Although sentiment in the eurozone industry was at its worst in six years, the eurozone consumer confidence index remained unchanged in September.

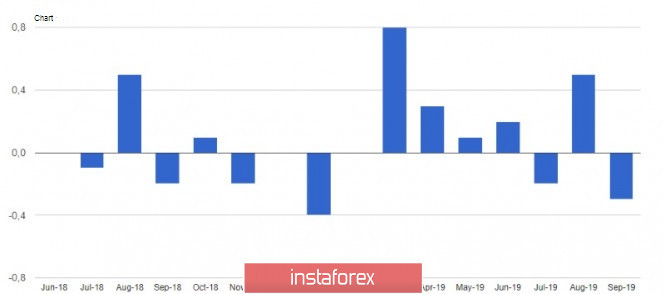

According to the report of the European Commission, the confidence index in the eurozone industry in September 2019 fell to -8.8 points from -5.8 points in August. Not surprisingly, the export orders of eurozone companies fell to the lowest level since August 2013.

But the eurozone services confidence index rose slightly to 9.5 points in September from 9.2 points in August. However, many experts believe that the problems in the industrial sector will sooner or later spread to other industries, including the service sector.

The eurozone consumer confidence index also recovered slightly in September from August and rose to -6.5 points against -7.1 points. The low level of interest rates and the availability of credit along with a good labor market had a positive impact on the index. The data completely coincided with the forecasts of economists.

As a result of the overall assessment, the European Commission's index of sentiment in the eurozone economy in September fell to 101.7 points against 103.1 points in August.

The measures are taken by the European Central Bank to reduce interest rates (it is about deposits) during the September meeting, as well as a return to the asset buyback program will certainly protect a significant part of the eurozone economy from the problems of the manufacturing sector, but this will not save from a recession in the coming years.

Today, data on the preliminary consumer price index in France were released. The report shows that inflation in September decreased by 0.3% compared to August and increased by only 0.9% year-on-year. Economists had forecast inflation to fall by 0.2% and rise to 1.0%, respectively. The preliminary harmonized by EU standards consumer price index in France in September strengthened by 1.1% per annum. Weak inflation remains a key problem of the European Central Bank, and the released data once again convinced traders of the need for more drastic measures.

A weak report on consumer spending cuts in France will harm economic growth by the end of the year. According to the data, spending in France in August remained unchanged compared to July and decreased by 0.4% compared to August 2018. The decline in spending is directly linked to a more cautious approach by households given the slowing global economy and the impending recession. Economists had forecast spending growth of 0.5% for August and a decline of only 0.1%, respectively.

As for the technical picture of the EURUSD pair, the situation has not changed dramatically compared to the morning forecast, but the market took the side of buyers of risky assets, which allowed it to stay above the annual minimum in the area of 1.0900 and approach yesterday's resistance in the area of 1.0940. A breakthrough in this range will lead to the demolition of stop orders of sellers and a larger upward correction to the area of 1.0970 and 1.1000.

GBPUSD

The British pound fell against the US dollar today after comments by Michael Saunders, member of the Bank of England's Monetary Policy Committee.

Saunders said that no matter what the Brexit scenario is, it will not lead to a sharp growth of the UK economy, even if one can avoid a hard Brexit, the uncertainties surrounding the details of the divorce from the EU, as well as the global slowdown, will put pressure on the Bank of England decisions interest rates.

In this scenario, the regulator will continue to maintain a soft monetary policy and may further soften it, but only in case of a deterioration of the situation in the economy, as the current level of inflation allows this to be done.

As for the technical picture of GBPUSD, the rebound from the level of 1.2280 was not associated with the return of bulls to the market, but with profit-taking on short positions at the end of the week. However, the first "call" for the bears sounded. It is unlikely that the demand for the trading instrument will continue above the resistance of 1.2350, however, larger players will consider the market to continue the downward movement only after the new benchmarks from the UK Parliament, as the downward movement of the pair in the last few days has become a serious reason to think about opening long positions by institutional players. The lower the pound, the more attention it will attract, as the scenario of extending the term of the UK's exit from the EU so far seems more realistic than a disordered exit. If Parliament wanted a sharp break in relations, it would have done it a couple of years ago. Few people believe that Prime Minister Boris Johnson will be able to negotiate with the EU and conclude a deal in the remaining time until October 31.