EUR/USD

Analysis:

Since August 1, an upward wave structure of the wrong type has been developing on the chart of the European currency. In its wave level, it claims to correct the wave of a long-term trend. In the incomplete last section of the last 2 weeks, the price is adjusted. The price is in the zone of a potential reversal of a large TF.

Forecast:

The current downward course is expected to be completed. The US session today will be rich in news, which can provoke a sharp increase in volatility, a reversal and the beginning of price growth.

Potential reversal zones

Resistance:

- 1.0980/1.1010

Support:

- 1.0910/1.0880

Recommendations:

Euro sales make sense in short-term "scalping" deals. It is recommended to monitor the reversal signals to find the optimal entry points in a longer position.

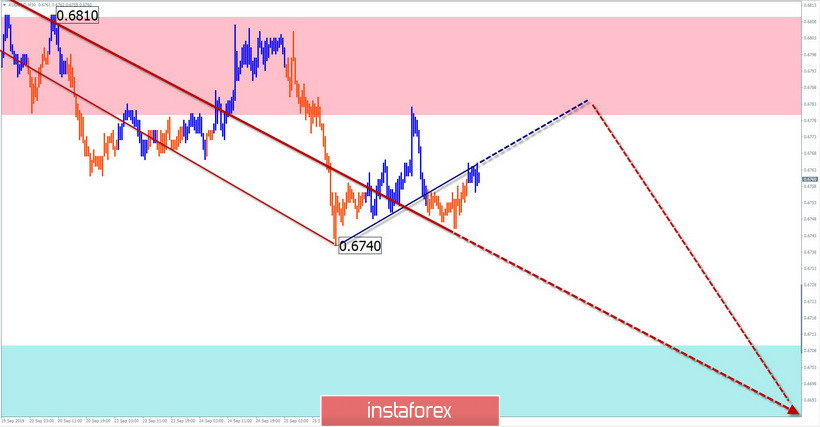

AUD/USD

Analysis:

The bearish wave that started on September 12 took the place of the correction in the larger wave model of August 7. The price is approaching the upper limit of the strong potential reversal zone, but there are no signals of the rate change on the chart.

Forecast:

The continuation of the current downward movement is expected in the coming days. At the European session, short-term price growth is possible, not further than the borders of resistance. In the area of estimated support, the probability of completion of the entire current wave is high.

Potential reversal zones

Resistance:

- 0.6780/0.6810

Support:

- 0.6710/0.6680

Recommendations:

Purchases of "Aussie" today can be very risky. The safest tactic would be to sell the instrument at the end of the upcoming pullback up. When the price reaches the support zone, pay attention to the counter signals.

GBP/JPY

Analysis:

On the pair chart, an upward wave has been developing since the beginning of September. In the last 2 weeks, the price forms a correction in the form of an expanding triangle. The price reached the support level of a large TF. The structure of the downward wave looks complete.

Forecast:

The price decline is expected to be completed today. The most likely scenario for the next session will be a "sideways" in the price corridor between the nearest oncoming zones. By the end of the day, we can expect the volatility to increase and the pair's move vector to change.

Potential reversal zones

Resistance:

- 133.30/133.60

Support:

- 132.40/132.10

Recommendations:

Today, it is better not to sell the pair because of the risk of "price saw". It is recommended to focus on the search for pair buy signals. The time of the news blocks release can serve as a pivot point.

Explanations: In the simplified wave analysis (UVA), the waves consist of 3 parts (A-B-C). The last unfinished wave is analyzed. The solid background of the arrows shows the formed structure, dotted – the expected movement.

Attention: The wave algorithm does not take into account the length of time the tool moves!