The US dollar continues to be in demand among traders due to the aggravation of the probability of a recession in the eurozone in the next few years. Trade conflicts and uncertainty with Brexit are also putting pressure on risky assets.

Demand for the dollar remains quite strong, which confirms yesterday's market ignoring the news that the Federal Reserve Bank of New York has made an infusion of another batch of US dollars.

As it became known, the New York Fed additionally allocated liquidity in the amount of 63.5 billion US dollars through repo operations. Such measures were announced at the end of last week. Such operations will continue to be used to eliminate the lack of liquidity in the short-term debt market. All applications filed by banks have been satisfied. The allocation of additional funds is a kind of hidden asset buyback program, which the Fed did not officially launch, but only went to lower interest rates at the September meeting to support economic growth and inflation.

Yesterday's report from the Fed-Dallas on the reduction of production activity was not surprising. According to the data, the manufacturing index in September fell to the level of 13.9 points against 17.9 points in August. The business activity index in September also fell to 1.5 points, against 2.7 points in August.

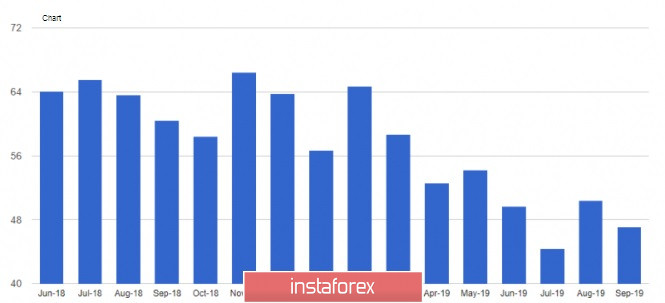

The Chicago purchasing managers' index (PMI) showed a decline in activity, as it was below 50 points. According to the data, Chicago's PMI was 47.1 points in September, up from 50.4 points in August.

Today, a report on the US ISM manufacturing index will be published, the reduction of which can put serious pressure on the US dollar. However, economists make an optimistic forecast and expect it to return to a level above 50 points.

However, before that, there will be similar reports on production activity in the eurozone countries, which will only aggravate the situation of risky assets and lead to their decline against the US dollar.

From a technical point of view, the market is under sellers' control and EURUSD is gradually approaching the next major support level of 1.0870. Its breakthrough, which could coincide with data on manufacturing activity and inflation in the eurozone, will only increase the pressure on risky assets, which will open a direct road to a minimum of 1.0840. With an upward correction of the trading instrument, the resistance of 1.0905 will limit the growth, while a larger level is seen in the range of 1.0930.

AUDUSD

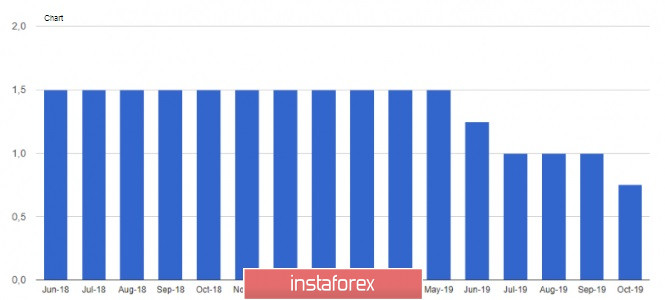

The Australian dollar continued its decline against the US dollar after the Reserve Bank of Australia lowered its key interest rate by 25 bps to 0.75% today.

Philip Lowe, Governor of the RBA, said that there is a reason to expect low-interest rates for a longer period, even though the global economic outlook looks good, however, the balance of risks is shifted to the negative side. Lowe is also willing to cut rates further if necessary, as inflation remains subdued and will remain so for some time.

The RBA said that they are closely monitoring the development of the situation in the labor market, as the economy still has unused capacity, but would like to see an increase in wages.