The Australian dollar paired with the US currency behaves cautiously, trading within the 100-point range without leaving the 67th figure. High-profile political events in the US only indirectly affected the "Aussie" – the pair fell by 70 points against the background of the overall strengthening of the US dollar. But in general, the situation remained the same: after the completion of the corrective growth (which lasted for almost two weeks), the pair settled in the range of 0.6740 – 0.6800.

Uncertain steps of both bears and bulls of the pair indicate that traders cannot determine the vector of further movement of AUD/USD. On the one hand, the Reserve Bank of Australia at the last meeting showed a neutral and wait-and-see position, while relations between Beijing and Washington have warmed. On the other hand, the minutes of the September RBA published later were rather "dovish-like" in nature, and the negative consequences of the global trade conflict continue to remind themselves in the form of weak macroeconomic reports. In conditions of such uncertainty, the flat movement of the pair is quite justified, especially in anticipation of the October meeting of the RBA, which will be held early next week.

It is worth recalling that at the end of the previous meeting, the regulator voiced a rather restrained position – according to the text of the accompanying statement, the RBA will only "if necessary" resort to reducing the interest rate to maintain sustainable economic growth. Reacting to this rhetoric, the AUD/USD pair demonstrated a fairly large-scale correction, rising by 150 points – from the base of the 67th figure to the middle of the 68th level. However, the minutes of this meeting published last week cooled the ardor of AUD/USD bulls. The document allowed a more detailed "decipher" the intentions of the members of the regulator – and they were very "dovish". The Central Bank did not rule out a further rate cut before the end of this year if the main indicators of the economy show a slowdown again. In the context of this formulation, the pair's traders switched to key macroeconomic releases, which in turn continue to disappoint.

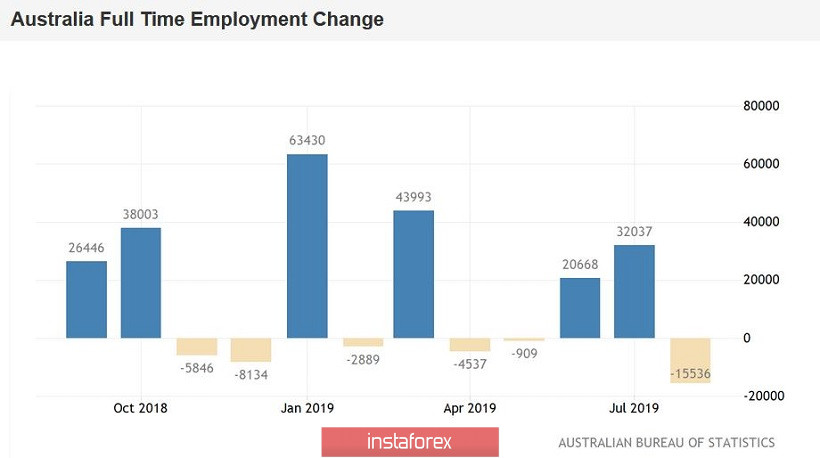

In particular, the data on the Australian labor market published at the end of last week did not impress the members of the Australian regulator at all. First, contrary to the expectations of most experts, the unemployment rate rose to 5.3%, while the consensus forecast assumed the preservation of the indicator at 5.2%. The increase in the number of employees, on the one hand, showed a positive trend: the forecast growth of 15 thousand, the figure jumped to 34 thousand. However, the structure of this indicator suggests that optimistic conclusions are premature. The fact is that the increase in employment in August was entirely due to part-time employment. But full employment collapsed into a negative area, resuming a negative trend. This indicator in the last month of summer decreased by 15 thousand. This factor has an extremely negative impact on the dynamics of wage growth, as full-time positions offer a higher level of wages and a higher level of social security. It is not surprising that the level of consumer confidence in Australia has a persistent downward trend, against the backdrop of weak wage growth.

Also, previously published data on GDP growth in Australia. The negative trend is most pronounced. The indicator has been declining for four quarters – in the first quarter of last year, this indicator came out at the level of 3.2%, in the first quarter of this year, the indicator grew by only 1.8%. The week before last, data for the second quarter of 2019 were published: contrary to the weak hopes of some optimists, they came out at the level of forecasts: the key indicator continued its downward trend, falling to the level of 1.4%.

Thus, given the latest releases, members of the Australian regulator are unlikely to change their position on the prospects for monetary policy. Moreover, they can more clearly signal a possible rate cut before the end of this year or early next year. This fact will certainly put pressure on the "Aussie". At the same time, we can express confidence that at the October meeting the Central Bank will certainly retain the parameters of monetary policy. In anticipation of the US-Chinese talks (which, as it became known today, will be held October 10-11), the members of the RBA will certainly not rush things by taking any steps.

In terms of technology, the situation is as follows. On D1, W1 and MN timeframes, the AUD/USD pair are on the lower line of the Bollinger Bands indicator under all the lines of the Ichimoku Kinko Hyo indicator, which formed a strong bearish signal "Parade of Lines". This suggests a clear advantage of the southern movement. The main target of the southern movement is located on the lower line of the Bollinger Bands indicator, which corresponds to the price of 0.6650.