According to the results of the third quarter, the North Sea variety lost about 9% of its value, which was the worst result from September-December last year, when futures quotes fell by 35%. After returning to the levels at which oil soared due to attacks on Saudi Arabia, buyers are hesitant to actively attack. Rising prices are seen as a reason for sales, as Riyadh was able to quickly restore damaged production, and the problem of slowing global demand due to the trade war has not disappeared. However, the situation could turn upside down in October.

At first glance, the attempts of the Crown Prince of Saudi Arabia, Mohammed bin Salman, to scare the Brent and WTI bears with a statement that black gold could fly to unprecedented heights, seem like a belated shot at a rabbit that escaped the horizon. Yes, a war in the territory, which accounts for 30% of the world's energy supplies, about 20% of global trade routes and 4% of global GDP, will be a disaster, but Riyadh says it would like to resolve the conflict through diplomatic means. Gone are the days when futures quotes changed from the fact that the prince sneezed, now there are many strong players on the market. And this circumstance can become a lifeline for the "bulls".

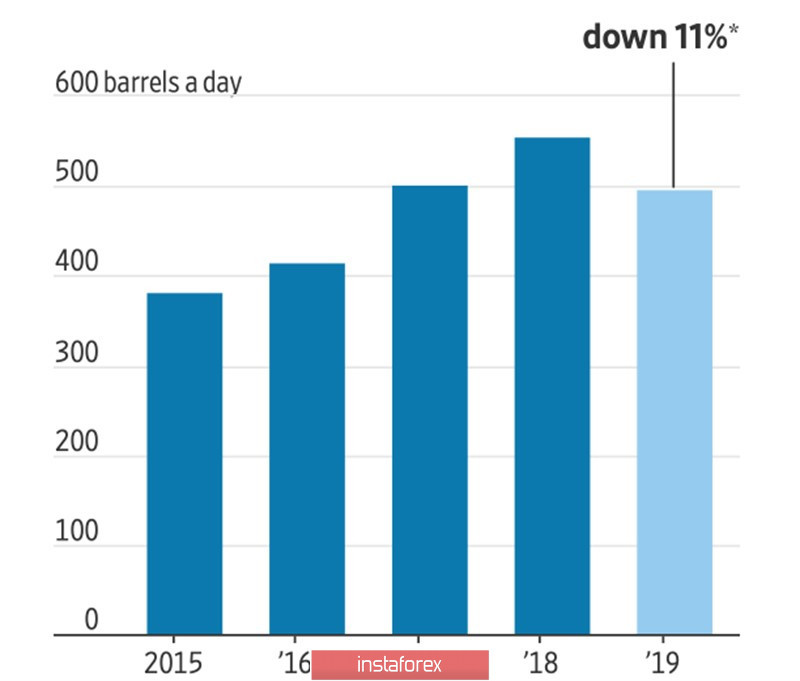

According to the US Energy Information Administration, US production fell to 11.81 million bpd in July. Let me remind you that in April, a record high of 12.12 million bpd was recorded. The growth rate was 1% for over seven months, while it was 7% over the same period last year. If in 2018 the periodic slowdown in the growth rate of shale production was mainly due to a fall in prices, then in 2019 technical factors came into play: the productivity of the wells turned out to be lower than expected due to their close proximity to each other. According to Evercore, the United States is at arm's length from peak production.

The dynamics of the average 90-day production of new wells in the United States

Oil production continues to fall in the Middle East Due to attacks on Saudi Arabia. Yes, Riyadh managed to recover most of the losses, but its current rate of 9.9 million bpd does not reach its previous values. OPEC countries' production in September, according to a Reuters survey of analysts, fell to an 8-year low of 29.8 million bpd.

In recent years, the black gold market has been in a tug of war between the states that are rapidly increasing production and reducing it in order to stabilize the price of the cartel. In 2019, global demand came to support the Brent and WTI bears, which is slowing under the influence of trade wars. However, if the growth rate of shale production in the United States continues to decline, while OPEC and Russia prolong the Vienna agreement, then prices will go up. A breakthrough in the trade negotiations between Washington and Beijing can add fuel to the fire.

Technically, purchases of the North Sea variety will become relevant at breakouts of resistance at $61.1 (correction level 61.8% of the AD wave of the "Bat" pattern) and $62.1 (Pivot level).