The dollar is growing across the entire spectrum of the market on Tuesday morning. Stock exchanges are traded mainly in the green zone, focusing on the fact that rumors about delisting of Chinese companies from US stock exchanges and restrictions on portfolio investment flows to China were promptly refuted by Spokeswoman of the US Treasury Monica Crowley and White House trading adviser Peter Navarro.

At the same time, China does not expect positivity from the continuation of negotiations. The Shanghai index fell by -0.92% on Tuesday, which, with a simultaneous drop in oil below $ 60 per barrel and a decrease in gold, indicates a growing confidence of the markets due to the US dollar.

Expectations of a global recession, in turn, are forcing investors to buy safe assets, but in the short term, expectations for trade negotiations will be fulfilled.

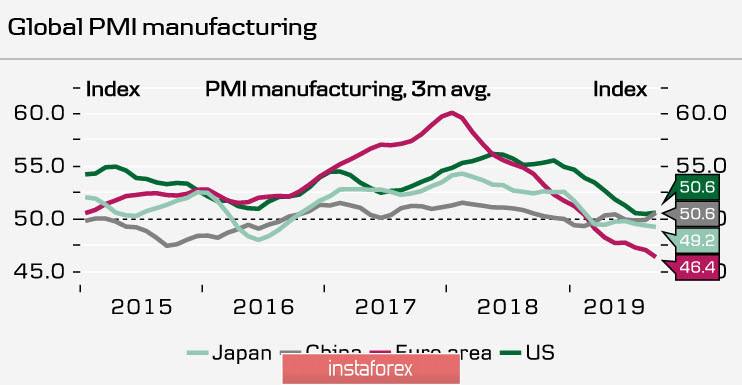

Today, the main focus is on the publication of the ISM index in the US manufacturing sector. The forecast is positive, despite the global trend.

Markets traditionally put on the United States with any increase in tension, especially since expectations on economic data remain generally positive. On Thursday - ISM in the service sector and on Friday - a report on the labor market. Until the markets see the result of their expectations, a change in trend is unlikely to happen.

The dollar will remain a favorite until the end of the week.

USD/CAD

The Canadian dollar, in the absence of significant news, is trading in the range. A slight strengthening in recent days was caused by a reaction to oil growth after a decline in production, but the trend is not stable. Expectations that oil will jump to $ 100 per barrel were not met. On Monday, Saudi Aramco announced a full recovery in production to early September levels, and weak macroeconomic data in China and the eurozone which indicate a growing threat of falling demand.

The Canadian continues to be in an unstable range from which an exit upward is slightly more likely. Moreover, a possible decrease in USD/CAD to the border of the channel 1.3180 will be used for repurchases. This support looks strong, and a little more likely movement to resistance 1.3305 / 10 and consolidation with the goal of breaking up.

USD/JPY

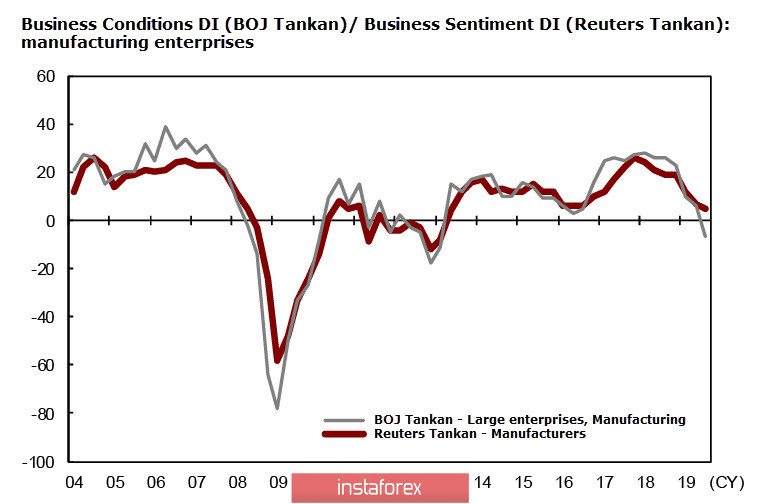

The Tankan index, which assesses the sentiment of large manufacturers, fell by 3 square meters. to 5p, which is the minimum since 2013. This decrease was less than predicted, but prospects remain weak.

Large enterprises (all sectors) forecast that fixed investment in 2019 will grow by 6.6%. Meanwhile, the previous forecast is reduced by 0.7%. A worsening forecast indicates that enterprises are not expecting any optimism about rising demand due to an increase in tax. Forecasts on capacity utilization have also been revised downward, as well as the sales expectations (from 1.0% to 0.4%), while export reduction is projected.

In general, the balance of risks, from the point of view of Japanese companies, is shifting downward. The data on industrial production published in December, which is a day earlier indicated a continued decline. The annual decline reached 4.7%. On the other hand, steel production in 2019 was already falling to a 10-year low, and there is little chance of a recovery in production, and hence export.

Today, the consumption tax rate is raised from 8% to 10% in Japan. Thus, the Bank of Japan will begin to study the effects of tax growth on the economy. First of all, to change inflation expectations. However, it will take time to evaluate. Given the global slowdown and decline in exports, BoJ does not have much time to decide on new stimulus measures.

Additionally, the dollar is strengthening throughout the spectrum of the market, and the yen is no exception. Today, an attempt is likely to test the resistance of 108.46 for strength. The probability of updating a local peak is high. Tankan survey data indicate that companies are waiting for the yen at the level of 108.60 or a little higher in the near future, and somewhere at this level, the yen will find the top.