Despite all this absurdity theater called Brexit, the pound was doing well yesterday. It received unexpected support from the UK's GDP totals for the second quarter, which showed that economic growth slowed from 2.1% to 1.3%. And although the scale of the slowdown looks horrific, it's not so bad. The fact is that it was initially assumed that the pace of economic growth would slow to 1.2%. Moreover, the growth in the first quarter was revised upwards, from 1.8% to 2.1%. Thus, it turns out that the British economy looks a bit more lively than expected. This is precisely what made it possible to largely smooth out the negative due to other macroeconomic data, which, by the way, also turned out to be better than forecasts. In particular, the rate of decline in commercial investment slowed from -1.6% to -1.4%. So even here there are at least some hints of improvement, despite the generally depressing nature of the whole picture. The combination of data on GDP and investment did its job, not allowing the pound to continue its journey to the next historical lows. In addition to these data, there were others. Thus, the volume of consumer lending in August amounted to 0.9 billion pounds against 1.0 billion pounds in July. Nevertheless, even here, there was a positive in the form of a review of previous data in a big way. The number of approved mortgage applications fell from 67,011 to 65,545, while they expected a decrease to 66,400. At the same time, the previous data was reviewed for the worse, as it was previously assumed that in July there were already 67,306 approved mortgage applications. Also, the balance of payments deficit decreased from -33.1 billion pounds to -25.2 billion pounds. And although the reduction in the balance of payments deficit in itself is not bad, they expected a decrease to - 19.5 billion pounds. To simply put it, everything is pretty sad, but not as terrible as intended. Thanks to what the pound could resist.

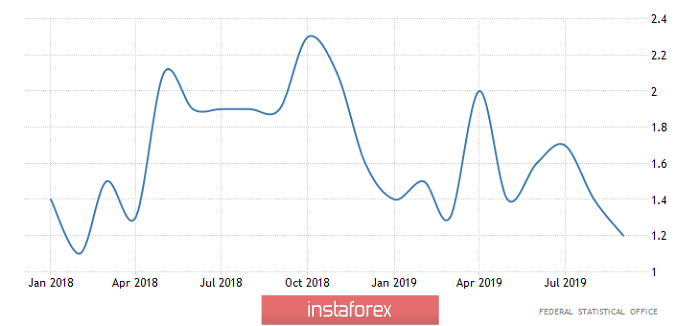

Meanwhile, the single European currency suddenly went down. Although the data on the unemployment rate turned out to be better than expected, since it did not remain unchanged, it fell from 7.5% to 7.4%. The first signal that something was going wrong was the data on retail sales in Germany. The growth rate of which slowed down from 5.2% to 3.2%. However, their investors somewhat ignored, until they saw the preliminary data on inflation all in the same Germany, showing its decline from 1.4% to 1.2%. There was no doubt left, and investors began to get rid of the single European currency. If such miracles happen in Europe's largest economy, it's foolish to believe that in general, everything will turn out differently in Europe.

Inflation (Germany):

After such sad data on inflation in Germany, investors with trembling legs are waiting for today's preliminary data on inflation in Europe, because the forecast that it will remain unchanged may well not be justified. It is highly likely that it will decline and leave the European Central Bank with nothing else but to make the refinancing rate negative. In addition, the final data on the index of business activity in the manufacturing sector of Europe are published, which should confirm the fact of its decline from 47.0 to 45.6, which indicates increasing risks of the recession in Europe. By the way, similar data come out in the UK, and they should show a decrease in the index of business activity in the manufacturing sector of the United Kingdom from 47.4 to 47.0. That is, again, an increasing risk of recession.

Inflation (Europe):

If in the Old World there is somehow not observed, then in the United States, expectations are quite good. It can be said almost festive. The fact is that the final data on the business index in the manufacturing sector should confirm its growth from 50.3 to 51.0. That is, the United States does not face a recession. Despite the countless screams of all kinds of media agitation and misinformation. Indeed, it is this indicator that is largely leading, and if it is above the mark of 50 points, and even growing, then talking about a recession is more crazy nonsense.

Manufacturing PMI (United States):

The euro / dollar currency pair after a slight rollback resumed its downward movement, breaking the pivot point of 1.0900 and, as a matter of fact, going down to the area of 1.0880. It is likely to assume that the downward mood will remain in the market for some time, where a periodic level of 1.0850 is located in front of the quote, which can play a temporary, but still support.

The pound / dollar currency pair continues to be in the accumulation phase in the region of 1.2270 / 1.2350. It is likely to assume that the movement within the given framework will still remain for some time, where it is worthwhile to carefully monitor the price fixing points, outside the borders.