Today's data on a decrease in unemployment in the eurozone did not support the euro, while a report on a decrease in inflation in Italy and Germany disappointed investors. Weak inflation is another reason for the European Central Bank to think about lowering interest rates in the future. The British pound ignored data on a reduction in economic growth, which could lead to an upward correction of the pair in the near future, as there were clearly fewer people wishing to sell at current levels than in the middle of last week.

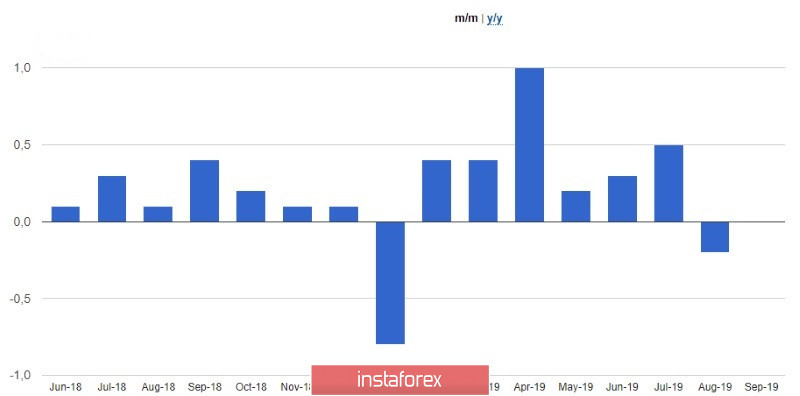

According to the data, the preliminary harmonized by EU standards consumer price index in Spain in September this year grew by only 0.2% compared to September 2018 after rising by 0.4% in August this year. On a monthly basis, inflation showed a decline. Economists forecast that Spain's preliminary harmonized HCPI CPI in September was 0.3% per annum.

As I noted above, Italy's consumer price index also put pressure on the euro, as it fell by 0.5% in September this year, after a seemingly convincing increase of 0.4% in August this year. On an annualized basis, the index showed an increase of only 0.4%. Economists had expected a decline of 0.3% compared to August and a growth of 0.6% compared to September 2018.

German inflation data also disappointed. According to the report, in September inflation remained unchanged compared with August, and annual growth slowed to 1.2%, according to the forecast of economists, who expected a reduction to only 1.3%.

But the number of applications for unemployment benefits in Germany has decreased, which is a good signal for an economy that is practically demonstrating a technical recession. According to the Federal Employment Agency, in September the number of unemployed fell by 10,000 after rising in 2000 in August. The data for the previous month were revised downward. Economists had expected an increase in the number of applications for unemployment benefits by 5,000. Unemployment remained unchanged at 5.0%. The number of registered vacancies in September fell by 47,000 to 787,000.

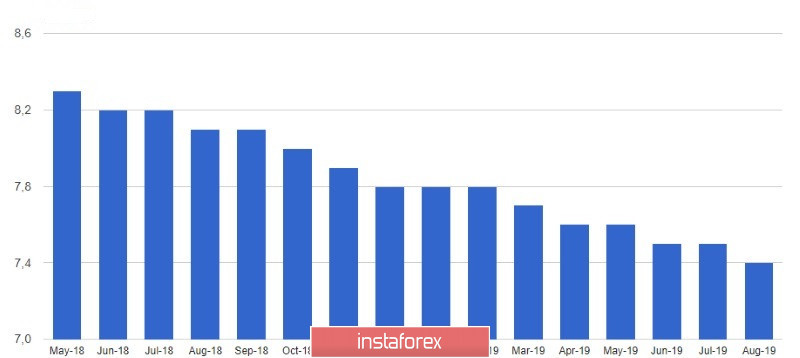

Data on the unemployment rate in the eurozone, of course, are a small "outlet" for the European Central Bank, which is under pressure from all sides. According to a report by the EU Statistical Agency, unemployment in August 2019 fell to 7.4% from 7.5% in July. However, the eurozone economy continues to slow down, and counting on its larger growth this year will hardly be possible. Many analysts do predict a recession in the coming years. The problem remains the manufacturing sector, as well as a drop in external demand amid trade conflicts. The total number of unemployed in the eurozone in August of this year decreased by 115,000, which indicates the strength of the labor market.

As for the technical picture of the EURUSD pair, a breakthrough of a large level of support at the annual low will necessarily lead to further sale of risky assets in the region of lows 1.0870 and 1.0830. However, to expect that the bearish trend observed since September 16 will continue without a significant upward correction will also be wrong. It is likely that large players will now collect stop orders of buyers below the low of the year, and then expand the market, forming a slight increase in the euro at the beginning of next month. Resistances found in 1.0930 and 1.0990.

GBPUSD

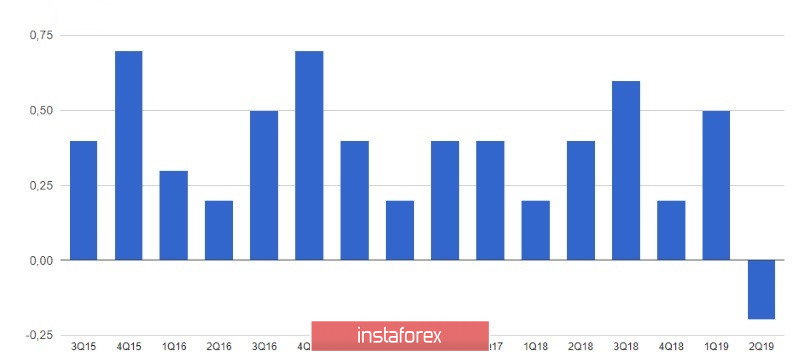

Pound sellers ignored evidence that the UK economy contracted slightly more than expected in the 2nd quarter of 2019. The decline was due to a weak manufacturing sector. There was also a serious decline in company investment amid a slowdown in global economic growth, as well as uncertainties around Brexit.

According to the National Bureau of Statistics, in the 2nd quarter on an annualized basis, UK GDP fell by 0.9%, while, according to the first estimate, the decline was 0.8%. Compared to the previous quarter, GDP fell by 0.2%, which fully coincided with the forecasts of economists.

Let me remind you that traders prefer short positions on the pound against the backdrop of uncertainty with Brexit, as the deadline for leaving the EU was postponed from March to October 31 this year.

The likelihood of impeachment to British Prime Minister Boris Johnson leads the country into an even greater political crisis and does not bode well for future economic growth. Last Friday, opposition figures in Britain began talking about impeachment procedures for incumbent Prime Minister Boris Johnson. And it should be assumed that there is every reason for this after the Supreme Court of Great Britain declared Johnson's attempt to suspend the work of Parliament unlawful on September 24.

As for the technical picture of the GBPUSD pair, the break of the 1.2280 support will lead to a further pound movement down to the 1.2230 and 1.2170 lows.