To open long positions on GBP/USD, you need:

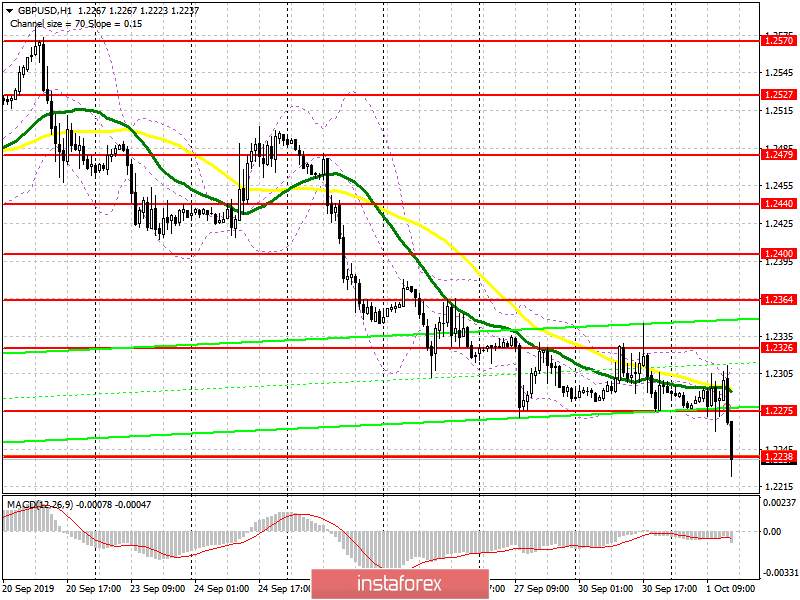

The report on the reduction of the index for the UK manufacturing sector, which remained below 50 points in September this year, returned the pressure on the British pound, and the expected breakthrough of the support of 1.2275 collapsed the pair to new monthly lows. At the moment, buyers are trying to hold the level of 1.2238, but in the absence of demand in this range and the rapid recovery of the pair, it is best to postpone short positions until the update of the larger support of 1.2165. The task of the bulls for the second half of the day will also be a return to the resistance of 1.2275, which will lead to a larger upward correction to the area of the maximum of 1.2326, where I recommend taking the profit. However, the main movement will depend on data on manufacturing activity in the US.

To open short positions on GBP/USD, you need:

The bears managed to break below the support level of 1.2275, which I paid attention to in my morning review, which increased the pressure on the pair. At the moment, the task of sellers will be a breakthrough and consolidation below the support of 1.2238, which will lead to a further decrease in GBP/USD to the area of lows 1.2165 and 1.2112, where I recommend fixing the profits. In the scenario of an upward correction of the pair in the second half of the day, the formation of a false breakdown in the resistance area of 1.2275 will be a clear signal to continue opening short positions further along with the trend. In the absence of sellers in this range, you can sell the pound immediately on the rebound from the maximum of 1.2326.

Indicator signals:

Moving Averages

Trading is below the 30 and 50 daily averages, indicating a further decline in the market.

Bollinger Bands

In the scenario of growth of the pound, you can count on sales immediately on the rebound after the test of the upper limit of the indicator in the area of 1.2326.

Description of indicators

- MA (moving average) 50 days – yellow

- MA (moving average) 30 days – green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20