The versatile fundamental statistics on the state of the US economy on Friday led to only a small upward correction in the EURUSD pair, but it is too early to talk about the end of the downward trend. The pound remained under pressure amid the growing likelihood of Boris Johnson being impeached.

Orders for durable goods rose in August, which is a good signal for the US economy, as otherwise, consumers are trying, on the contrary, to limit themselves from expensive purchases, if they feel the threat of an impending recession. However, if you look in more detail, the growth was mainly due to a jump in demand for military aircraft, while other components, including the indicator of investment of companies, decreased. According to the US Department of Commerce, orders for durable goods in August increased by 0.2% compared with the previous month and amounted to $ 250.67 billion. Economists had expected orders to fall by 1% in August.

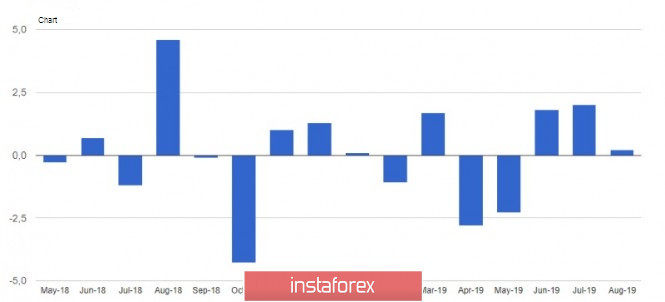

But the data on the growth of consumer spending in the US in August did not please economists. The indicator slowed, indicating a loss of momentum that is fueling the US economy amid a weakening global economy. According to the US Department of Commerce, personal spending by Americans in August 2019 rose only 0.1% compared to July, after growing by 0.5%. Let me remind you that the growth of personal spending is the main driving force of economic growth in the United States. The economy is expected to add only 2.2% in Q3 after growing 3.1% in Q1.

At the same time, the report on household sentiment in the US remains optimistic. According to the data, sentiment rose after the recovery in the labor market, which was due to lower interest rates. Thus, the final September index of consumer sentiment of the University of Michigan was at the level of 93.2 points against the preliminary estimate of 92 points. Economists had expected the index to reach 92 points in September. The expectations index rose to 83.4 points in September.

Despite all the efforts and statements of the Fed, problems with inflation in the US remain. This is evidenced by Friday's report on the growth of the price index of personal consumption expenditures. According to the Federal Reserve, the PCE inflation indicator in August 2019 showed an increase of only 0.03% compared to the previous month, while the base index, which does not take into account volatile categories, grew by 0.14% in August.

Speech by Fed spokesman Harker, which took place on Friday at the end of the North American session, passed unnoticed by the market. President of the Federal Reserve Bank of Philadelphia, Patrick Harker, said that now we need to monitor developments in terms of interest rate policy, as the state of the economy is good, but there are clear downside risks. The most significant of these come from trade, global economic growth, and uncertainty. Harker also expects unemployment to remain below 4% and the economy to continue to show growth of around 2%.

As for the technical picture of the EURUSD pair, the market is still in the balance, but under the control of sellers, who did not allow a larger upward correction of risky assets. The upper limit of the downward price channel in the resistance area of 1.0958 limits the correction. Only a breakthrough in this range will strengthen the demand for the trading instrument, which will lead to an update of the highs in the area of 1.1000 and 1.1030. If the pressure on risk assets will come back after today's weak fundamental statistics on the eurozone, the breakthrough low of 1.0905 ensures a flow of new sellers that will lead to the renewal and lows of 1.0870 1.0840.

GBPUSD

On Friday, representatives of the British opposition spoke about the impeachment procedure of the current Prime Minister Boris Johnson. It should be assumed that all the grounds for this is after the Supreme Court of Great Britain declared Johnson's attempt to suspend the work of Parliament illegal. On Thursday, the proposal for impeachment was put forward by the Welsh Party at a meeting of the parties. Consideration of the proposal will take place this week, and if the House of Commons votes to start the procedure, the Prime Minister could be prosecuted for his actions. There is talk that Johnson may be banned from working in Parliament, as well as subject him to other disciplinary sanctions.

However, buyers of the British pound is not happy, as political differences are a serious problem for the month before the UK's exit from the EU. If the position of Boris Johnson shakes, a larger fall of the pair GBPUSD is possible, as impeachment will further lead to a deadlock on the Brexit deal and a real possible solution to this problem will be another request from the UK to extend the country's exit from the EU for another six months.

As for the technical picture of the pair GBPUSD, the breakthrough of the support of 1.2280 will lead to a further movement of the pound down to the lows of 1.2230 and 1.2170.