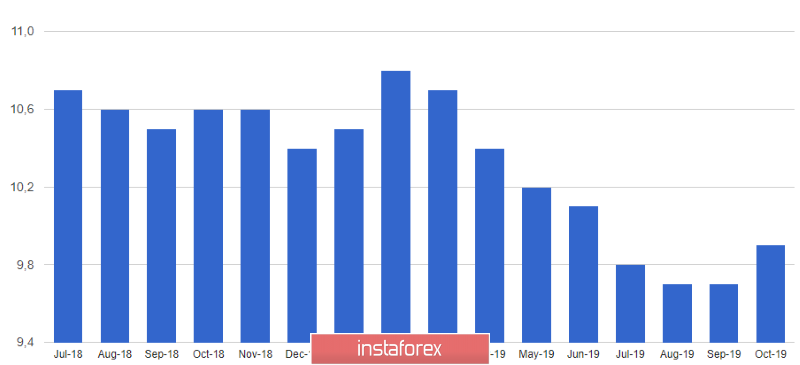

According to the GfK research group, the consumer confidence index in Germany in October 2109 should show growth to 9.9 points from 9.7 points in September. Economists assumed that the indicator would remain unchanged at 9.7 points.

However, the situation may change dramatically if, by the end of October, the situation with Brexit does not become clearer, and US trade conflicts with China and the eurozone worsen.

The indicator of economic expectations in September rose to -9.0 points, while the indicator of expectations regarding own income fell to 46.8 points from 50.1 points in August.

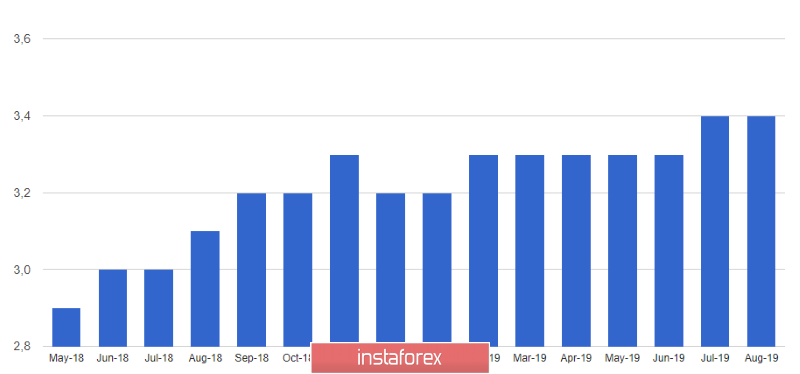

Data on growth in lending to companies in the eurozone in August also did not return demand for the European currency. Despite this, the growth of lending indicates the preservation of momentum in the economy of the region. The report of the European Central Bank indicated that the annual growth in lending to non-financial corporations accelerated to 4.3% in August from 4% in July. But lending to eurozone households grew by 3.4% in August, as in July. The growth of the M3 monetary aggregate amounted to 5.7% in August versus 5.1% in July, while economists had forecast an increase of 5.1%.

As for the technical picture of the EURUSD pair, sellers of risky assets pushed the trading instrument to new lows this year and updated support at 1.0925. However, further downward potential directly depends on the speech of the head of the ECB. A break of the low of the year will lead to a further downward trend of the euro with a test level of 1.0840 and 1.0800. In the upward correction scenario, the upper boundary of the short-term downward channel is seen in the resistance area of 1.0971.